When selling a company, the earn-out clause is a decisive factor in achieving a fair and forward-looking purchase price.

How does an earn-out work? An earn out Divides the purchase price into a fixed and a variable component The variable portion is only paid after the transaction has been completed and is based on the company’s future performance. This mechanism is often used, if there are uncertainties about the true value of the company or if the seller wishes to remain involved in the future development of the company.

Earn-out clauses can be found in company purchase agreements. They are part of the purchase price clause in the Company sale. An Earn Out Divides the purchase price into a fixed and a variable component on.

You don’t have much time to read? A compact summary of everything you need to know about Earn Out:

- Earn out clauses are used when the parties to the contract have Different estimates of the purchase price possess.

- What are earn-out payments? Part of the purchase price will be paid at a later date.

- The outstanding payment is usually Dependent on economic developments of the business made.

- There are no legal restrictions on the earn-out payment, so there is room for manoeuvre.

- An earn out clause also carries risks, such as the deliberate manipulation of corporate development with the aim of lower payments.

Table of contents

- Earn Out Definition

- Earn-out clause in the acquisition of a company

- Earn Out example

- Company purchase agreement

- Earn Out Agreement

- When does an earn out scheme come into play?

- Option right

- Earn out model

- Define calculation basis

- Accounting standards

- What arrangements need to be made?

- Dangers

- Advantages and disadvantages from the point of view of seller and buyer

- Seller loan as an alternative

- Taxes

- Conclusion

Earn Out Definition

A Earn Out is a Downstream, additional and often variable purchase price component. The earn-out payment is linked to an uncertain future event. This event is usually earnings or the future earnings performance of the company.

Earn Out German: The term “earn out” can be translated into German as “subsequent purchase price payment” or “performance-related purchase price payment”.

Earn-out clause in the acquisition of a company

Through an earn-out clause in the Company purchase agreement Buyer and seller agree that not the full price, but only a certain part is paid upon transfer of the shares. Such clauses are particularly important in complex Corporate transactions This is common in cases where the future development of the company and thus the final value of the company are not clearly known at the time of sale. The other part of the purchase price is Company acquisition settled later.

Earn Out example

To illustrate the application of an earn-out arrangement, consider the following example: A company is sold for a price of €2 million. The seller and the buyer agree that 1.5 million euros will be paid immediately and the remaining 500,000 euros as an earn-out depending on the achievement of certain sales targets in the next financial year. If the company achieves or exceeds the defined sales targets, the earn-out amount is paid out in full. If the company fails to meet these targets, the earn-out amount is reduced accordingly or cancelled altogether.

Company purchase agreement

A company purchase agreement is a special form of purchase agreement. This purchase agreement regulates the specific conditions and clauses that are relevant to the sale and purchase of a company or an interest in a company. The company purchase agreement is a Economic and legal transactionA transaction in which a company or an interest in a company is transferred to the buyer either in whole or in part.

One of the most important aspects of a Company sale procedure is the Agreement of the purchase price based on the valuation of the company.

Are you looking for a suitable buyer for your succession? Take advantage of our comprehensive network.

Earn Out Agreement

In addition to the classic earn-out clauses, there are more specific earn-out models that are tailored to the individual needs of the contracting parties.

What is an earn-out model? An earn-out model is a specific agreement within a company purchase agreement that defines exactly how the earn-out is structured. It determines the conditions for additional payments, such as the achievement of certain financial targets or milestones that the company must fulfil after the takeover.

In addition to the classic earn-out clauses, there are more specific agreements that are tailored to the individual needs of the contracting parties. These can take a variety of forms and often include special criteria that go beyond the usual financial indicators. Examples include the achievement of strategic goals or the successful integration of certain business areas after the takeover. These customised agreements allow for a more precise adjustment to the specific circumstances and objectives of the parties involved, which can contribute to a fairer and more target-oriented purchase price.

When does an earn out scheme come into play?

