Current situation in business succession

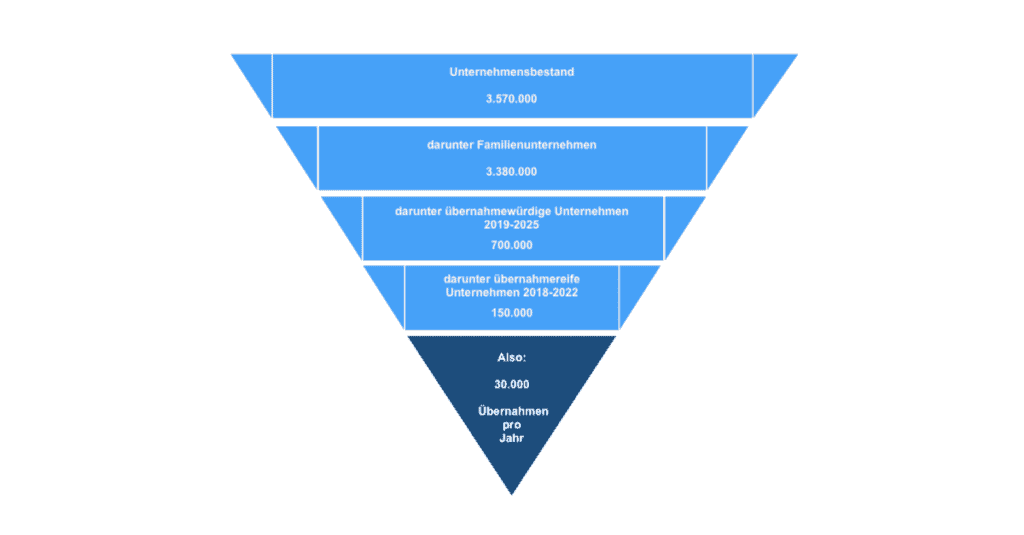

According to the Institute for SME Research (IfM), 150,000 companies in Germany will face the task of settling their company succession in the next 5 years (2018 to 2022). On average 30,000 each year. This steadily increasing volume of business successions up to 2025 is primarily age-related. The service sector is in first place, followed by manufacturing and trade. In total, around 2.5 million employees are affected by this development.

Company succession in Germany (2018 - 2022)

A central problem with the Company sale is that no natural successor can be found. For these enterprises, the question of existence then arises. It is often overlooked that the potential for a continuation of the business is certainly there if the employees can contribute their competences and participate. In the worst case, unregulated, wrong or late succession can lead to insolvency or liquidation of the company. The loss of many employees’ jobs then represents a major economic problem!

Basics webinar presented by Nils Koerber

Company sale (M&A) without risk and loss of value

Only 18 percent of family businesses transfer their business to managers from their own ranks. A so-called Management Buy Out (MBO). But why not transfer the company to several or all employees? The form of the registered cooperative (eG) can make a constructive contribution to solving the succession problem.

The cooperative model (eG) - briefly explained for business succession!

Cooperatives are economic enterprises that are managed independently by their members and which at the same time operate on behalf of their members. They are made up of natural or legal entities.

Objective of the alliance is the promotion of its members through joint managed business activities. There are different types of cooperatives, such as building, production, consumer and sales cooperatives. sales cooperatives.

While a KG can be founded with at least two partners and a GmbH with at least one partner, a cooperative needs at least three persons to be founded. The cooperative is solely and exclusively obliged to promote the interests of its members. The cooperative’s business activities are geared towards either economic, cultural or social goals.

