We make your business succession more successful. Guaranteed*

Warum Sie uns für Ihre Unternehmensnachfolge (M&A) wählen sollten? Aufgrund des Kerns hinter KERN.

Achieve the best results in company sales (M&A), company acquisitions and generation changes with KERN - your independent consulting group in Germany, Austria, Poland and Switzerland. Awarded several times by the renowned Wirtschaftswoche, as Top-Consultants and with the German-Brand-Award as well as Innovator 2021.

Start video

Experience from more than 2,000 follow-up projects

Bei diesem Unternehmensverkauf war eine besondere Herangehensweise nötig, da es sich um eine kleines aber feines Unternehmen handelt.

»KERN hat über die Verkaufsvorbereitung, der Suche nach den Kaufkandidaten bis zu den Verkaufsverhandlungen den Prozess begleitet.

»The project included the complete preparation and support of the company sale.

»Known from numerous publications

Die einzigartige M&A-Erfolgsgarantie für Ihren Unternehmensverkauf ohne Risiko

Der Verkauf Ihres Unternehmens ist für Sie von größter Bedeutung. Bei welchem Berater sind Sie am besten aufgehoben?

Mit der einzigartigen KERN M&A-ERFOLGSGARANTIE (Sondervereinbarung) erhalten Sie Ihr Geld zurück, wenn ein Verkauf nicht gelingen sollte.

Secure the sale of your life’s work at 100%.

We make your business succession more successful

Company sale

Erfahren Sie alles, was Sie zum Verkauf Ihres Lebenswerkes wissen müssen. Im Video “Unternehmensverkauf in 10 Schritten” lernen Sie den bewährten KERN M&A Prozess kennen. Ebenfalls per Video lernen Sie, wie sich die Gründer von Acousticpearls mit dem Unternehmensverkauf Ihren Traum erfüllt haben.

Learn more >

Generation change

Die Nachfolge innerhalb der Familie braucht Lösungen, die auch die emotionale Seite brücksichtigen. Im Video mit Nils Koerber, entdecken Sie den ganzheitlichen KERN-Familienprozess für den Generationswechsel. Sichern Sie sich kostenlos den Experten-Ratgeber als PDF-Download.

Learn more >

Company acquisition

Ein Unternehmenskauf ist eine große Entscheidung. Hier erfahren Sie, warum dieser Weg einfacher, lukrativer und spannender ist, als selbst zu gründen. Entdecken Sie, wie Ihnen das KERN-Netzwerk bei Ihrem erfolgreichen Unternehmenskauf zur Seite steht. Starten Sie gleich mit dem Einrichten Ihres kostenlosen Suchprofils.

Learn more >

Häufige Fragen zur Unternehmensnachfolge

Die Unternehmensnachfolge ist ein unumgänglicher Prozess in der Wirtschaftswelt. Darunter verstehen wir, dass ein Unternehmen an einen Nachfolger übergeht. Dabei handelt es sich nicht um eine Neugründung, sondern um die Transfer of an already existing company or sole proprietorship. Dieser Prozess der Übergabe, des Verkaufs, der Schenkung oder des Kaufes einer Firma, kann einen längeren Zeitraum in Anspruch nehmen und unterliegt in fast jedem Einzelfall den unterschiedlichsten Besonderheiten.

Es gibt verschiedene Anlässe einer Unternehmensnachfolge: Mehrheitlich findet diese statt, wenn der aktuelle Unternehmensbesitzer einen Verkauf anstrebt. Aus welchen Gründen auch immer. Das Unternehmen kann dann von potenziellen Nachfolgern/Investoren erworben und übernommen werden.

A good 40 % businesses are passed on within a family. Dann findet eine familieninterne Betriebsübernahme statt. Diese macht den Prozess allerdings nicht weniger umfangreich und häufig sogar emotionaler aufgrund der persönlichen Verbundenheit von Übergeber und Übernehmer.

Die Unternehmensnachfolge, im Rahmen eines Generationswechsels, kann in Form einer Schenkung, Vererbung oder eines Verkaufs an die nachrückende Generation erfolgen.

