Maximise your success as a salesperson!

Vendor Due Diligence VDD is a fundamental pillar in the sale of a company! It offers sellers a strategic advantage. By an independent third party ? be it a Auditor, lawyer, tax consultant or management consultant ? can these make an objective assessment of your company leave. This process aims to achieve this, the opportunities and risks of the sale not only to identifybut also to analyse them in detail.

Such in-depth research enables sellers to enter into sales negotiations with well-founded information and increase the attractiveness of their company for potential buyers. The VDD goes beyond the traditional Due Diligence beyondby being proactively initiated by the seller to ensure a holistic and transparent presentation of the company.

Compared to buy-side due diligence, which focuses on the buyer’s due diligence, VDD emphasises the seller’s interests by taking a proactive role in the acquisition process.

The value of a company can be communicated more precisely and potential risks minimised at the same time. Through this Transaction-orientated approach This enables efficient and transparent communication between the parties involved, which ultimately speeds up the entire sales process and increases the likelihood of a successful conclusion.

The Vendor Due Diligence VDD at a glance:

- Basic principle: Vendor due diligence is a decisive step in the process of Company sale, initiated by the sellerto enable a transparent and objective evaluation of the company prior to acquisition.

- Flexibility in scopeThe The level of detail of the VDD is customisable and is determined by the seller according to the needs and strategic objectives of the company acquisition. This enables a customised presentation of the company.

- Purpose and benefitsThe aim of the VDD is to provide a comprehensive and in-depth insight into the company in order to the sales position to strengthen and Potential risks for the acquisition at minimise.

- AddresseesThe results of the VDD are provided specifically to potential buyers or as part of auction proceduresto speed up the acquisition process and support the decision-making process of interested parties.

Table of contents

What is Vendor Due Diligence?

A vendor due diligence is a company audit that is carried out for a company for sale by the seller. before the Company sale is carried out.

The audit is carried out by the seller’s appointed advisors, who should, however, be independent. The extent to which the VDD is carried out and the exact areas of the company to be audited are left to the seller’s discretion. As a rule, a “neutral” audit is certified.

Through the VDD, the Strengths and weaknesses of the company revealed be made. This gives the seller the opportunity to compensate for possible weaknesses in advance, if necessary, and the buyer quickly gets a good overview of the company. The VDD is also well suited for a parallel bidding process.

Advantages of the VDD

- Through the Due Diligence Report, the seller can Identify weak points in his company and eliminate thembefore the buyer undertakes a possible extended inspection.

- The effort for the buyer side is reduced and thus the process of selling the company can be facilitated and accelerated.

- By identifying weak points or grievances early on, the seller can Go into sales negotiations better prepared and argue better accordingly.

- The chance of finding a buyer more quickly is higher, as the buyer has the opportunity to get a good overview of the company for sale at an early stage and this provides him with a corresponding degree of security without having to trigger an extensive DD process himself immediately.

- The Transaction process of the sale is acceleratedas the buyer does not have to carry out an inspection to this extent by the VDD itself; this saves time.

Learn in our webinar which further measures are crucial for an effective business sale:

In our online seminar Selling a Business you will learn how to find the right buyer for your company.

What are the contents of a vendor due diligence?

Vendor due diligence is often prepared according to the thematic areas of a company.