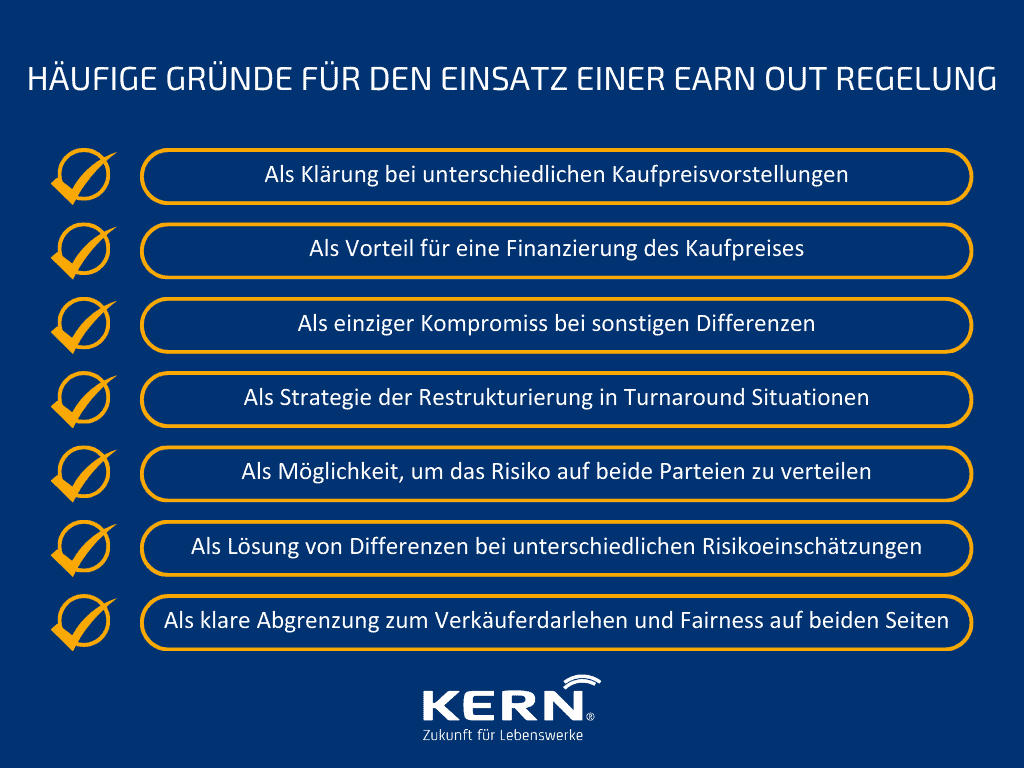

An earn out scheme can be used when Buyer and seller have different ideas about the purchase price of the company have.

These deviating purchase price expectations can have the following causes:

Different assessment of the future earnings or economic development of the company

The valuation of a company is usually based on the capitalised earnings value method according to the IDWS1 standard. In the skilled crafts sector, the AWH method also plays a role. Since these are forecasts for the future, they can be assessed differently by the seller and the buyer. In addition, there may be other uncertainty factors.

This leads to the seller and buyer having a different idea of the purchase price. Through an earn-out arrangement, a compromise can be found here that is fair to both parties. Part of the purchase price is shifted to the future development of the company after the takeover.

Financing the purchase price

In some cases, the buyer may not be able to raise the full purchase price by the time the shares are transferred. Even then, an earn-out arrangement can be advantageous, as the purchaser can only pay the remainder of the purchase price if the company’s earnings develop positively. must.

Other differences

Also, if there are other differences in the valuation of the company, such as in the interpretation of certain risks, an earn out arrangement can lead to the elimination of the conflict.

An earn-out can thus be a possible and also the only compromise in order to satisfy both parties and to achieve an Prevent failure of the entire transaction.

Turnaround situations

If a company is in crisis, it can lead to insolvency or result in the liquidation of the company. However, there is also the Possibility of a turnaround by the M&A process (Mergers and Acquisitions). An investor/buyer believes in the future when concrete changes are implemented with him.

In a turnaround, the company’s weak points are analysed and it is brought back into the profit zone as quickly as possible. With an investor before, or more precisely during such a phase, the company gets several Strategies and options for financial, operational and strategic restructuring. Often, painful changes are easier to implement with the help of a third party than with the previous structures at the management or shareholder level.

Risk distribution

The purchase price is one of the most important criteria in a company purchase agreement. Connected with this is also the question of the distribution of risk between seller and buyer.

There are often several months between the signing of the company purchase agreement and the actual transfer of the company/shares (closing).

During this time, it may happen that the economic situation of the company has changed in such a waythat it influences the value of the company. The expected development after the closing also affects the agreed purchase price, which can also have an impact on the value of the company.

These possible, value-influencing changes are associated with a corresponding risk. Of course, neither the buyer nor the seller wants to bear this risk in full. Therefore a Earn Out scheme a promising way to spread the risk between both parties.