You are currently viewing a placeholder content from Vimeo. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information

You are currently viewing a placeholder content from Vimeo. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationIm Rahmen einer Unternehmensnachfolge Beratung Expertenwissen in Anspruch zu nehmen, ist nicht nur eine Idee, sondern dringend zu empfehlen. Kaum ein Übergeber hat einen solch komplexen Vorgang häufiger in seinem Leben umgesetzt und kennt somit alle wichtigen Inhalte. Berater für Unternehmensnachfolge sind für die Planung und Durchführung dieses Anliegens zuständig. Dazu gehören viele verschiedene Aspekte mit steuerlichen, juristischen, wirtschaftlichen und emotionalen Hintergründen , welche wir Ihnen im Folgenden näher vorstellen.

Business valuation

Der erste Schritt besteht häufig darin, den Wert des Unternehmens zu ermitteln. Eine marktgerechte Business valuation ist ein wichtiger Schritt in der Nachfolgeplanung, da sie den Marktwert des Unternehmens bestimmt. Anhand dieses Wertes wird der mögliche Kaufpreis ermittelt, der aktuell für das jeweilige Geschäftsmodell und die Branche realistisch sein könnte.

Der erste Schritt kann jedoch auch viel früher stattfinden, nämlich im Rahmen einer Vor-Prüfung der Verkaufsoption. Wir von KERN nennen das den Fitness check für die Unternehmensnachfolge. Mit ausreichend Zeit können dann noch wichtige Weichen gestellt oder mit intelligenten Wertsteigerungssystemen, der mögliche Verkaufspreis in der Zukunft attraktiver gestaltet werden.

Information Memorandum (auch genannt Exposé)

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationEin Berater für Unternehmensnachfolge unterstützt maßgeblich bei der Erstellung eines umfassenden Information Memorandums. Dieses Dokument gibt potenziellen Nachfolgern einen Überblick über das Unternehmen, seine Finanzen, Stärken und Schwächen sowie die Perspektive nach einem Company sale.

Selbstverständlich wird ein Information Memorandum nur gegen eine Vertraulichkeitserklärung herausgegeben und jeder Interessent wird vorab im Detail auf die Nachhaltigkeit als Interessent einer Unternehmensnachfolge überprüft.

Finden eines Käufers

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information

Berater für Unternehmensnachfolge (damit meinen wir nicht Berater, die M&A und Unternehmensnachfolge “mal” und “auch” umsetzen, sondern täglich 24/7 den Fokus auf diese spezielle Dienstleistung ausgerichtet haben) helfen Ihnen dabei, den richtigen und besten Käufer zu finden und einen optimalen Preis mit belastbaren Rahmenbedingungen auszuhandeln.

