Selling a business is a delicate matter. The number of possible sources of error is high. An incorrect company valuation leads to a purchase price far too low or scare away all interested parties.

The disclosure of company internals to competitors that have been passed on by a prospective buyer can have particularly dire consequences. To clarify the process of selling a company, the most important steps are explained below.

But before analysing, one point must be made: Every business sale is different. Therefore, many decisions depend on the individual situation. For there are worlds between a sale in the context of a retirement succession, a restructuring sale or a takeover forced by a competitor.

You don’t have much time to read? Here is the company sale procedure in brief

In the preparatory phase of the sale of the company, the goals and the strategy to achieve them are determined. Here the especially the company valuation is important. Because the value of the company determines the purchase price.

In the marketing phase, it is important to identify and approach the right potential buyers. This group of people should be aligned with the strategy for the sale. It is also important to decide early on whether a bidding process or an individual search should be implemented.

In the company due diligence (DD) and negotiation, the interested parties check what risks they are taking on with the company purchase. Starting from the Result of this test a final purchase offer is made, which can be negotiated. If both parties agree, the result of the negotiation flows into a company purchase agreement.

Table of contents

Preparation phase

In the course of a company sale, the first step of the preparation phase already plays an important role. It represents a decisive basis for the success of the entire sales process.

Preparation of the sales documents

Professional investors receive many different purchase offers and also tend to reject an offer quickly if the data is unclear. A seller must therefore make use of the short attention he receives in the offer phase. It is therefore important to most relevant information about the company and to create information documents from them.

The easiest way to prepare the information is to evaluate internal data. To filter out the most relevant data, it is important to put yourself in the buyer’s shoes. Which information increases his interest and is really relevant for the business model? What is the USP (unique selling proposition) and what are the growth opportunities?