Different price expectations of buyer and seller

Different price expectations of seller and buyer are not uncommon. When valuing a company, the forecasts are decisive. However, these also leave a lot of room for manoeuvre and are often assessed differently by the buyer and the seller. The Seller usually sees developments more positively than the buyer and would thus like to agree on a higher purchase price.

Another reason for the different price expectations is an information asymmetry between seller and buyer. The seller has usually known his company for many years, the buyer looks at it more as an outsider. This leads to a Different risk assessment between seller and buyer and, as a result, to different purchase price expectations.

An earn-out arrangement can help to resolve these differences. However, there are no specifications for earn-out regulations and both parties are free to design this regulation. This often makes the contractual rules very complex and if the wording is unclear, earn-out clauses in particular can lead to disputes afterwards.

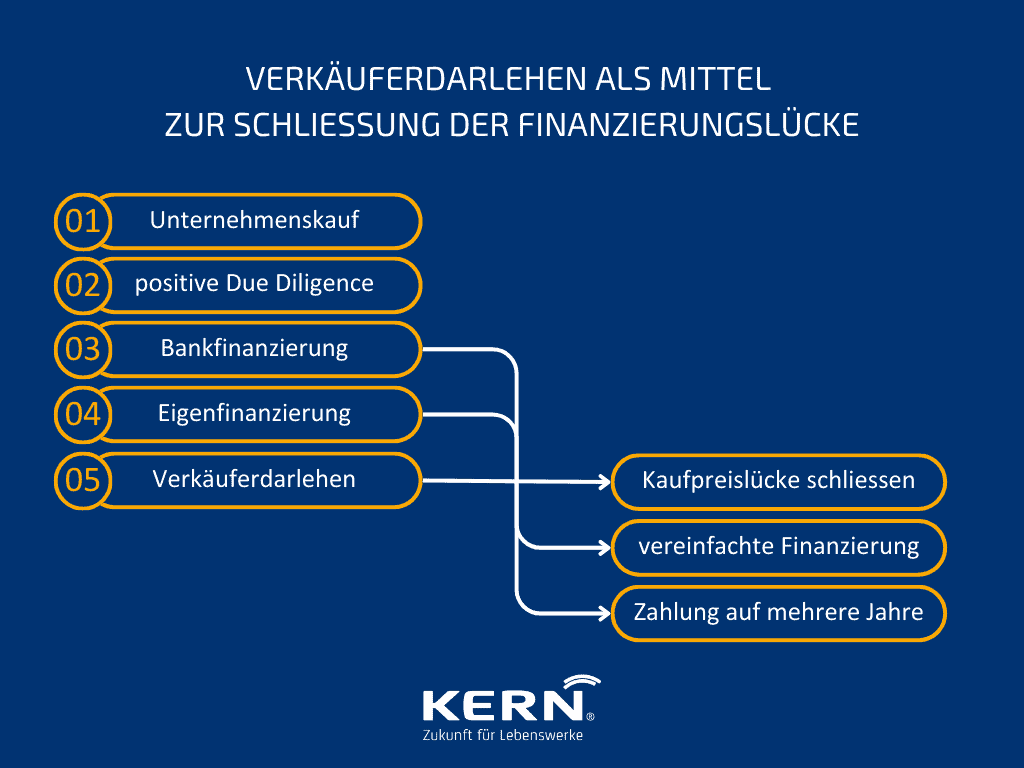

Distinction from the vendor loan

With a Vendor Loan The seller defers a part of the purchase price to the buyer by means of a so-called Seller loan. Part of the purchase price is thus paid upon takeover, the rest of the purchase price is offset as a loan. The seller thus assumes an extended risk. After all, he often lags behind the financing banks in terms of security.

If the buyer goes bankrupt, the seller often bears the full risk for his loan.

In the case of a seller’s loan, the purchase price for the company may be due immediately and at the same time a portion is deferred by the seller. In contrast, with an earn-out, the variable part of the purchase price is only due later and also only if the company develops positively. In this case, both then bear the risk and both are of course interested in the positive development of the company.

Option right

For a high level of security for the seller, in rare cases the contracts may stipulate an option right for the seller in the earn-out clauses. The seller then has the option right during the entire term of the earn-out scheme, to draw a possible basic share of the flexible shares and have it paid out. However, this is then determined by concrete characteristics and is legally complicated to implement in practice.

Earn out model

Classic design

In the classical form, it is mainly a matter of recording the economic success of the company. The purchase price can then be determined according to this recording. In order to then finally determine whether and in what amount an earn-out amount arises, it is necessary from the defined corner points and calculations depending on.