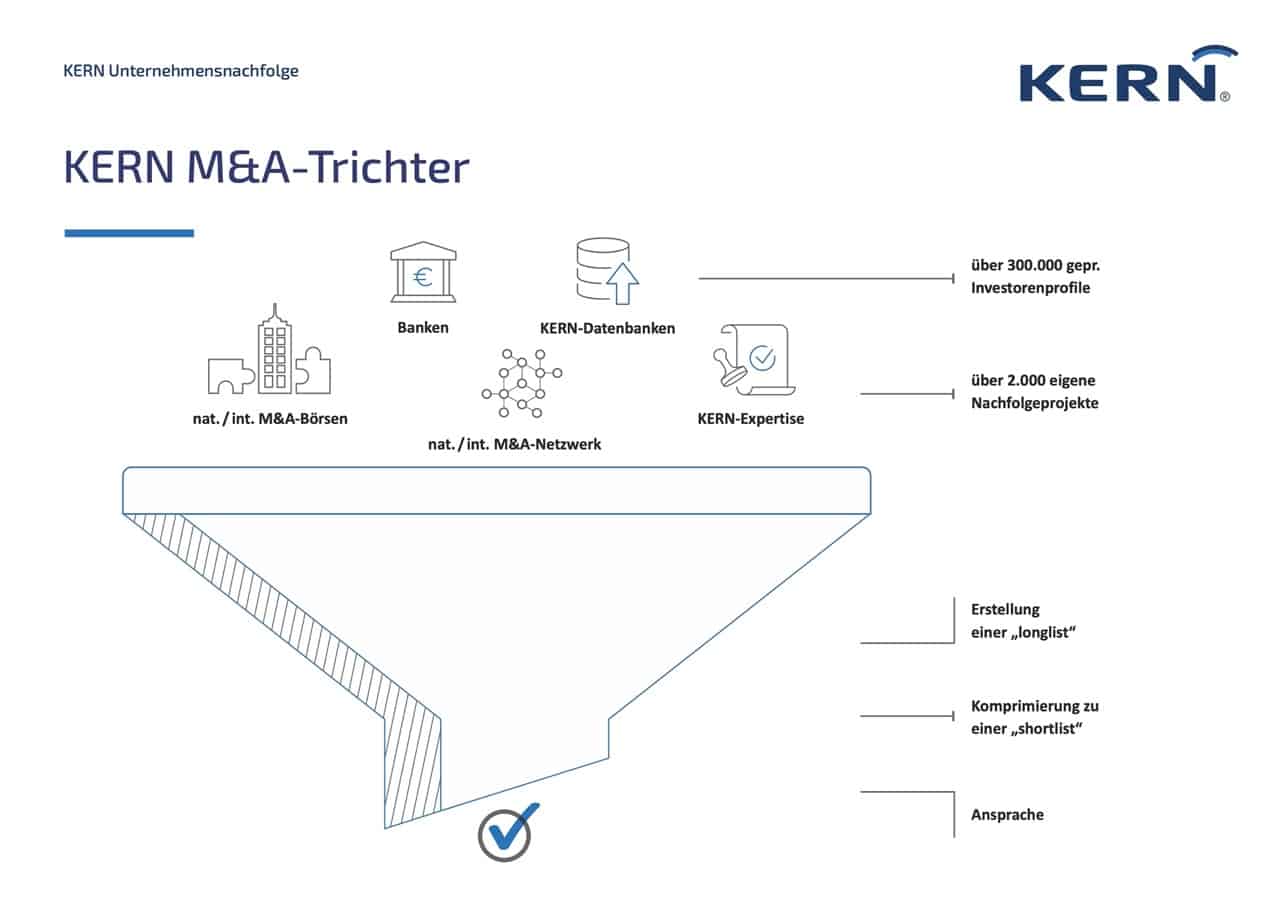

M&A databases are of great importance in this respect. KERN allein verfügt z. B. als eine der größten Beratergruppen für Unternehmensnachfolge, fortlaufend über mehr als 300.000 Investoren- und Käuferprofile. Wir wissen also genau, wer, wann, wo und wie investieren möchte. Ebenso sind nationale und internationale Netzwerke zu Banken, Sparkassen, Rechtsanwälten und Steuerberatern das entscheidende Kriterium für eine anonyme, diskrete und zugleich erfolgreiche Käufersuche. Wenn mehrere Käufer gleichzeitig als Interessenten zur Übernahme in der Unternehmensnachfolge identifiziert werden können, ist das ein großer Vorteil für den Verkäufer einer Unternehmung. Und auch der Preis wird damit stabiler oder sogar höher ausfallen.

Einstellen in eine Nachfolgebörse (Unternehmensbörse)

Ein weiterer Weg, um den geeigneten Nachfolger zu finden, ist das Einstellen Ihres Unternehmens in eine Nachfolgebörse. Auf diese Weise werden Kaufinteressenten auf Ihren Betrieb aufmerksam. Wichtig! Alle Insertionen müssen anonym gestaltet sein und wir von KERN übernehmen dabei den verlässlichen “Sicherheitspuffer”, damit kein Marktteilnehmer oder Mitarbeiter von Ihrem Projekt erfährt.

Negotiation with prospective buyers

Der Berater unterstützt Sie bei den Verhandlungen mit den potenziellen Nachfolgern. Mit dem nötigen Know-how wissen die Berater, worauf es dabei ankommt und sondieren schon vorab sehr genau aus, welcher Interessent für die Unternehmensnachfolge wirklich relevant sein könnte. Zur Sicherheit fragen wir unsere Mandanten immer vor der Einsichtnahme in ein Information Memorandum, ob dieser jeweilige Käufer auch tatsächlich gewünscht wäre. Erst dann folgen die Vertraulichkeitserklärung (NDA) und der Versand. Oder eben auch die freundliche Absage. Vorteil: Der Verkäufer bleibt mit seinem Projekt der Unternehmensnachfolge bis dahin immer sicher in einer anonymen Position.

