You would like to Sell company or are you planning a family-internal transfer and want to know the value of the company before you hire a consultant? Then take advantage of our Company value calculator: simple and free of charge.

Table of contents: Procedure for the calculation of goodwill

- The simplest method: The company value calculator from KERN

- The second simplest method: the company valuation by rule of thumb

- Income approach according to the IDW S 1 standard

- The multiple company valuation (EBIT method)

- The simplified capitalised earnings method

- The net asset value method

- The AWH standard procedure for craft enterprises

- The discount cash flow (DCF) method

- The Stuttgart Procedure

An overview of all business valuation methods and an online business value calculator

In total, there are seven proven methods of calculating goodwill in Germany. All methods have their justification and are applied differently in practice.

Start company value calculation FREE OF CHARGE:

For what reason do you want to calculate the enterprise value?

Here is the overview

Since it is not only the a company value it is important to know and compare the most important procedures with their advantages and disadvantages. By applying different valuation methods, you can look at your company from different perspectives and ultimately obtain a Value corridor. This gives a realistic picture of the Corporate value from different perspectives. This is because the seller and the transferor on the one hand and the buyer and the successor on the other need a serious point of reference for the further course of action in the succession process.

The simplest method: The company value calculator from KERN

You can get a first guideline with a direct result in our article on the Business Valuation Calculator.

Is it possible to calculate the company value with a rule of thumb?

Yes, for a first indication it is! A best practice for applying the rule of thumb is based on the EBIT method.

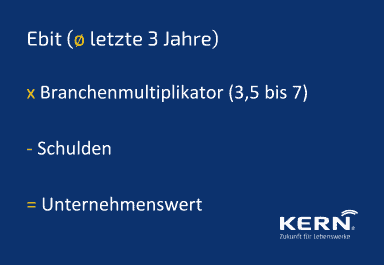

Calculate company value Rule of thumbTo determine the value of your company as a whole, multiply the average EBIT (earnings before interest and taxes) of the last three years by the relevant industry multiple (between 3.5 and 7) minus debt.

Important to know: There is not just one rule of thumb on the market, but a variety with different calculation bases. Nevertheless, the application of a rule-of-thumb method is also worthwhile in order to quickly obtain an initial orientation for the determination of the enterprise value.

Determine the sector factor of your company, e.g. in the DUB Magazine.

Managing director’s salary and other factors to be taken into account when calculating the value of the company

There are a variety of factors that have both positive and negative effects on your company’s valuation. Here is a list of the ten most important criteria:

- Reason for the assessment

- Industry affiliation of the company

- Properties of the customer base

- Dependence on the entrepreneur

- Managing Director Salary

- Turnover and profit achieved

- Investment and modernisation needs

- Seasonality

- Cyclicality

- Types of turnover

We will be happy to explain to you which errors can occur in the handling of these criteria in a personal telephone call.

| What distinguishes the calculated enterprise value from the market value? |

| A calculated goodwill does not correspond to the market value of the company - Why is that? Goodwill is calculated using scientific methods as of the balance sheet date on the basis of certain assumptions. It expresses what the respective valuer plans to do with the company and depends on the chosen method of calculating the company value. Market value, on the other hand, is achieved in a negotiation. And in a negotiation it depends on the negotiating position of buyer and seller. And this is usually determined by supply and demand, the general development of the industry and the individual development of the company for sale. Ultimately, the expectations of the buyer also play a role. Because the price is also based on the expectation of how much profit he can make with the company in the future. The market value can therefore deviate upwards and downwards from the calculated company value. But without a company value, no price can be determined, so the company valuation is an important step in the sale and transfer. |

IHK study: 43% of senior entrepreneurs demand an inflated sales price

Expert opinion

We at KERN company succession The view is that a well-prepared and well-informed Business valuation strengthens the negotiating position of the entrepreneur.

It informs the seller in detail about the current earning value of his company and the current factors influencing the company’s development. As a result, he is ideally prepared for later negotiations with this know-how. At the same time, it is an important basis for the subsequent Due Diligence or financing discussions for the acquirer.

By critically examining the information provided, the external professionals ensure that a company valuation results in a purchase price expectation that can be enforced on the market is derivable.

Other methods of determining the value of a company

Income approach according to the IDW S 1 standard

In practice, a standardised procedure for calculating the value of a company has been established in the form of the capitalised earnings method in accordance with the IDW S 1 standard (Institute of Public Auditors in Germany). Here the enterprise value is determined by discounting the financial surpluses accruing to the company owners. As a result, this leads to lower ? often market-realistic ? enterprise values compared to the simplified capitalised earnings value method. company values. As a result, in the case of an intra-family succession, this leads to a lower tax burden or lower settlement sums vis-à-vis co-heirs and thus to a lower financial burden for the companies to be transferred and their owners. The capitalised earnings value method is widely used in German-speaking countries and is accepted by the authorities, banks, tax advisors, etc. just like the simplified capitalised earnings value.