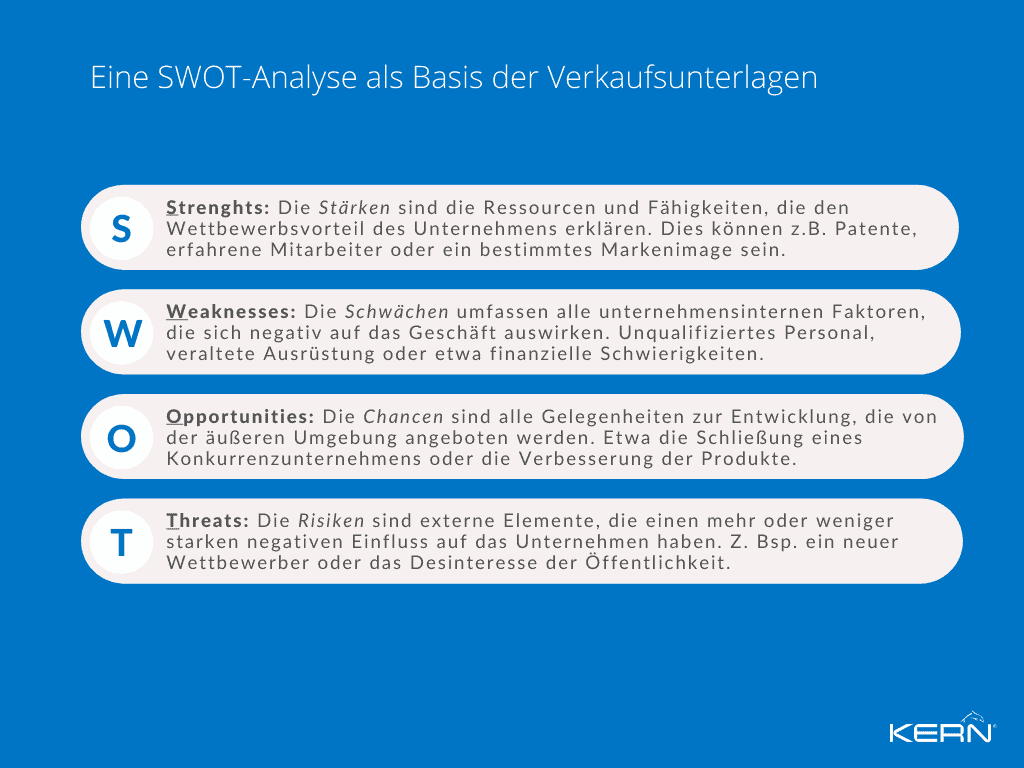

In any case, a buyer should think about the Strengths, weaknesses, opportunities and threats be clarified. Therefore, a SWOT analysis can form the basis of the sales documents.

M&A advice and tasks

For many entrepreneurs, the sale of their business is a once-in-a-lifetime event. However, not only is a lot of money at stake, but liability risks must also be minimised. That is why many entrepreneurs look for a professional M&A consulting.

These consultants have many years of experience with Corporate transactions and support the entrepreneur with their expertise. Their tasks range from aligning the sales strategy to the legal review of the finalised purchase agreement.

In this way, entrepreneurs are not only protected from mistakes that could reduce the purchase price, but can also reach a large number of interested investors in the shortest possible time through the advisors’ network. Regardless of the fact that a project Company sale has an extremely high time requirement and this can be intelligently compressed via advisors.

View verified purchase requests from entrepreneurs

M&A strategy

In order to be able to choose the right strategy, the goals must be clearly defined. The most important question an entrepreneur should ask himself is: Do I really want to sell 100% of the shares immediately or would I rather sell the shares step-by-step? And what do I want to sell? Depending on how these questions are answered, different buyers come into question.

The company sale

If an entrepreneur no longer wants to have a direct stake in his company, a sale at 100 % is a good option. And at the same time a Company sale not a blueprint.

Some investors are willing to pay the majority and up to 100 % of the purchase price in cash, other investors prefer a purchase price based on the future development of the company. And the parameters for part of the purchase price should be specified as precisely and concretely as possible in writing with all options.

Both sides should clarify early on whether there will be a transitional phase with the seller for familiarisation and how long this can be. In the majority of cases, the seller and transferring entrepreneur must agree to a non-competition clause. Sometimes even family members are included in this non-competition agreement.

The company succession

At the Company succession many company owners who have founded and built up a company find it difficult to accept that their company may be merged with another company in the future. The ideal of the endless continuation of the previous history into the future is unconsciously in the foreground.

Family entrepreneurs are also more willing to forego money if they believe that the company and the employees will be in good hands and the acquirer will presumably develop the future with a high sense of responsibility towards history.

This wishful thinking of a transferor or seller also plays a role in an intra-family generation change. However, it is usually easier for the transferor to clarify and trust this important question within the framework of similar values and the common vision of the generations.

Business valuation

The Business valuation is a subjective assessment of the value of a company. Models are used to determine a “fair” price for a company from various company data. price for a company from various company data.

The most important valuation methods in the purchase of a company are the discounted cash flow method, the capitalised earnings value method, the sub-total value method and the multiples method.

In the discounted cash flow and capitalised earnings methods, the estimated future cash flows or annual surpluses are discounted and added up. In the subtotal value method, the value of all assets is estimated (makes sense in business models where fixed assets are more valuable than earnings).

In the multiples method, key company figures such as equity, turnover or profit are multiplied by common values to obtain a rough estimate of the company’s value. The simplified, tax-based capitalised earnings value method, on the other hand, is not suitable because it usually uses factors that are significantly too high. Logical from the point of view of the tax authorities, it nevertheless does not correspond to the usual market value.

Can the value of the company be increased?

Irrespective of the options in commercial law for balance sheet valuation, given sufficient time by the seller, every business model should be examined in detail for development potential. After many years of entrepreneurship, “tunnel vision” often obscures important opportunities for new markets, products, services or scaling.