Letter of Intent

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationThe writing of a Letter of Intent (Absichtserklärung vor einem Unternehmensverkauf) ist ein wichtiger Schritt im Bereich der Unternehmensnachfolge. In diesem werden die Absichten des Käufers und des Verkäufers festgehalten. Und zwar sehr detailliert und konkret. Ein guter LoI verhindert Missverständnisse und bereitet den späteren Kaufvertrag in wichtigen Fragen gut vor. Wer einen umfangreichen LoI unterschreibt, will mehrheitlich auch das Ziel erreichen. Das gilt für Käufer und Verkäufer in einer Unternehmensnachfolge.

Company purchase agreement

Schließlich wird Sie der Berater dabei unterstützen, den Company purchase agreement für Ihre Nachfolge anzufertigen. Hier gilt die Regel: Wer schreibt, der bleibt 😉 Damit ist gemeint, dass schon der Entwurf für die Inhalte und Strategie im Prozess der Unternehmensnachfolge von hoher Bedeutung ist. Ob ein spezialisierter M&A-Anwalt den Entwurf anfertigt oder einen Entwurf prüfen muss, ist von der Kostenseite eher zu vernachlässigen. Die Transaktionsberater achten darauf, dass die Inhalte eines Vertrags in der Unternehmensnachfolge beiden Seiten gerecht werden können und Missverständnisse durch eine achtsame “Dolmetscher”-Tätigkeit ausgeschlossen werden können. Die Emotionen sind kurz vor dem Ziel häufig besonders angespannt und dem trägt ein erfahrener Berater in der Unternehmensnachfolge mit seiner Erfahrung bei.

Mediation

Im Rahmen einer Unternehmensnachfolge kann es auch zu Konflikten kommen. Dies betrifft häufiger den innerfamiliären Generationswechsel. Mithilfe der “Technik” einer Mediation (moderierte Gesprächsführung in konkreten Schritten für die Zielerreichung und Lösung von Konflikten) helfen Ihnen erfahrene M&A-Berater mit einer Mediationsexpertise dabei, diese beizulegen.

Besonders dann, wenn die Nachfolge innerhalb der Familie stattfindet, ist die Beratung relevant. Diese unterstützt dabei, die Dinge objektiv zu betrachten und Emotionen nicht über den Verlauf entscheiden zu lassen. Vor allem dann, wenn es zu Streitigkeiten kommt, kann ein Berater diese schlichten und alle Aspekte sachlich vorgeben.

The phases of a business succession

Company succession through a company sale consists of various phases. At the beginning, all important dates the company, determine its value and develop strategies.. Sobald das Konzept steht, wird begonnen, den anonymen Kontakt zu Interessenten aufzunehmen. Läuft die Verhandlung mit Käufern erfolgreich ab, kommt es schließlich zum Kaufvertrag sowie zur Übergabe des Unternehmens.

Die große Mehrheit aller Unternehmer:innen übergibt im Rahmen einer Unternehmensnachfolge, egal ob durch einen Verkauf oder innerfamiliären Generationswechsel, nur einmal das persönlich geschaffene Lebenswerk. Die Komplexität ist im Rahmen der steuerlichen, wirtschaftlichen, juristischen und emotionalen Besonderheiten extrem hoch. Kein Fall einer Unternehmensnachfolge ist wie der andere. Erfahrene Experten “verdienen” für ihre Mandanten mehr, als im Zweifelsfall die Fehler, rechtliche und steuerliche Probleme oder emotionale Eskalationen, kosten könnten. Das Honorar, häufig mit Erfolgskomponenten, ist damit günstiger als das Desaster einer misslungenen Unternehmensnachfolge. Im schlimmsten Fall wird ein Lebenswerk durch Unwissenheit beschädigt oder sogar vernichtet.