Expert Tip: A company valuation according to the IDW S1 standard or the DCF method is always recommended if the high values regularly resulting from the simplified capitalised earnings value method want to be prevented from the outset.

The Multiple Business Valuation

This procedure applies to the Company sale as an excellent first orientation for the company valuation. The determination of the goodwill is based on the EBITs industry-specific factors are taken into account by means of a Multiplier considered.

Research multiples

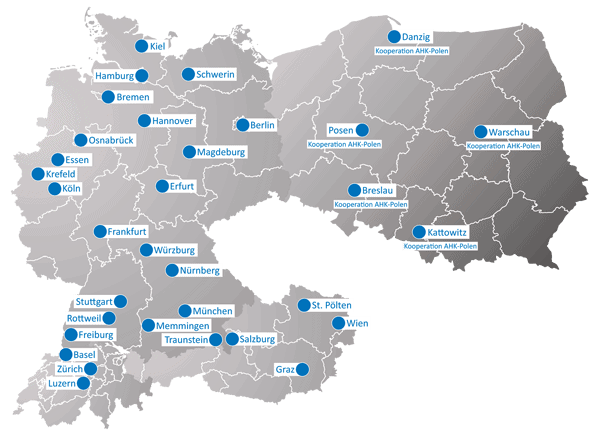

The sector multipliers are regularly updated and published by various providers for different sectors. In the context of business succession, two providers in particular have established themselves in this country:

- The trade journal Financewhich determines the industry multiples using stock market data (therefore suitable above all for large companies), and

- the DUB SME Multiples of the Deutsche Unternehmerbörse, which designed its valuation method for companies with a turnover of less than 20 million euros.

Simplified capitalised earnings method

The simplified capitalised earnings method according to §199 ff. BewG is mainly used for unlisted companies, i.e. the majority of German medium-sized family businesses.

Since 2009, it has been used by the tax office instead of the replaced Stuttgart method, for example to calculate inheritance tax. It is based on the Average yield of past years (according to § 202 of the Assessment Tax Act (EEC)) and one of the Base interest rate dependent capitalisation factor (since 2016: 13.75).

The formula for calculating the goodwill in the simplified capitalised earnings value method is:

Expert Tip: If the simplified capitalised earnings value method leads to a perceived unreasonably high Company sale valuationentrepreneurs should try to claim a lower goodwill from the tax office by means of an individual expert opinion.

Calculate enterprise value according to the net asset value method

This procedure is also easy to understand and is particularly suitable as an auxiliary value for the evaluation of small Farms with expensive machinery or real estate. However, the disadvantage of the net asset value method is that No intangible assets are taken into account in the calculation. This means that a customer base that has grown over many years, a strong brand or competitive position, or specialised knowledge and other important future factors are left out of the calculation.

This method assumes that the company is worth just as much as the sum of the parts that make it up.

The net asset value method is therefore more suitable for determining a ?Minimum price? but rarely or hardly ever as the sole method for determining value.

Calculate the value of a craft business according to AWH standard

Most succession specialists nowadays, irrespective of the type and size of the business, value it according to the industry-derived capitalised earnings value method of the IDW (Institute of Public Auditors in Germany).

In contrast to the simplified income capitalisation approach, the Regular capitalised earnings method not only the past years are relevant, but also the forecast for the coming business years.

Special features of craft enterprises

For craft enterprises, however, this standard is not usable, because they:

- are often heavily dependent on the owner for their earnings,

- often have fewer financial structuring options due to the interlocking liability of private and business assets; and

- usually have only inadequate business planning methods.

These special features are taken into account by the AWH standard, which was developed by business consultants of the crafts organisations. It thus represents a corresponding modification of the IDW standard.

The discounted cash flow (DCF) method

The discounted cash flow method has become increasingly popular and is also recognised internationally. It is suitable for larger, long-standing existing companies with continuous growth and even profit increases. The method is not suitable for smaller, rather unstable farms with little systematic growth strategy.

It is basically similar to the capitalised earnings method: A surplus value is discounted to the present value. But unlike the capitalised earnings value method, the DCF method uses the future cash flow consulted.

The focus of this valuation is thus on the future development of the company’s earnings. The DCF method is therefore a Purely forward-looking valuation method.

Dhe Stuttgart Procedure

This valuation method was abolished by the Inheritance Tax Reform Act as of January 2009 following a decision by the Federal Constitutional Court; however, it is still used in numerous older company agreements to calculate the value of a company for the purposes of inheritance and gift tax.

If you have any further questions about the Stuttgart procedure, please contact one of our colleagues. Advisory network on.

Did you like this article? Then feel free to leave us a comment.

NOW the KERN Podcast discover on our homepage and get even more expert knowledge!