Today, in combination with artificial intelligence, there are excellent analytical tools and sellers can then weigh up whether they would prefer to invest another 2-3 years to develop the value of the company.

If a company sale is planned, the value of the company can possibly be significantly increased through a targeted examination of the business model and the balance sheet structure. Alternatively, the value of the company can be SWOT analysis should be taken into account. If the company is protected against risks, for example with special insurance policies, the value of the company can be increased. However, the costs for this must be taken into account.

Information Memorandum / Company Exposé

The Information Memorandum, also Company Exposé helps interested parties to gain a comprehensive overview of the company. In addition to a brief introduction to the history, the products and the strategic orientation, the following information is provided ?hard? and ?soft? factors listed. The ?hard? factors are the company figures with which the interested party can determine a company value.

The ?soft? factors include those points that cannot be quantified or can only be partially quantified. Here, for example Leadership levels, Market environment, staff training, unique selling propositions and customer and supplier relationships described. The SWOT analysis is one possible tool for producing this information.

Buyer approach and marketing phase

Within the 4 phases of the sales process, the buyer approach should not be neglected under any circumstances.

Potential buyers / company successors

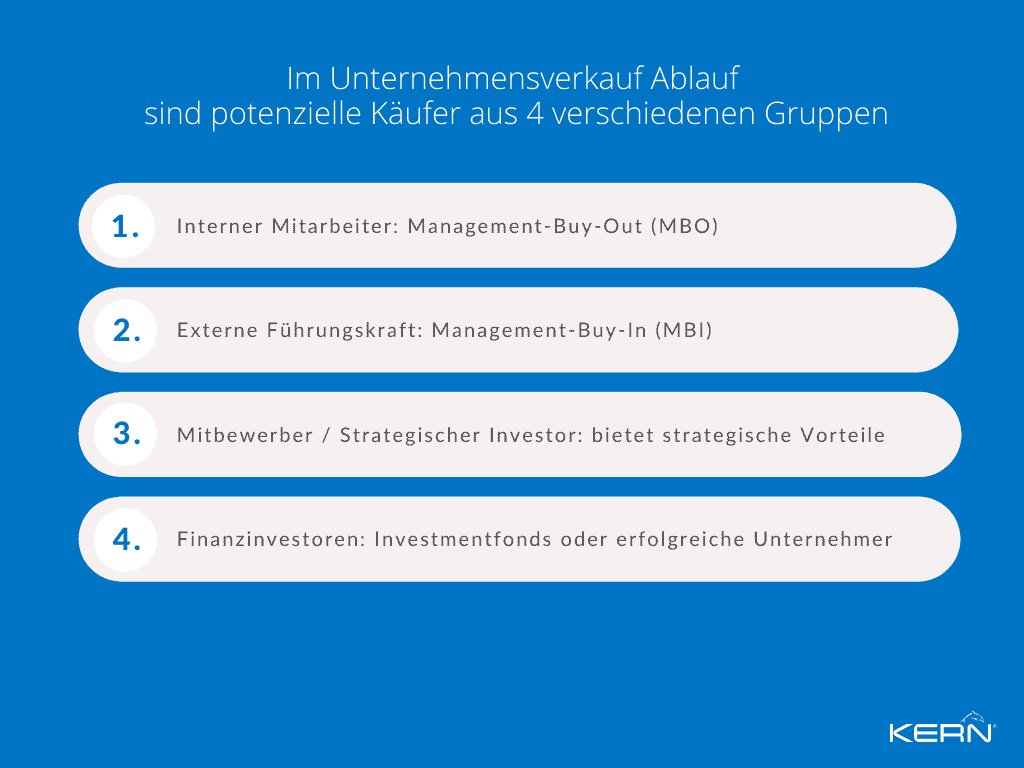

A company can be sold to different types of interested parties. Each type of buyer should be approached differently, as different investors also have different incentives in a business transaction.