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information

Um einen geeigneten Experten für die Unternehmensnachfolge (M&A) auszuwählen, sollte man sich darüber im Klaren sein, welche Ziele in der Unternehmensnachfolge erreicht werden sollen und welche Qualitäten eines Begleiters zur optimalen Unterstützung notwendig sind. Sobald Sie sich über Ihre Bedürfnisse im Klaren sind, können Sie damit beginnen, Ihre Optionen einzugrenzen.

Fragen Sie immer nach konkreten Referenzen und Fallbeispielen. Entscheidend ist der Fokus auf dieses anspruchsvolle Beratungsfeld. Nur wer in der Tiefe und über Jahre hinweg diese komplexen Vorgänge einer Unternehmensnachfolge häufig beraten hat, sollte für Sie in dem Kreis der möglichen Auswahl eine Rolle spielen.

Auch wir überzeugen mit einer Erfolgsgarantie und über 2.000 erfolgreichen Nachfolgemandaten. Daher könnten wir der/die richtige Nachfolgeberater:in für Sie sein.Tatsächlich gibt es Unternehmensberatungen, die sich ausschließlich auf die Unterstützung von Unternehmen bei der Nachfolgeplanung sowie -umsetzung spezialisiert haben. Sie haben den Umfang und die Wichtigkeit dieser Thematik erkannt und sich zum Ziel gemacht, Unternehmer:innen dabei in allen Fragen zu unterstützen.

Als Unternehmer:in steht man irgendwann vor der Herausforderung, sein Lebenswerk weitergeben zu müssen bzw. auch zu wollen. Dabei spielen viele verschiedene Faktoren eine Rolle, nicht zuletzt der emotionale Umstand, welcher diesen Prozess erschweren kann. Mithilfe einer spezialisierten Nachfolgeberatung fällt es möglicherweise leichter.

KERN bietet für die Startphase, zur Findung der eigenen Klarheit als zukünftige:r Übergeber:in, ein besonderes Tagesseminar (digital oder analog) an.

Planning company succession

Der Prozess der Unternehmensnachfolge bedarf einer gründlichen Planung. Ohne Vorbereitung sind Fehler und Verluste vorprogrammiert. Eine Unternehmensnachfolge kann nicht einfach von einem auf den anderen Tag stattfinden, sondern besteht aus verschiedenen Phasen der Unternehmensnachfolge und bedarf umfangreicher Vorbereitungen.

Find company successors

Falls die Nachfolge nicht innerhalb der Familie stattfinden soll, gilt es, einen potenziellen Nachfolger zu finden. Eine geeignete Möglichkeit dafür ist u. a. eine Unternehmensbörse. Auf einem solchen Portal können Sie anonym Ihr Lebenswerk anbieten und somit Kaufinteressenten anziehen. Achtung, bitte wählen Sie eine Börse sehr genau aus, denn es gibt nur sehr wenige, relevante Portale für die Unternehmensnachfolge.

Checkliste für die Unternehmensnachfolge

Auch für jemand, der gern ein Unternehmen kaufen möchte, spielt der Begriff der Unternehmensnachfolge eine Rolle. Wenn Sie nicht unbedingt gründen, aber dennoch ein Unternehmen führen möchten, können Sie sich beispielsweise auf Nachfolgebörsen nach einer geeigneten Firma umsehen. Der Kauf im Rahmen einer Unternehmensnachfolge hat klare Vorteile.

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationWhat are the advantages?

Aus dem Kauf eines Unternehmens bieten sich viele verschiedene Vorteile. Sie müssen keine aufwendige Prozedur einer Gründung starten, sondern übernehmen ein bereits bestehendes Unternehmen. Einer der Vorteile dabei ist, dass Sie in der Regel mit erfahrenen Mitarbeitern durchstarten, which are incorporated und sich in dem erworbenen Geschäftsmodell auskennen.

Ein erfolgreich laufender Geschäftsbetrieb, unabhängig von der Branche, gewährt vom ersten Tag an Einnahmen und ein etabliertes Fundament der Sicherheit. Nun gilt es die Unternehmung für die Zukunft auszurichten und eine eigene Vision mit dem etablierten Geschäftsmodell zu verbinden.

Opportunities and risks

Die Chancen bei der Übernahme eines Unternehmens bestehen u. a. darin, eine bereits erfolgreiche Unternehmung noch weiter expandieren und skalieren zu können. Eine gründliche Due Diligence helps to recognise the company’s full potential.