A seller will usually like to measure success by turnover. A buyer, on the other hand, is more likely to measure operating profit, because that is the variable that is particularly important to him. It is advisable if both sides also agree on clear rules for the measurement parameter. For example, turnover may not be shifted or costs artificially increased.

Surplus clause or debtor warrant

This is a special case of an earn-out clause: the buyer undertakes to make an earn-out payment in the event of a sale of the company before the implementation of the agreed arrangements.

Duration

The earn out period determines the duration of the scheme. Usually an earn out period of 2 to 3 years, maximum 5 years is set. With a longer duration, or longer forecasts, the probability of occurrence becomes lower and lower.. Too many factors play a role in the company’s development that cannot be taken into account in advance. In addition, the influence of the new owner on the company and its development increases over the years.

Share of the purchase price

The share of the purchase price to be paid upon transfer of the business is fixed. The subsequent share is variable and depends on the success of the business. The amount of the fixed purchase price is left up to the seller and the buyer. The same applies to the variable portion. Since it is No legally required earn-out clauses only the seller and the buyer have to come to an agreement.

Define calculation basis

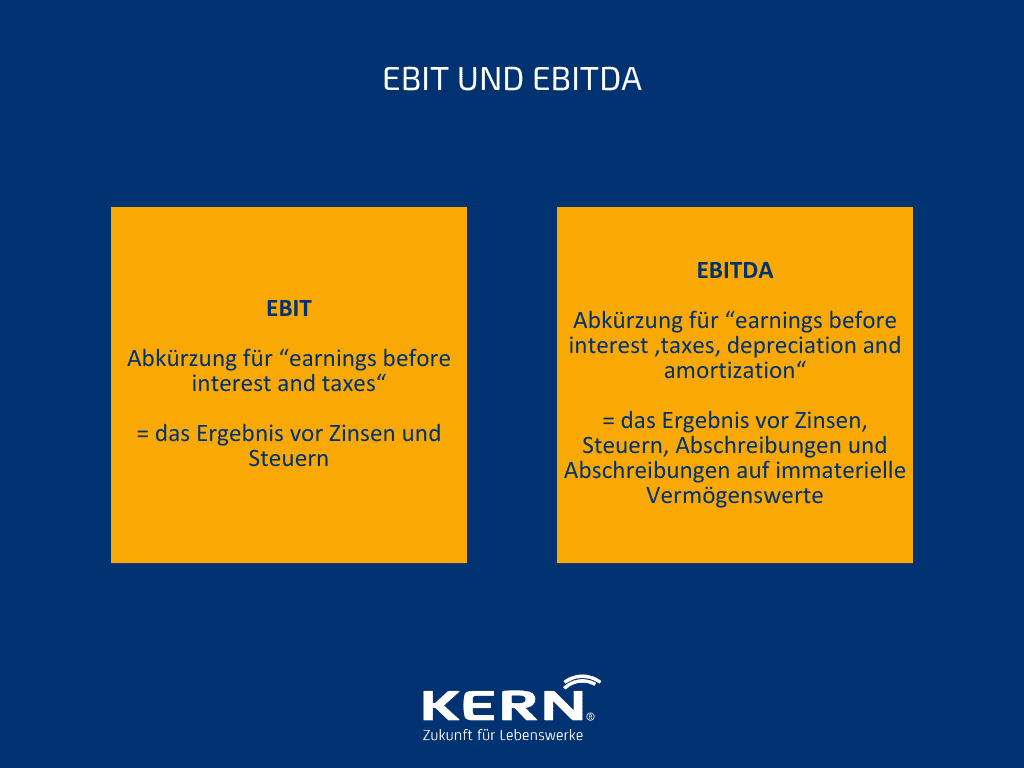

The Basis for the earn-out calculation is as a rule the EBITDA (the profit resulting from the ordinary activities of a company, excluding interest, taxes, depreciation, amortisation and other financial expenses).

Furthermore, the income statement ratios such as EBIT (Earnings before interest and taxes)turnover or net profit for the year.

Furthermore, some positions agreed upon during the negotiations should be cleared up in order to exclude potential disputes.

Financial due diligence can help determine EBITDA and show where adjustments may need to be made.

The adjustments have the aim of To reflect the original performance of the company and thus minimise the different value perceptions of seller and buyer.

Financial Due Diligence

Financial due diligence is intended to help determine the value of the company by Company-specific issues, certain legal disputes, warranty issues, employee severance payments, site closures or the loss of certain customers and orders reveals.

It also takes into account extraordinary income and expenses of the company.