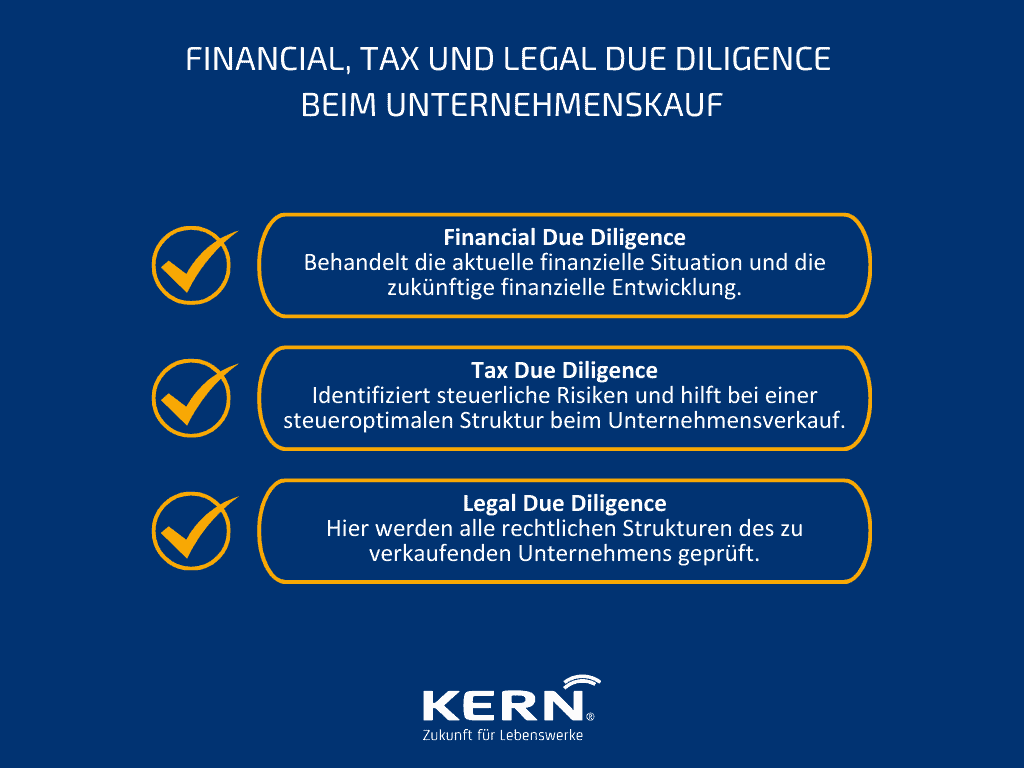

Since at the time the vendor due diligence report is commissioned the possible prospective buyers and their specific focus is not yet known, the VDD often consists of the Financial, Tax and Legal Due Diligence. Supplemented, if necessary, by Market and Environmental (environmental risks).

Since the project commissioned by the buyer Due Diligence and the VDD are similar in their basic structure, we would like to present our Due Diligence Checklist:

Highlight your company’s strengths with due diligence and justify the purchase price you are seeking. Check the most important points now.

Financial Due Diligence

Financial due diligence deals in detail with the finances of the company. This involves both the Current financial situation as well as future financial development.

Tax Due Diligence

Tax due diligence presents the tax situation of the company, identifies tax risks and thus helps to create a tax-optimised structure for the sale of a company. and to limit risks in the future after the sale.

Legal Due Diligence

During legal due diligence, all legal structures of the company to be sold are examined. The subject of the legal due diligence is above all Shareholders’ agreement, ownership and contracts with staff and suppliers.

Scope of the VDD

The VDD can be carried out in different ways. The seller can have a detailed report prepared on the individual areas or only a descriptive fact bookwhat is to be presented to the prospective buyers.

The Fact Book will then be made available to potential buyers. Together with the Non-Reliance Letter handed out.

Fact Book

The VDD report is often referred to as a Fact Book. This is usually only a descriptive report by the VDD. This Fact Book is presented to the prospective buyers at the beginning of the negotiations. The Fact Book provides a transparent and well-founded overview of the company for sale.

In addition, there is the advantage here that not all of the company’s sensitive data has to be disclosed. Through the Descriptive design of the Fact Book the buyer receives a Sound and transparent overview of the companybut not sensitive details.

Especially if the company is to be sold in an auction process, the Fact Book from the VDD is indispensable and has now become standard.

Non-Reliance Letter

A Non-Reliance Letter is the English term for a contractual disclaimer.

The Non-Reliance Letter is handed out to bidders in an auction procedure with the Fact Book and must be signed by them.

The Non-Reliance Letter includes a Bidders’ reliance on the accuracy and completeness of the VDD reportof the Fact Book.

When is the VDD produced and by whom?

Vendor due diligence is generally carried out before the sale of a company. As a rule, it is already carried out when the sale of the company is planned but there are no prospective buyers yet.

In order to get as realistic a picture of the company as possible and to gain the trust of potential buyers, the Vendor due diligence by an independent third party, a lawyer, auditor or tax advisor carried out.

The report that is then prepared is issued to the potential buyers as a so-called Fact Book. In addition, the prospective buyers receive the Non-Reliance Letter.

