Especially for the owners of smaller farms, the Company succession in the skilled crafts sector has become a question of survival. The following practical example describes the successful business handover of a craftsman in a structurally weak location. The project was named one of the best business succession projects in Germany by the renowned WirtschaftsWoche magazine.

We were commissioned as KERN ? Die Nachfolgespezialisten to find a successor for a long-established and successful refrigeration and air conditioning company with seven employees. As no family member wanted to take over the succession, the owner decided to sell and hand over his craft business.

This lack of qualified skilled workers reduces the chances of success for a business succession in the skilled crafts sector

The special feature of this mandate: For years, the refrigeration and air conditioning industry has suffered from a severe shortage of young talent, master craftsmen and skilled workers. This lack of qualified specialists is increasingly reducing the chances of succession in the trade and now also in other sectors.

Highly profitable and outstanding regional market position

Due to its specific portfolio of services and good staff retention, the company has built up an outstanding regional market position with many regular customers and service contracts over the course of more than 25 years. The company’s location, which is not favourable from a transport point of view, and its high profile also represent a barrier to market entry for competitors.

The business was particularly suitable for management buy-in candidates or strategic investors with growth plans in this region.

Another challenge in the search for a successor was the compulsory master craftsman status imposed by the Chamber of Crafts. It was also necessary to skilfully use the high level of customer loyalty to the managing master craftsman in the interests of the successor.

Intensive preparation ensures good first impression

Previously, the contracting authority had used various methods (including multiplier method, turnover method) to calculate an excessive Enterprise value determined. Therefore, this was reviewed and corrected to a market-realistic level. The specific geographical location and the dependence of the company on the third-party manager and master were taken into account.

The next step was to create a detailed exposé. It consisted of a comprehensive presentation of the business model and the background and potential of the company.

In addition, this exposé also contained an adjusted valuation of the company, including reprocessed key business figures neutralised by special effects.

The exposé was the information basis for the subsequent identification of strategic investors from all over Germany. It also helped to contact guilds for refrigeration and air conditioning technology and refrigeration schools with master classes.

Direct approach to interested parties and stock exchange placement

The sales strategy was agreed with the client in advance. We discussed possible starting points such as expanding the location, recruiting skilled workers and profitably expanding the customer base for strategic investors from the refrigeration industry. At the same time, we considered a possible portfolio expansion for companies from the sanitary and heating sector or the approach of so-called management buy-ins (MBIs) in preparation for the handover of this craft enterprise. The result was an anonymous sales offer to approach interested parties.

Structured buyer search in different channels

At the beginning of the implementation phase, a structured search for buyers was carried out: both in KERN’s nationwide network, as well as by directly approaching strategic investors and also by searching reputable company exchanges.

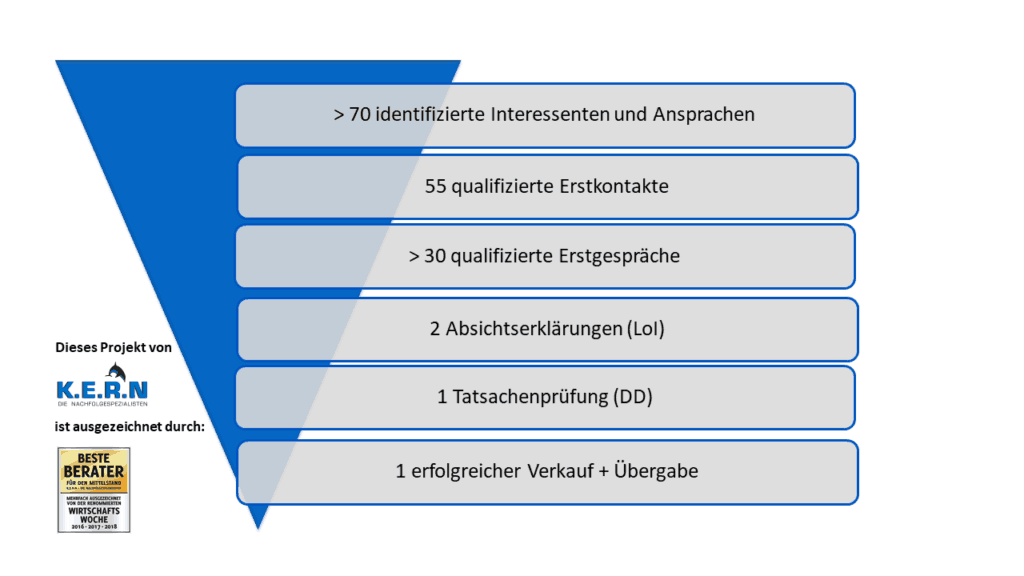

In the course of the project, we had contact with well over 70 potential buyers. The potential successors were pre-selected in more than 30 detailed telephone interviews. After the corresponding approval by our client and the subsequent agreement of confidentiality, the exposé was handed over to them.