Internal employee

At Management Buy Out (MBO) the management of a company acquires the company shares and thus gains control over the company. MBOs are often a planned generational change in which the buyer already has all the information about the company in advance.

External manager

At Management Buy In (MBI) an external actor acquires control over the company. However, they have significantly less information about the company. Therefore, purchase price negotiations are often much more difficult than with an MBO.

Competitor / Strategic Investor

The acquisition of a competitor offers a variety of strategic advantages. Thus Customer and supplier relations, research and development results and the competition is reduced at the same time. In addition, the integration of the acquired company into the value chain of the strategic investor can create synergies and increase the value of the company.

Financial investors

The business model Buy company for financial investors is to resell the purchased company at a later date at a profit. The goals of financial investors are often Start-ups or companies in growth sectors.

Financial investors are often investment funds or successful entrepreneurs who already have a large amount of capital. This is invested in many companies in the hope that the investments in successful companies will prevail and generate a large return in the future.

Active buyer search with the long list / short list method

The Long List/Short List method is a systematic procedure for the Identification and classification of potential buyers for the company.

The Long List lists all the criteria that a buyer should fulfil. Based on this list, all suitable buyers are roughly identified.

The criteria of the long list are weighted on the short list. The result is a ranking of the most suitable potential buyers. These can then be further subdivided according to the most important decision criteria.

Approach prospective buyers

The classes created can be used to target potential buyers. HereThe highest effort should be invested in the Courting the candidates of the most relevant class flow.

Should no prospective buyer emerge in the most important class, talks with the companies of the second and possibly the third class will be intensified. Since these actors are probably aware that there are better matching purchase candidates, an individual communication strategy should be worked out for each target group.

Passive buyer search with a company exchange

While the long list/short list method is used to actively search for potential acquirers, a company exchange makes it possible to draw the attention of investors to a company for sale on a broad basis, who are interested in an Company acquisition are interested. For this purpose, the entrepreneur or advisor creates an anonymous sales advertisement. The advertisement should mention basic information and arouse curiosity.

If investors are interested, they can then contact the seller or advisor and get to know them. Every seller who wants to do this himself and directly should think about his anonymity in advance and consider how long he can maintain it. An advisor is the perfect safety buffer for a long period of anonymity.

With a company exchange you receive qualified advertisements from interested parties

The confidentiality agreement

Selling a business without an exchange of information between buyer and seller is impossible. The Non-Disclosure Agreement (NDA) is intended to prevent the prospective buyer from passing on or publishing the information received.

Although companies publish annual financial statements every year, this does not include much sensitive information. And fundamentally, an open intention to sell is a potential risk for a seller.

If, for example, contracts with suppliers fall into the hands of a competitor, the latter could use them to determine the exact manufacturing costs of the product produced and start a price war. Therefore, sensitive data should only be shared after agreed confidentiality and binding clarification of a sustainable investment interest.

Corporate audit and negotiation

No company purchase can be completed without thorough checks. They form important pillars in the course of a purchase process and for determining the final purchase price of the company.

The due diligence

At the Due Diligence is a due diligence process that should be specifically prepared with a plethora of questions from the interested party. The aim is to Economic, tax and legal risks of a company acquisition to identify.

For this purpose, the prospective buyer is given access to a wealth of company data, the so-called data room. As negotiations progress and the buyer’s questions deepen, this data room can be expanded.

A due diligence is mostly carried out by the seller and is oriented towards the question needs of the potential buyer. In the case of larger companies, an exception may be a Vendor Due Diligence be.

If risks and problems are identified via DD before entering into final contract negotiations with a prospective buyer, these can be communicated to the prospective buyer during the negotiations or remedied by then. A detailed and fundamental due diligence ultimately protects both sides from possible claim risks after a purchase.

The sale of a company from a tax perspective

Taxes are an important issue when selling a company. On the one hand, taxes may be incurred when transferring control of a company, and on the other hand, sellers already try to find out during due diligence how future taxes can be avoided.