Financial due diligence can be carried out by both the seller and the buyer and usually consists of three parts:

- the Analysis of the past,

- the analysis of corporate planning,

- and the revised planning based on own Due Diligence Findings.

Clarification of the reference value through adjustment of positions

The reference figures, such as the P&L ratios, can be checked extensively through financial due diligence. This ensures that any shortcomings can be uncovered. This allows the seller to adjust these positions. The Reference values become more precise as a result and have a corresponding influence on the purchase price.

Accounting standards

The applicable accounting standards are just as important as the exact definition and specification of the benchmarks.

The Accounting standards should be established for the entire calculation period and applied. They should not deviate from the period under review of the financial due diligence.

If the accounting standards change in the calculation period, this must be corrected for the purchase price adjustment.

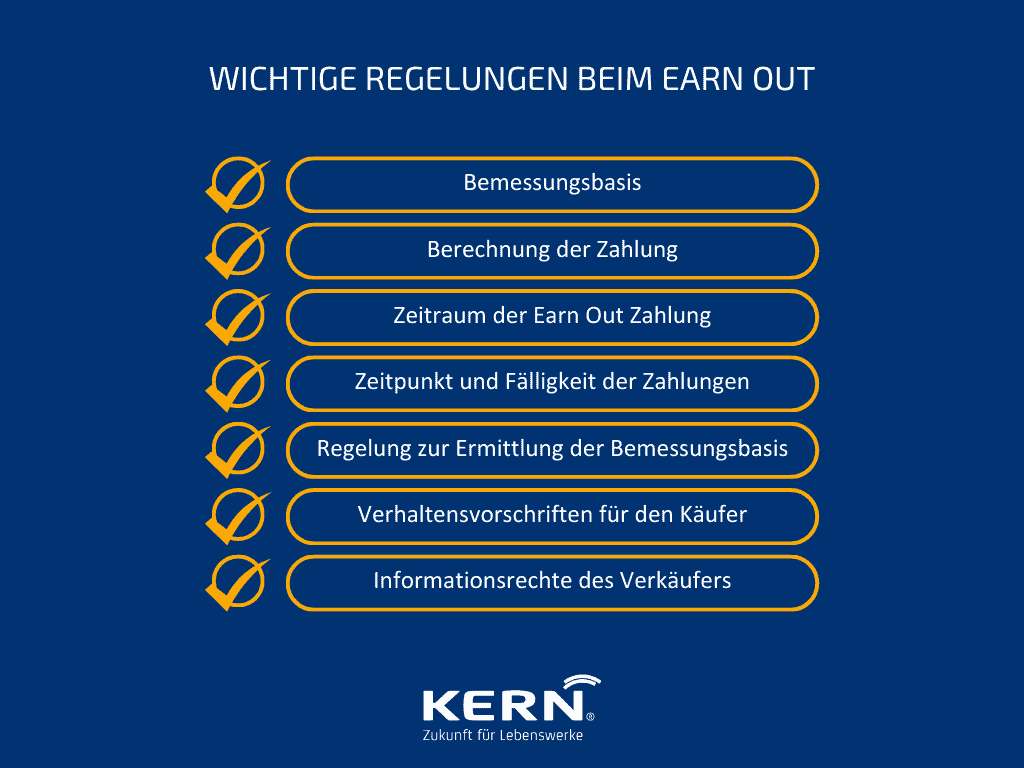

What arrangements need to be made?

The design of earn-out clauses is not subject to any specifications. Sellers and buyers are therefore free to design their own clauses, but should consider a number of factors.

