A closing is understood to be the Legal entry into force of a financial statement.

Although at first glance it may seem like a formality, it is important for buyers and sellers to know the difference between signing and closing.

The following article clarifies.

You don’t have much time to read? The closing in brief:

- Closing refers to the Economic transition of the company

- It is the Completion of the Transition phase after signing

- Until enforcement, in practice various measures be taken

Table of contents

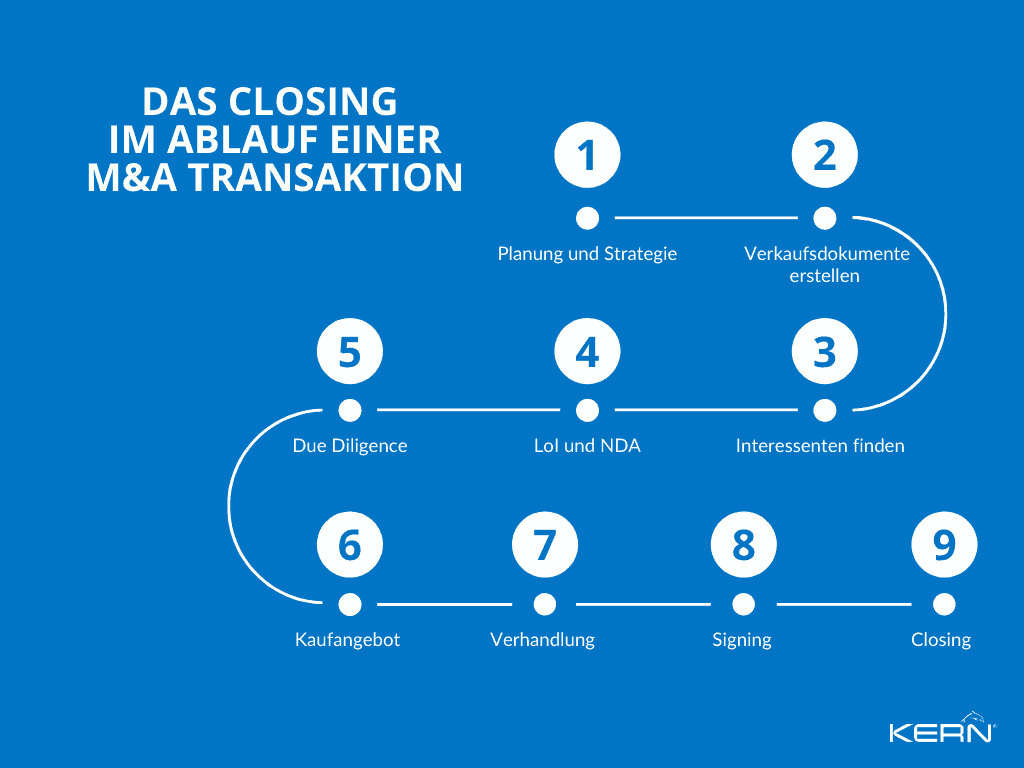

Definition: Closing in the M&A transaction

When one speaks of a closing in the context of an M&A transaction, it is, by definition, the day of the economic transfer of the company to the new owner. The previously Contractually stipulated handover is executed here.

Specifically, this means that a legal contract previously exists that has been signed by both the buyer and the seller. If the conditions for the conclusion have been fulfilled by both parties, this Contract in force on a previously agreed effective date. This entry into force designates the Closing.

Find out about all the hurdles and terms of a successful sale:

In our online seminar Selling a Business you will learn how to find the right buyer for your company.

Origin of the term

The term closing comes from the English language and means “closing”. This means in detail that a transaction is closed by a legally binding contract executed by both contracting parties, i.e. is completed.

Difference between signing and closing

A Company sale usually takes place on the basis of its Complexity in several steps. Once the contracting parties have agreed on the corresponding terms and conditions, the contract is signed. This process is called signing. In the case of legal entities (e.g. limited liability companies), the signing must be certified by a notary public.

By signing, i.e. concluding the contract, both parties enter into obligations under the law of obligations, according to the definition. The fulfilment of these obligations is due on a key date specified in the contract. If the obligations laid down by both parties fulfilled, the contract will then be executed on the cut-off date specified in the signing.

Ownership changes hands and the transaction is completed. The closing has thus taken place.

Closing example

The Shareholder XYZ would like to sell its shares in the 123 GmbH to the Buyer ABC transferred. Both parties have agreed on the corresponding framework conditions, such as the purchase price.

In addition, it was stipulated in the contract that shareholder XYZ would pay its liabilities to the Suppliers L, M and N has to settle. The buyer ABC, on the other hand, still has to have the takeover of the company shares approved by the Cartel Office, as it already owns several companies in the same industry.

The signing will take place on 01.11.2022 in the presence of a notary. The date agreed for the economic transfer of the shares in the company is 01.01.2023.