If a business is passed down within the family, a Gift tax for the new entrepreneur if the company is passed on at a price below the value of the company. The prospective buyer, on the other hand, checks which legal form can save him taxes. Certain legal forms and contractual constellations can help both sides to save taxes.

The Due Diligence Checklist

Due diligence involves the use of documents from the areas of financial statements, taxes, financing, competition analysis, sales, marketing, purchasing and logistics, business organisation, HR, land and buildings and company law.

In principle, the documents should fully reflect the last 3-5 years. During Annual financial statements and market analyses for business valuations are used, all Contracts (shareholder agreement, customer and supplier contracts, employment contracts) reviewed for legal risks become.

The complete transmission of all important documents is particularly important for the seller. Liability is transferred for all risks that were known to the buyer. If information is withheld, the seller must also be liable after the sale of the business.

Take a look at our Due Diligence Checklist to find out more about what will be tested in detail.

Contract and conclusion

The final step in the process of selling a business is the contractual arrangements. Although the sales process is coming to an end, attention should still be paid. Often there is a strong emotional tension on both sides at this stage. The appropriate communication thus takes on a particularly high significance for achieving the final signature.

Asset Deal or Share Deal?

The transfer of a company can take place in two different ways. At Asset Deal the company sells individual assets to the buyer. All assets should be recorded and transferred individually.

In practice, this is often difficult, especially if intangible assets are to be transferred, since the entire purchase price must be divided among the individual assets. In addition to assets, liabilities can also be transferred.

At Share Deal on the other hand, it is not the assets but the shares in the company that are transferred. This means that control over the company, including all assets and liabilities, changes from the seller to the buyer.

The asset deal offers the possibility to take over only certain parts of a company. In this way, the buyer can minimise the liability risk by not assuming certain liabilities. On the other hand, the expense of an asset deal may be significantly higher in detail and contracts with customers or suppliers could be subject to a termination risk in the process.

Read more about the topic in our technical article Share Deal vs. Asset Deal.

The bidding process

The bidding procedure is a process in which the highest bidder can be determined from among the interested parties. For this purpose, in a first phase all interested parties are asked to submit a non-binding offer. Based on these offers, the seller selects the most promising investors.

In a second phase, these receive extended access to internal data and can thus submit a binding offer. In the final phase, those who have submitted the best bids are given access to the Most confidential information. Contract negotiations then take place with these interested parties. This procedure is clearly structured and can be implemented within a manageable period of time.

The Letter of Intent

The Letter of Intent (Letter of Intent in advance of an upcoming DD) is an important tool in contract negotiations. Both parties record their most important intentions in detail and in writing. In this way, it can be recognised at an early stage whether an agreement is at all possible.

The company purchase agreement

If the buyer and seller were able to reach agreement during the contract negotiation, the Company purchase agreement is drawn up. This describes all negotiated points, such as the number of company shares taken over (in the case of a share deal) and the purchase price.

Although a company purchase agreement for the sale of a company is in principle not bound to any particular formHowever, parts of the contract, such as shares in a limited liability company or real estate, may require notarial certification.

The Earn Out Clause

An important component of a company purchase agreement is the Earn Out Clause. In addition to the purchase price, this clause guarantees the seller a performance-related additional price. The buyer and seller agree on this, Conditions and amount of subsequent, further payments, firm.

Such a performance-based payment serves in many cases as a compromise in the case of widely divergent price expectations or risks in future development. It also serves as additional motivation if the entrepreneur continues to work for the company.

Closing of the transaction - signing and closing

The final step in the sale of the business is the signing of the contract and its fulfilment. Closing. The transfer of the shares in the company takes place when all necessary contractual conditions, for example payment of the purchase price, have been fulfilled.

You can find more detailed information and useful tips in our guide to selling a business.