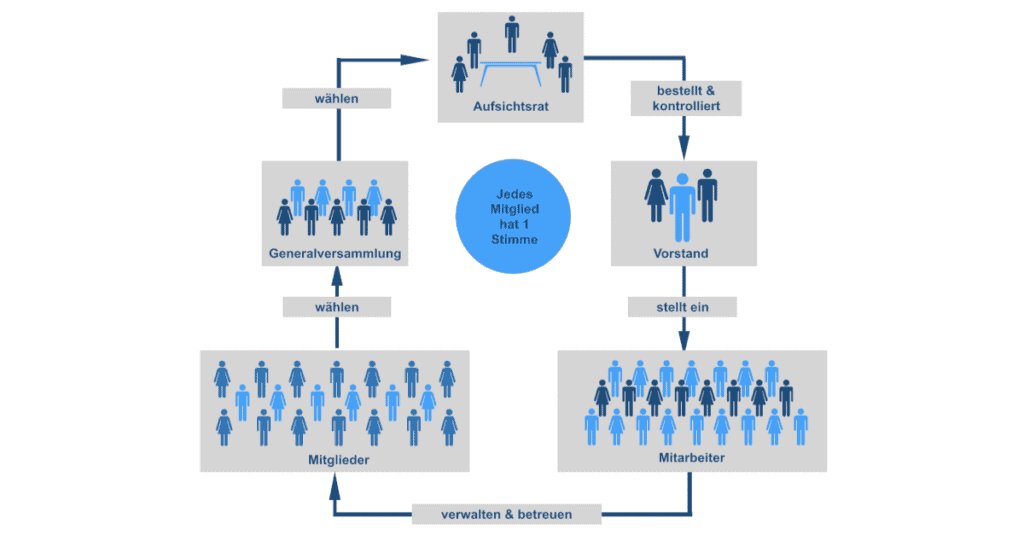

With a board of directors and a supervisory board, the cooperative has a clear management and control structure. It is a democratic legal and corporate form. Each member has one vote ? regardless of the amount of capital held. Small cooperatives with up to 20 members can do without a supervisory board.

The cooperative concept:

Members of a members of a cooperative are only liable with their capital share if the articles of association the articles of association exclude the obligation to make additional contributions. Upon withdrawal, they have a Upon withdrawal, they are entitled to repayment of their share capital from the cooperative. This does not require a third party to take over the shares.

Structural Changes are only possible with a three-quarters majority. This gives the registered cooperative a great stability. It thus secures entrepreneurial independence and rules out a hostile takeover.

The legal form of the registered cooperative is suitable for many very different purposes. It is flexible, easy to manage, and it is Proven for over 160 years. Entry or exit takes place unbureaucratically, at nominal value and without notary or Company valuations.

In principle, the cooperative has the same tax status as a corporation. However, with the cooperative refund (appropriation of profits) it has an ‘exclusive tax saving model’. The reimbursement is booked by the cooperative as a tax-reducing operating expense.

Every cooperative is a member of a cooperative auditing association. In the interest of the members, this association regularly audits the economic situation and the regularity of the management. The statutory audit in accordance with the Cooperative Act gives the members Certainty about the economic development.

Through the internal control of their members and the independent audit by the cooperative federation, cooperatives are by far the most most insolvency-proof legal form in Germany. The Conversion of a corporation (GmbH; AG) as well as a partnership (GbR, OHG, KG, GmbH & Co. KG) into a cooperative is possible without any problems according to the Transformation Act.

In order to promote the attractiveness of the cooperative model, a Bundesrat initiative was recently launched by the NRW state government. It wants to adjust corporate taxation accordingly. With this bill, the Bundesrat plans to raise the tax exemption limit for employee participation from currently 360 euros to 5,000 euros per year. So far, however, the draft provides for a restriction to young companies (?start-ups?).

The cooperative as a succession solution

The registered cooperative (eG) offers an alternative for committed employees of the company in cases where there is not yet an arrangement for succession and transfer of the company. In this way, therefore, no new company is created, but rather additional entrepreneurs.

The The transfer of the company follows the usual conditions of the founding of a cooperative. The minimum of three founding members take over the and are jointly responsible for the further economic success of the company. success.

The advantages are are obvious:

- Since the cooperative can pool the financial resources of several participating persons, the financing of the Purchase price easier to realise.

- In addition, the cooperative offers the retiring entrepreneur the possibility of a gradual retirement. For example, as a member of the supervisory board of the eG or as a consultant for the company in an employment relationship.

2 Practical examples for cooperative in business succession

1. the Kohlbrenner eG planning consortium, Berlin

The originally owner-managed urban planning company was successfully transferred to a cooperative as part of the company succession search. In 2006, the owner, who was a sole proprietor at the age of 64, offered the company to his employees for sale, as a successor from the family was not available. But because no single employee wanted to take over the responsibility alone, only a joint solution came into consideration. Of the 20 permanent employees, 8 were willing to invest in the company. The way to a sale price acceptable to all was a particular challenge. The price expectations were ten times different. When the agreement was reached, the purchase price was paid in a lump sum and a graduated profit sharing was spread over several years. In this way, a link was found between the purchase price and the company’s earnings situation. In addition, the former boss is still active as a consultant for the company.

The clients were open to the eG model. An external conflict solver proved helpful in bringing it about. (Source: https://library.fes.de/pdf-files/wiso/14628.pdf)

2. the Grünspecht eG carpentry company, Freiburg

The carpentry Grünspecht was founded in 1984 as a GbR in Freiburg. In 1991 it was then into an employee cooperative. With 28 employees, 16 of them of them belong to the cooperative. The carpentry company stands for ecology and sustainability and is run by a team from all age groups. The basis is a cooperative, self-managed corporate culture. Every employee, who wants to take responsibility for and influence the development of the company development of the company is admitted with a compulsory share of 2,500 euros. share. The long-term commitment to the cooperative and an intensive participation in the company’s decisions mean that joining the cooperative is well well thought out.

It is remarkable that younger employees in particular are also joining the cooperative, thus and thus secure the long-term succession of the company. The good economic situation situation offers scope for a strong family orientation (e.g. parental leave). parental leave).