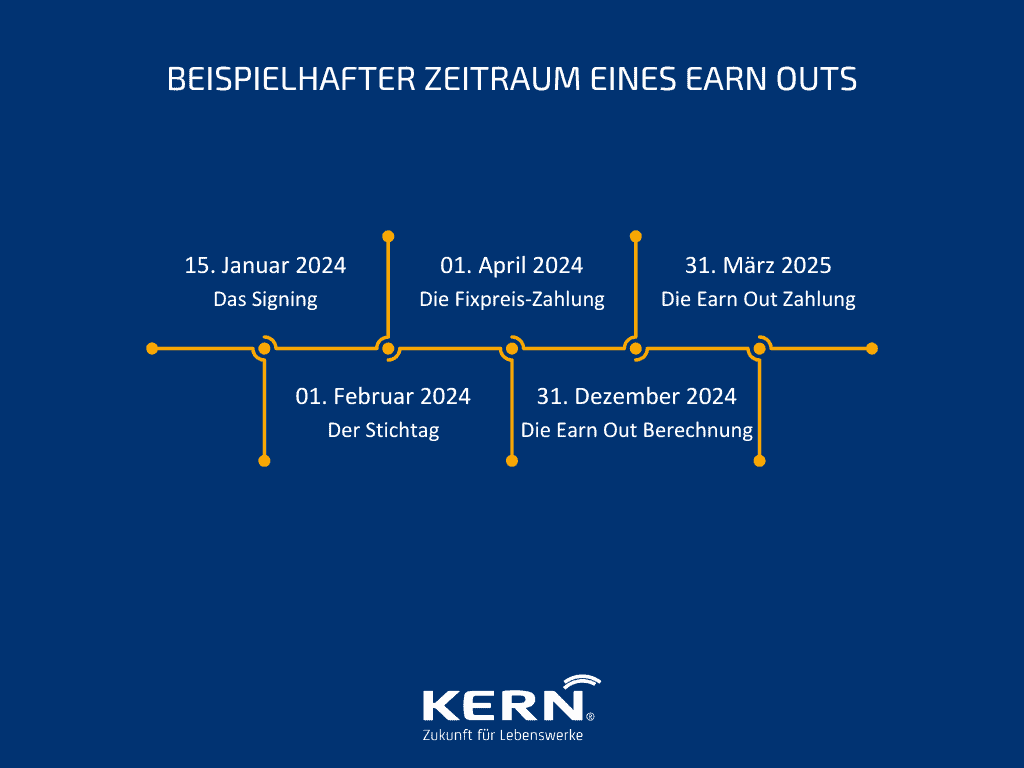

The following points and dates would have to be defined and regulated without fail so that there are no disputes between the two parties later on.

Dangers

In an earn out scheme, the seller runs the risk of abuse. Since the company has already been economically and legally transferred to the buyer, he has the possibility to significantly influence the basis of assessment for the earn-out arrangements.

Advantages and disadvantages from the point of view of seller and buyer

Advantages for the seller:

The seller can achieve an overall higher purchase price through an earn out arrangement.

If the key figures are even higher than planned and additional payments have been agreed, the total purchase price can be significantly higher.

Disadvantages for the seller:

Since the seller no longer has any influence on the development of the company, the buyer can inhibit the economic success so that the company cannot show any economic growth at the given time.

The seller bears the credit risk for the buyer, as the downstream purchase price is subordinated. However, this risk can be secured by a corresponding collateral or financing commitment of the earn-out.

Advantages for the buyer:

Earn-out arrangements reduce the Risk of misjudgement in the Business valuation.

If the key figures are even higher than planned and additional payments have been agreed, the total purchase price can be significantly higher.

Disadvantages for the buyer:

An earn-out arrangement does not allow the buyer to apply a fixed risk discount in the valuation of the company and thus reduce the purchase price.

He may have restrictions on his freedom of action due to the earn out clauses, which may be detrimental to the company.

If you as a buyer have not yet found an interesting property to buy, we will be happy to help you with our years of experience.

Seller loan as an alternative

If the buyer and seller agree in principle on the purchase price and the reason for the earn out provision is only that the buyer is not able to pay the full purchase price at the time of the purchase, an alternative should be considered.

This Alternative may be a vendor loan. In this case, the seller defers part of the purchase price to the buyer.

Taxes

When the seller sells his business, he generates a profit at the time of transfer of ownership to the buyer. It does not matter when the purchase price is due or actually received by the seller. This means that the Profit from the sale of the company to be taxed in full upon completion of the transaction is. An exception are very differentiated regulations in the contract.

When does the seller have to pay tax on the earn-out payments? Taxation of earn-out payments is generally recognised at the time of actual payment. This means that the seller does not have to pay the taxes due on the earn-out until the earn-out payments are actually made. This differs from the immediate taxation of the initial sales price and can offer tax advantages, particularly if the earn-out payments are spread over several years.

However, a subsequent reduction of the purchase price can also have a retroactive tax-reducing effect.

Conclusion

An earn-out clause can be useful if the seller and buyer have different price expectations. In this case, the earn-out provision can help to bridge the gap.

It should be borne in mind, however, that there are No legal requirements for an earn out clause and that this can be correspondingly extensive.

In any case, care must be taken to ensure that the design of the earn-out scheme takes all important aspects into account. Only in this way can the Potential for conflict between buyer and seller reduced and ensure that there are no disputes in the future.