?TAXES ??? - Please resubmit.?

Does this sound familiar? Many entrepreneurs consider this topic rather too abstract, although the vast majority of them would hardly give up the advantages of tax savings when selling a business. But how does one gain a clear perspective on this ‘complex matter’? Which aspects need to be considered in order to optimise the tax burden in the succession in a sustainable way and as far as possible for all parties involved?

Basics webinar presented by Nils Koerber

Company sale (M&A) without risk and loss of value

In this article, you will learn which taxes can arise in the case of business succession and what influence the legal form has on the amount of the tax burden. In addition, you will learn how you can work on increasing the value of your company in a targeted manner by adjusting your balance sheet.

Finally, you will read how to create structures for a tax-optimised business succession and subsequently pay taxes at the Company acquisition save. This article only provides suggestions for your succession planning. Because every project is individual: for this reason, discuss your planned Company sale always at an early stage with a specialist experienced in transactions and your tax advisor.

| Since 2004, KERN has specialised in Company sale consulting in the SME sector. It was the first M&A consulting with the GERMAN-BRAND-AWARD 2021 and from the SZ Institute as Best Advisors 2023 excellent. |

Table of contents:

- The most important types of tax in business succession

- Which legal forms are decisive for the sale of a company with regard to taxes?

- Taxes for internal succession

- Combining succession planning with emergency preparedness

- Taxes in external succession

- Tax implications with regard to the chosen legal form when selling a company

- Company sale tax calculator

- Tax concessions / Holding

- Capital gain Sale of business

- When is a company sale tax-free?

- Frequently asked questions

- Calculation examples

- Why time and good preparation of the sale of the business helps to save taxes

The most important types of tax in business succession

Relevant taxes that you have to reckon with when selling your business or your business succession depending on your individual succession situation are these:

- Income tax

- Inheritance tax or gift tax

Which legal forms are decisive for the sale of a company with regard to taxes?

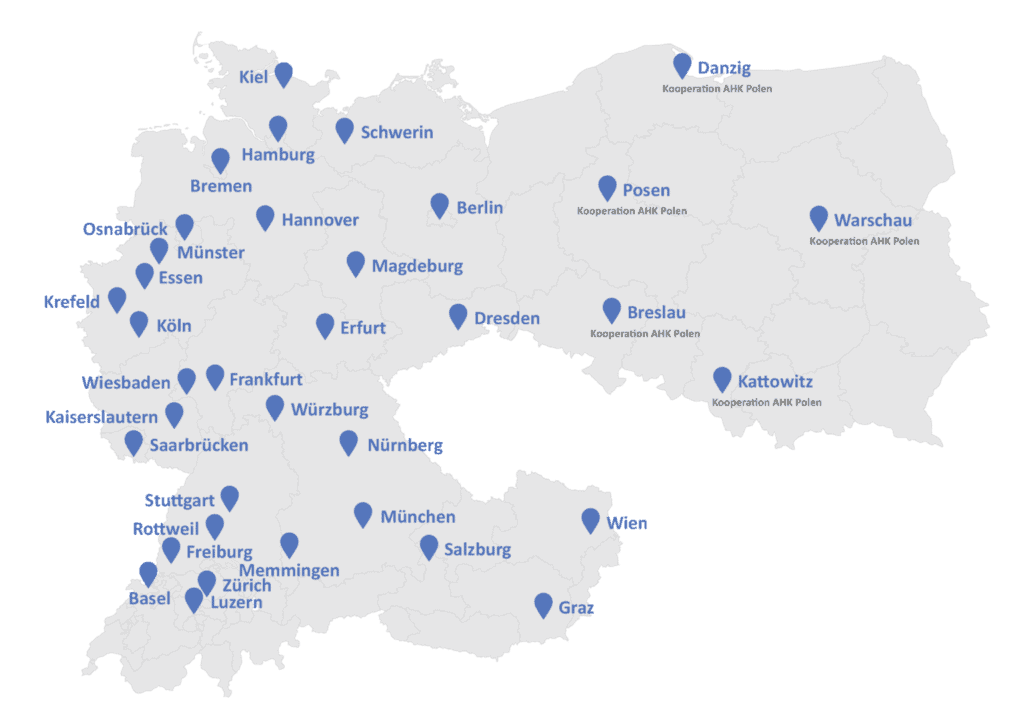

The chosen legal form of a company not only has an impact on your day-to-day business, but also directly on company succession. Thus, a distinction is made between sole proprietors and co-entrepreneurs in partnerships and partners in a corporation.