Facilitation ensured successful company succession in the skilled crafts sector

A total of 3 of the prospective buyers showed further interest. Subsequently, the coordination and moderation of the talks between the transferor and the transferee took place. Parallel to these talks, corresponding declarations of intent for the transfer of the business of this craftsman were prepared. Later in the process, the tax advisors and lawyers of both sides were involved. In close coordination between seller and buyer, the next step was to accompany and support the preparation of the contract as well as an audit appropriate to the project (similar to an abbreviated due diligence).

The moderation by KERN’s transaction-experienced advisor ensured goal-oriented negotiations. Intensive moderation and translation was necessary, especially in the fine-tuning between the tax advisors and the lawyers on both sides. In retrospect, this was the essential factor in making this business handover in the trades successful. Here it became clear: commissioning a specialist experienced in business succession significantly reduces the risk of an expensive project abortion or costly mistakes.

Lack of entrepreneurs as a central bottleneck in business transfers in the skilled crafts sector

The identification of a suitable prospective buyer was unforeseeable and the greatest difficulty to be overcome in the overall process. This turned out to be extremely complicated.

In this project, the lack of entrepreneurs in the craft sector that went hand in hand with the already existing buyer’s market became apparent: both the de facto monopoly position, the very high earning power and the excellent growth opportunities in the food industry, tourism and special plant and machine construction all spoke in favour of the project. Nevertheless, it was uninteresting for many strategic investors and MBIs.

Location plays an important role in succession decisions

The reason was the geographical location of the company. In the view of many investors, this limited the future development of the business. However, at the time of the sale, the company was already serving a number of clients from neighbouring regions. For family reasons, many of the interested MBIs did not plan to move or shied away from regular commuting. And this despite the very good market position, a return on sales of 25 percent and the excellent growth opportunities of this company.

In the end, however, the company was sold to a graduate engineer within the framework of an MBI after only 11 months. Against the background of an average project duration of 18-24 months, this is a great success.

Successful company handover after 11 months

The first contact with the transferee took place two months after the start of the project. The signing of the notary contract and the handover of the company followed nine months after the first meeting.

A good compromise between the purchase price offer and future prospects was the goal for both seller and buyer.

Even during the concretisation phase, great attention was paid to safeguarding the interests of both sides. For three months after the initial contact, the first letter of intent was available.

The buyer prepared his financing and acquisition concept very well. For this reason, he received a very quick financing commitment from the bank and the investment bank of the federal state after another three months.

As a result, this business succession in the skilled crafts sector is very successful: no relocation took place and all jobs were retained.

The transfer of this craftsman’s business went according to plan and went smoothly. The third-party manager works very well with the buyer. In addition, another master craftsman is now being set up to take over the role of the current master craftsman in the long term. Moreover, the customers remain loyal to the company and so the business continues to run smoothly.

You might also be interested in this:

Free guide to the sale of a company and company succession

3 practical tips for preparing a business succession

Interview: Preparing the succession within the family well

One third of all craft enterprises face business succession in Grafschaft Bentheim

Comment: Unresolved company successions endanger our prosperity

Company succession also a topic in the Osnabrück region

The general conditions for successful company successions are coming to a head

Company sales on the rise in Emsland

How do you recognise a reputable business sale advisor?

The costs of a business succession or an M&A project

Company successions in East Westphalia and Bielefeld are on the rise

Primarily, business transfers in the skilled crafts sector are made more difficult by the high shortage of entrepreneurs. In addition, there is often the obligation to be a master craftsman. But the location can also make the search for a buyer more difficult.

First and foremost, there is good preparation, including an informative exposé. After that, an anonymous offer for sale helps in approaching interested parties. Once a suitable buyer has been identified, moderation by a consultant with transaction experience ensures goal-oriented negotiations. The fine-tuning between the two parties is particularly important.

First of all, a comprehensive presentation of the business model and the background and potential of the company is important. In addition, it should also contain a valuation, including key business figures that have been processed and adjusted for special effects.