In the cooperative model, responsibility in the company is spread across many shoulders and thus the succession secured.

A central problem in many companies is company succession. Often there is no natural successor. Therefore, the question of the company’s existence must be asked. In the worst case, unregulated, wrong or late succession can lead to insolvency or liquidation of the company. The loss of jobs for many employees represents a major economic problem. Many entrepreneurs overlook the potential of their own employees.

Basics webinar presented by Nils Koerber

Company sale (M&A) without risk and loss of value

Only 18 percent of family businesses transfer their business to managers from their own ranks. A so-called Management Buy Out (MBO). But why not simply transfer the company to several or all employees?

The registered cooperative (eG) offers a very good alternative for committed employees of the company in such cases for which there are not yet any arrangements for succession and transfer of the company. The eG does not create a new company, but rather additional entrepreneurs. This is an employee buy-out. The transfer of the company follows the usual conditions for founding a cooperative. At least three founding members take over the company and are jointly responsible for its continued economic success.

The cooperative model - the advantages are obvious:

- Since the cooperative can pool the financial resources of several participating persons, the financing of the Purchase price easier to realise.

- In addition, the cooperative offers the retiring entrepreneur the possibility of a gradual retirement, for example as a member of the supervisory board of the eG or as a consultant for the company in an employment relationship.

The cooperative model (eG) - briefly explained!

Cooperatives are economic enterprises that are independently managed by their members and at the same time manage for their members. They are composed of natural or legal persons.

The aim of the alliance is to promote their members through jointly managed business activities. There are different types of cooperatives, such as building, production, consumer and sales cooperatives.

While a KG can be founded with at least two partners, and a GmbH with at least one partner, at least three persons are required to found a cooperative. The cooperative is solely and exclusively obliged to promote the interests of its members. The cooperative’s business activities are geared towards economic, cultural or social goals.

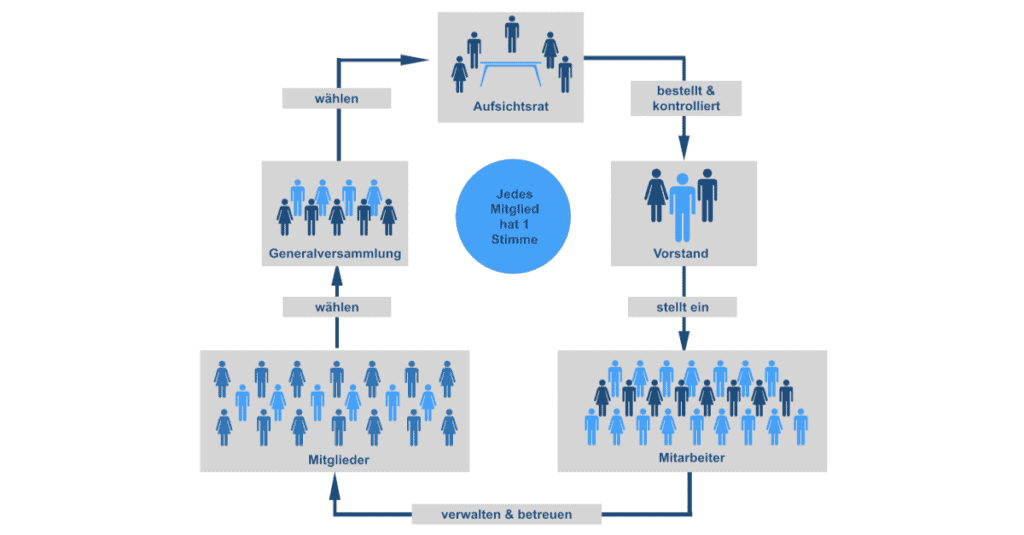

With a board of directors and a supervisory board, the cooperative has a clear management and control structure. It is a democratic legal and corporate form in which every member has a vote ? regardless of the amount of capital held. Small cooperatives with up to 20 members can do without a supervisory board.

Cooperative concept

Members of a cooperative are only liable with their capital participation if the articles of association exclude the obligation to make additional contributions. Upon withdrawal, they have a claim to repayment of their share capital against the cooperative. This does not require a third party to take over the shares.

Structural changes are only possible with a three-quarters majority. This gives the registered cooperative a great stability. It thus ensures entrepreneurial independence and rules out a takeover.

A proven concept

The legal form of the registered cooperative is suitable for many different purposes. For example, it is flexible, easy to manage and Proven for over 160 years. Entry or exit is unbureaucratic, at nominal value and without a notary or company valuations.

In principle, the cooperative has the same tax status as a corporation. However, with the cooperative refund (appropriation of profits) it has an ‘exclusive tax saving model’. The reimbursement is booked by the cooperative as a tax-reducing operating expense.

Every cooperative is a member of a cooperative auditing association. In the interest of the members, this association regularly audits the economic situation and the regularity of the management. The statutory audit in accordance with the Cooperative Act gives the members Certainty about the economic development of the cooperative.

Through the internal control of their members and the independent audit by the cooperative federation, cooperatives are by far the most most insolvency-proof Legal form in Germany.

The Conversion of a corporation (GmbH, AG) as well as a partnership (GbR, OHG, KG, GmbH & Co. KG) into a cooperative is possible without any problems according to the Transformation Act.

The cooperative model becomes more attractive

To promote the attractiveness of the cooperative model, a Bundesrat initiative was recently launched by the NRW state government. It wants to adjust corporate taxation accordingly. With the bill, the Bundesrat plans to raise the tax exemption limit for employee participation from currently 360 euros to 5,000 euros per year. So far, however, the draft provides for a restriction to young companies (?start-ups?).

Images: KERN - Company succession. Successful

Authors’ Community:

iteratecDr Michael Gebhart, Dr Zoltan Fazekas, Manuela Braitmaier

KERN: Roland Greppmair, Holger Habermann, Wolfgang Bürger

TIPS for further reading:

Family-internal business succession continues to lose importance

Lack of successors threatens family businesses and jobs in Germany