Job security, adequate income and good working conditions are part of the cooperative’s promotional mission. The Grünspecht carpentry workshop is thus a successful example of a proactively pursued successful business model. Generation change in the company. (Source: https://library.fes.de/pdf-files/wiso/14628.pdf)

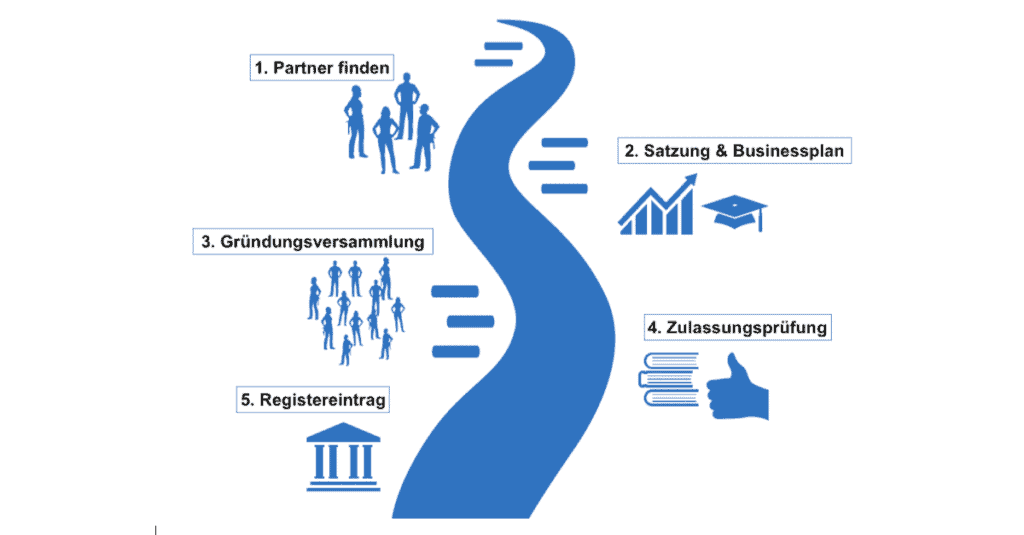

5 steps to a cooperative for business succession

The formation of a cooperative usually takes place over 5 steps:

Founding path of the cooperative:

© Graphic: KERN ? The succession specialists

1. develop ideas and win partners

Starting with the basic idea, like-minded partners must be found and convinced to put together the founding team. Subsequently, both the basic economic concept and the goals of the joint enterprise must be drafted.

2. develop an economic concept (business plan) and founding statutes

Based on the basic concept, a corresponding business plan must be worked out, the articles of association drafted and tasks and competences (allocation of offices) in the future cooperative defined.

3. foundation of the cooperative

After the approval of the participants, the cooperative is to be founded by signing and electing the organs.

4. entrance examination

Subsequently, a foundation audit (economic concept & articles of association) must be applied for by the cooperative auditing association, which verifies the regularity of the cooperative’s objectives and foundation.

5. registration of the cooperative

After a successful formation audit, the cooperative is entered in the register of cooperatives and can begin its activities.

Conclusion for business succession solutions

We, at KERN ? Succession Specialists, are convinced that business succession in the form of a registered cooperative is a sensible alternative in special cases.

In the context of a economy, the advantages of shared assets can also be transferred to the sharing of The advantages of shared assets can also be applied to the sharing of responsibility in entrepreneurship.

Many people interested in succession fail to obtain financing for their entrepreneurial dream because they have little equity capital. In addition, the generation between 30 and 40 years of age in particular has an increased need for security.

The sharing of responsibility and the non-solely economic orientation of a company correspond to modern values, which the historically proven model of the registered cooperative takes into account.

Authors

Nicole Kalonda - KERN - The succession specialists, Hamburg location

Götz Kehrein - KERN - The succession specialists, Hamburg location

Roland Greppmair - KERN - The succession specialists, Munich office

Holger Habermann - KERN - The succession specialists, Munich office

TIPS for further reading:

5 important trends in business succession in 2019

What increases the value of the company?

KERN Group again receives award in consultant quality

Company value calculator determines company value

Image: Fotolia.com

Cooperatives are economic enterprises that are managed independently by their members and at the same time operate for their members. They are composed of natural and legal persons.

The cooperative offers an alternative for committed employees of a company in cases where there is not yet an arrangement for succession.

The advantages:

1. since the cooperative can bundle the financial possibilities of several people, the financing of the purchase price is easier to realise.

2. the retiring entrepreneur may continue to work as a member of the supervisory board or as a consultant for some time and gradually withdraw.

A cooperative is founded with at least three persons. The cooperative is solely and exclusively obliged to promote the interests of its members. The business activities of the cooperative shall be directed towards either economic, cultural or social objectives.