On 01.01.2023, both the shareholder XYZ and the buyer ABC have fulfilled all formalities stipulated in the purchase agreement. The shares in 123 GmbH are therefore transferred from the old shareholder XYZ to the new shareholder ABC on this date.

Interim Phase and Closing Conditions

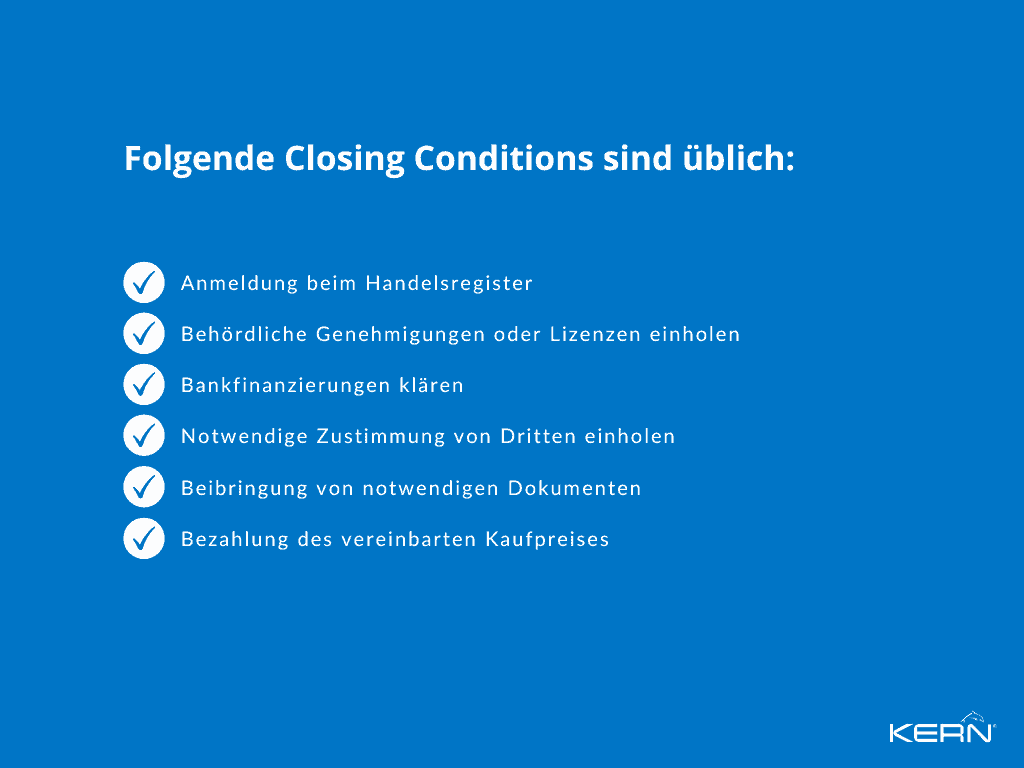

The interim phase is the phase that lies between the signing and the closing. This phase serves to fulfil the agreed points, i.e. the closing conditions.

The closing conditions can be more or less extensive. This is for example Depends on the type, size and industry of the company and primarily depends on what both parties have agreed with each other in a legally binding manner.

The more comprehensive the closing conditions are, the longer the interim phase usually is.

The closing in the company purchase agreement

The closing will take place at a Company acquisition set by a cut-off date. On this cut-off date, the Company shares and/or assets shall pass to the purchaser. The prerequisite for this is that the closing conditions have been fulfilled.

The date of closing is recorded in writing in the company purchase agreement and accepted by both parties at signing. In addition, the conditions and measures necessary for the closing are also listed in the company purchase agreement.

Measures until enforcement

The measures up to execution, i.e. the Closing Conditions, are in the Company purchase agreement described. With the signing, both parties have agreed to implement these measures by the set deadline. The measures can be very different depending on the company purchase agreement. Examples of these closing measures are:

We are happy to accompany you through all the necessary steps ? From the sales advertisement to the closing and beyond:

Closing of asset deal / transfer of business

In an asset deal, the company itself sells tangible and intangible assets. The intangible assets also include the employment relationships. Before the transfer of operations, i.e. the closing of the asset deal, can take place, the following steps must first be taken Employees according to § Section 613a (5) BGB to teach.

Workers must be informed in full detail of the timing, reason, legal, economic and social consequences regarding their jobs when they are purchased and taken over.

The background for this regulation is that in an asset deal, in contrast to the share deal, the employer changes, as it does not remain the same company. This new employer may not simply be imposed on the employee.

You can find more information on this topic in our article Share Deal vs. Asset Deal.

Accordingly, section 613a (5) BGB provides for a Objection period of one month for the employees. Only when this objection period has expired can the asset deal be closed.

It is important to adhere to the exact requirements of section 613a (5) of the German Civil Code (BGB) and to inform the employees in full, as otherwise the objection period after the transfer of the business will not expire if the employees are given incorrect, erroneous information.