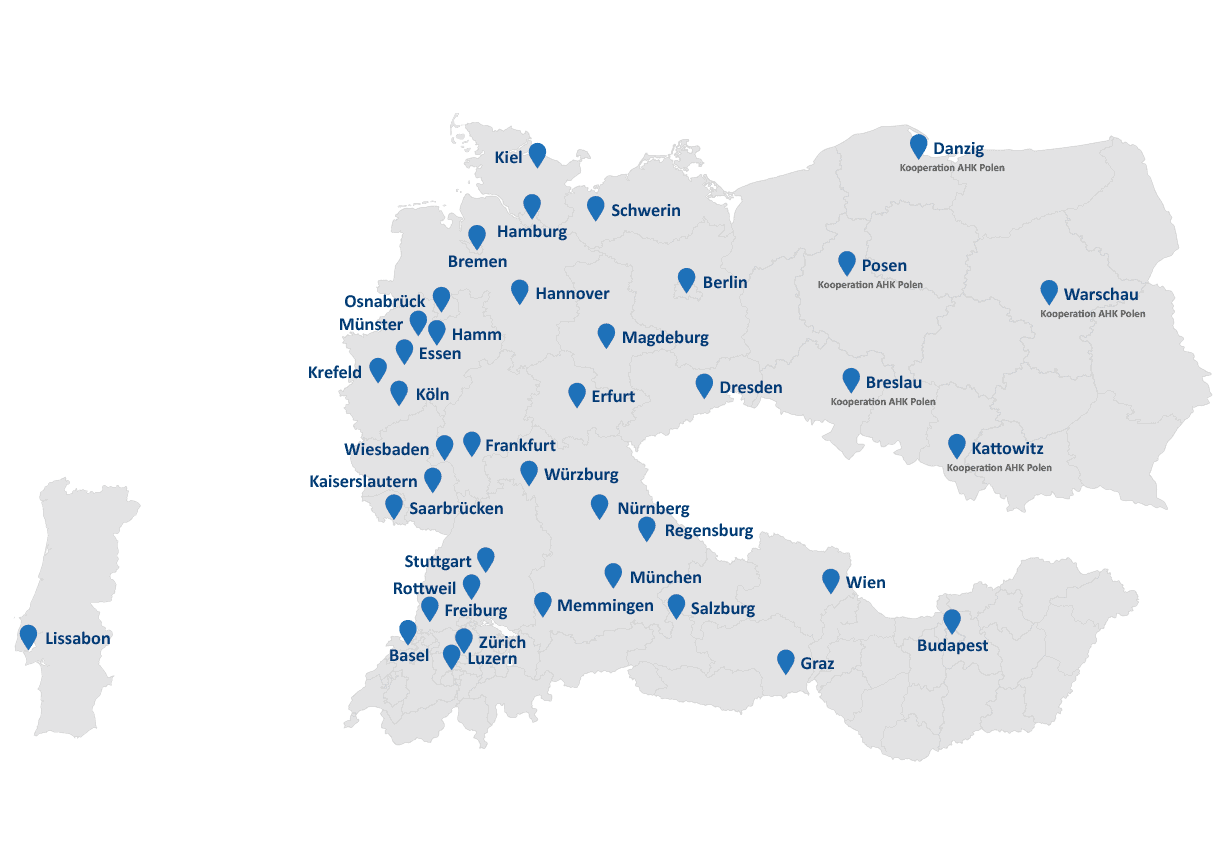

As experienced advisors in matters of Company sale we will be happy to assist you with our expertise.

When does VDD make sense for sellers?

Vendor due diligence can be useful for the seller for several reasons. VDD is particularly useful if, for example, the seller wants to provide identical framework conditions in a bidding process and wants to increase the pace by providing comprehensive data.

By creating a VDD at an early stage, the seller has the opportunity to Be better prepared for sales negotiations and to be able to argue better. The independent audit report makes him aware of the possible weaknesses from a buyer’s point of view.

The seller thus has the possibility to to consider in advance appropriate measures to optimise his business and to present these accordingly during the sales negotiations.

A VDD is also particularly useful if the seller intends to sell his company in an auction or bidding process. In this case, the vendor due diligence report can be the be made available to bidders as a basis for information.

This approach saves the potential buyers the financial effort and human resources, as they do not have to carry out due diligence themselves before they have even bid on the company.

Conclusion

Vendor due diligence can make sense for the seller and provides him with some advantages. At the same time, this type of approach is also cost-intensive and does not guarantee a sale at the price desired by the seller.

The VDD evaluates the company neutrally and reveals both positive aspects and grievances. This gives the seller the opportunity to react at an early stage and strengthens him in the sales negotiations..

Especially for sellers who want to save time, are planning a bidding process and would like to have the weaknesses of their company shown in detail by third parties in advance, VDD could be a good way to go.

If the seller commissions a VDD and hands out the fact book to the potential buyers, this also creates confidence on the buyer side and also saves the buyer the cost and effort of first carrying out an inspection himself.

This Ultimately accelerates the transaction process and reinforces a positive outcome.