Und zugleich hat auch ein etabliertes Unternehmen täglich Herausforderungen zu bestehen. Eine Unternehmensnachfolge ist gegenüber einer Gründung natürlich nicht risikolos, aber vermutlich in der zeitlichen Betrachtung immer erfolgreicher als ein klassisches Start-up. Immerhin scheitern gut 80 % aller kompletten Neu-Gründungen. Ob ein Unternehmenskauf

Funding

Die Finanzierung einer Unternehmensnachfolge ist eine der größten Hürden für eine erfolgreiche Übernahme. Kann sich ein Käufer das mögliche Volumen eines Kaufpreises leisten? Wo finde ich die passenden Finanzierungspartner? Welche Fördermittel und öffentlichen Bürgschaften helfen das Projekt Realität werden zu lassen.

Questions and challenges, often up to the business plan, should also be prepared and implemented with experts.

Checkliste für Unternehmenskäufer

Wenn es an der Zeit ist, die Nachfolge für Ihr Unternehmen zu planen, ist es wichtig, eine Unternehmensberatung zu wählen, die zu Ihnen und Ihrem Unternehmen passt. Wenn die Chemie zwischen Ihnen und den Beratern stimmt und das fachliche Know-how geprüft wurdenothing stands in the way of a successful company sale. An indispensable prerequisite for external advisors is a high level of competence in assisting with company successions.

Successor wanted: Find companies and purchase requests

Die KERN Firmenbörse ist der Treffpunkt von Unternehmern, Investoren und denen, die es werden möchten. Käufern bietet das die Möglichkeit, sich einen Überblick über die zu verkaufenden Unternehmen zu verschaffen. Hierfür bieten wir die kostenfreie Möglichkeit das eigene Such-Profil zu erfassen und nach Branche, Geographie, Größe, Kapital etc. anzulegen.

Verkäufer können als unsere Mandanten auch auf diesem Weg einen potenziellen Nachfolger finden. Immer geschützt durch die anonyme Präsentation und den Sicherheitspuffer unserer KERN-Prozesse.

The DIHK Nachfolgereport 2020 hat gezeigt, dass vor allem durch die Pandemie Unternehmensnachfolgen stark ausgebremst wurden. Doch das muss nicht länger sein. Unsere Börse und unsere Berater unterstützen Sie tatkräftig.Wenn man als Unternehmer eine Nachfolgeberatung in Erwägung zieht, stellt sich die Frage, wie viel das kosten wird. Die Antwort kann nicht pauschalisiert werden, denn sie hängt von der Größe und Komplexität des Unternehmens, der Art der Nachfolgeplanung und den besonderen Umständen des Eigentümers und des Unternehmens ab. Wir von KERN arbeiten stark erfolgsorientiert und garantieren sogar unter bestimmten Umständen den Verkauf einer Unternehmung. Ohne jegliches Risiko für den Verkäufer: https://www.kern-unternehmensnachfolge.com/erfolgsgarantie/

Business succession advice

Die Planung der Unternehmensnachfolge ist entscheidend für den langfristigen Erfolg von Unternehmen. Jeder, der eine Firma führt, wird früher oder später vor dieser Herausforderung stehen. Um diesen Prozess nicht allein durchstehen zu müssen und das hohe Risiko von Fehlern einzugehen, ist die Inanspruchnahme einer M&A consulting meaningful.

Bei der Beratung zur Unternehmensnachfolge geht es um die Planung der Zukunft Ihres Lebenswerkes. Dazu gehören Themen wie die Erstellung eines Nachfolgeplans, die Auswahl eines Nachfolgers und der Durchführung der Übergabe.

Wenn auch bei Ihnen eine Unternehmensnachfolge ansteht, stehen wir Ihnen dabei gern zur Seite. Im Rahmen einer kostenlosen Erstberatung können wir gemeinsam besprechen, wie Ihre Ziele konkret und sicher erreicht werden können.

Wir beraten sowohl Klienten, die ihr Unternehmen verkaufen möchten, als auch Unternehmer, die einen Kauf anstreben oder den innerfamiliären Wechsel innerhalb der Familienunternehmung vollziehen wollen.