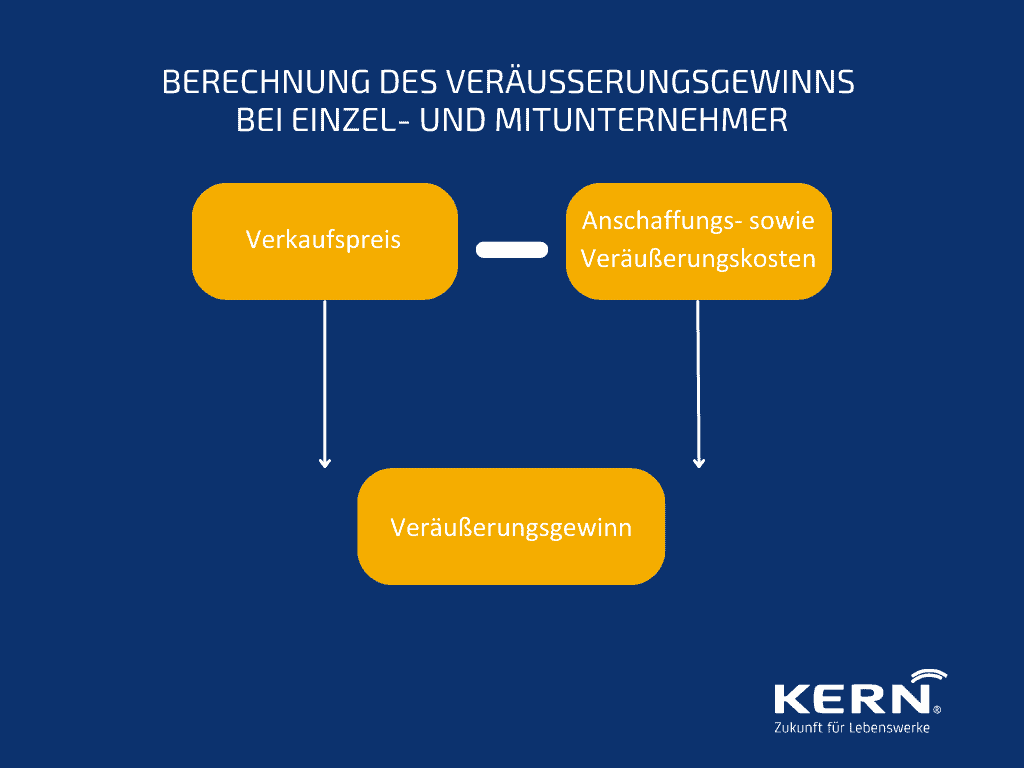

Sole proprietors and co-entrepreneurs but also entrepreneurs who participate in partnerships are taxed in the same way. These partnerships also include limited partnerships (KG or GmbH & Co. KG) and general partnerships (OHG). And this is how their taxable capital gain is calculated:

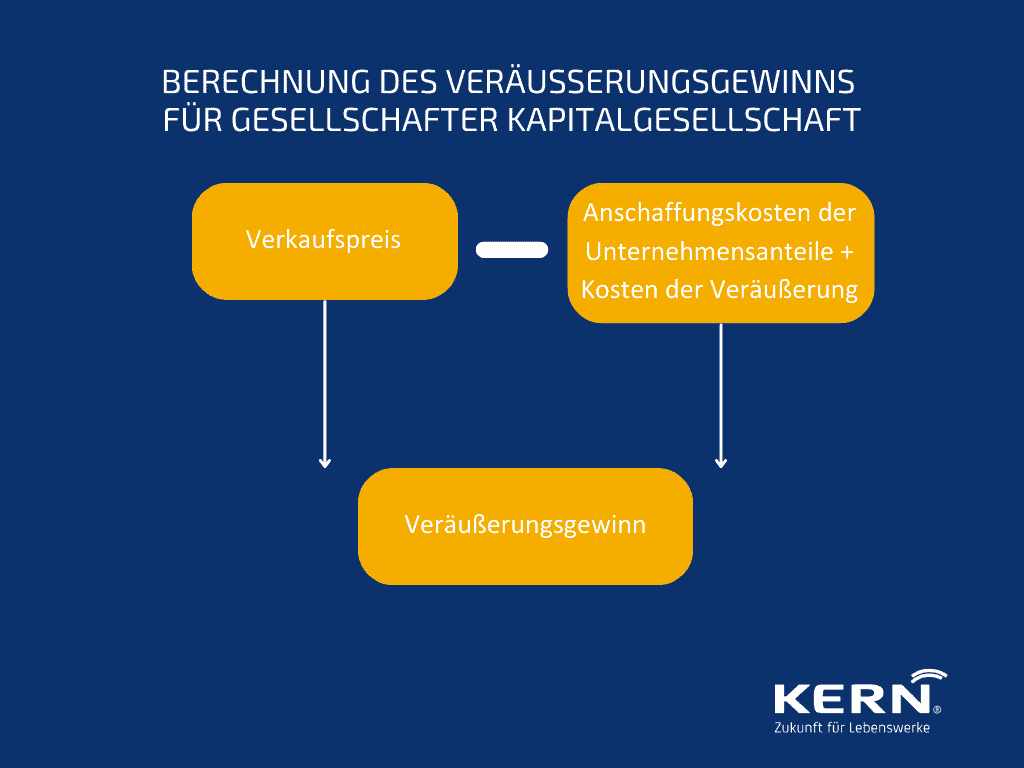

The shareholders of a Corporation are, however, subject to different tax regulations as the shares in a company are transferred. The acquisition costs of the company shares and the costs of the sale are deducted from the sale price. The formula here is:

Taxes for internal succession

Just a few years ago, the majority of German family businesses passed to a successor from within the family. Inheritance and gift taxes play a significant role in this form of succession. Here it is first necessary to clarify who has the right to inherit the business, who wishes to exercise this right and what tax consequences follow from these decisions. Accordingly, the following types of tax may be incurred:

Gift tax

The regulation of an inheritance and a succession are closely related from all perspectives. Because Not only company heirs are affected by inheritance and gift taxbut possibly also buyers who have acquired a company below market value. The difference between purchase price and market value is considered a gift for tax purposes - which may have to be taxed accordingly.

Inheritance and gift taxes in this country are also treated together in the legal code, as they are comparable in the tax context. The regulations on gifts function primarily as a supplement to the Inheritance Tax Act. They are intended to prevent testators and heirs from avoiding inheritance tax through premature gifts.

Every ten years, considerable assets can be transferred tax-free to the next generation during one’s lifetime within the framework of a gift or anticipated succession. The tax-free amount for inheritances and gifts is, for example, the following for natural children 400,000 euros per child. Shares in a company can also be transferred in this way in a tax-efficient manner. In this case, the company value should in any case be determined using a recognised procedure such as the IDW-S1. On the basis of such an objectified expert opinion, the transfer of assets is accepted by the tax office in most cases.

Inheritance tax

The Inheritance tax is incurred when assets are transferred from deceased natural persons to their heirs. In family-run SMEs, it often represents a major financial burden when business assets are inherited, which can even seriously jeopardise the continuation of the business. The legislator took this problem into account in its last major inheritance tax reform and enacted, albeit limited, exemptions for the inheritance of business assets.

If the gift or inheritance tax is also to be financed from the company after the transfer, it is advisable to check the current exemption and preferential regulations. These include the following:

- Retention scheme

- Standard exemption

- Option exemption

- Payroll regulation

- Meltdown of the standard and option exemption

- Special discount for family-run businesses

- Deferral arrangement in the event of death

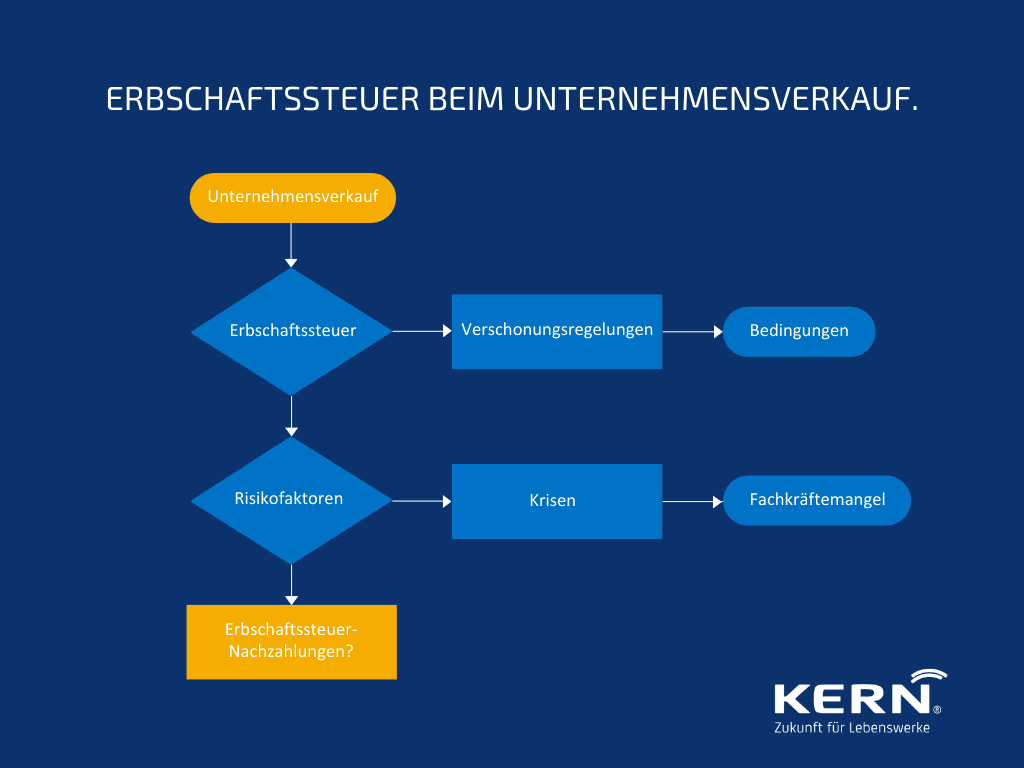

An essential prerequisite of this exemption regulation is that the payroll must reach a certain amount for up to 7 years and the business must be owned by the heirs for that long. This means that entrepreneurial freedom may be severely restricted for up to 7 years.

For example, the Corona pandemic led many companies into situations that threatened their existence. As a result, they went on short-time work or even reduced staff. In times of a simultaneous shortage of skilled workers, many entrepreneurs also used this crisis situation to invest in productivity leaps. In short: at present it is not possible to foresee whether sufficiently high wages will be paid during or after the crisis to meet the Payroll Prerequisites to be complied with. Therefore, in both cases Inheritance tax back payments the logical consequence be.

At this point we recommend the involvement of a transaction-experienced and specialised advisor. Since tax optimisation can quickly become very complex, good advice pays off quickly.

Combining succession planning with emergency preparedness

In practice, it also often happens that the business is to be passed on to only one heir or that an heir does not wish to inherit the business. The signing of a Declaration of waiver of compulsory portion or a Declaration of renunciation of inheritance can provide a remedy here. This regulates the waiver of the heir’s right to a compulsory portion; the waiving relative can then no longer insist on his or her right to a compulsory portion in the event of inheritance. In succession planning, corresponding compensation arrangements are often also agreed with the renouncing heirs within the framework of the renunciation declarations.

However, it becomes more complicated with an increasing number of successors. In this case, a (hopefully existing) Will can be resorted to. As a rule, the provision for the spouse is also clarified in the same context. In contrast to external succession, internal family succession is about finding a contractual solution that is supported by the entire family. The wills should then in any case be synchronised with the partnership agreements. In case of deviations, the regulations of the partnership agreements always apply.

It is advisable to start succession planning at an early stage and to link it to emergency planning. KERN offers a tool for this Structured emergency preparednesswhich answers the essential questions, structures the initial situation and is a good preparation for the succession plan.

Taxes in external succession

Due to the lack of internal family successors, external succession, i.e. the Company sale to third parties. Analogous to the generation change within the family, in the case of an external succession Income taxesare incurred. In addition, depending on the transaction structure, VAT consequences must also be taken into account. And, when it comes to German real estate, there will also be Real estate transfer tax due.

For external succession, it is therefore important to initiate certain tax measures before the planned sale. The profit on the sale of the business is generally taxed ? i.e. the amount that exceeds the book value of your business.

Income tax

Income taxes are due on every sale of a company or share. Under tax law, the amount of the capital gain - not to be confused with the selling price - is the decisive factor. It forms the taxable base for the calculation of income tax.

The capital gain is calculated as follows for sole proprietorships and partnerships:

The capital gain counts as income from trade or business, but is subject to special tax regulations due to its progression effect, which is treated as extraordinary income according to § 34 EStG.

| Disposal price |

| - Disposal costs, e.g. notary fees, Consulting costs, commissions - Book value of the operating assets |

| = Capital gain |

Tax implications with regard to the chosen legal form when selling a company

If an entrepreneur sells shares in a corporation or partnership, income tax is generally due. If the shares in a corporation are part of the business assets of the entrepreneur, only 60% of the capital gain is subject to income tax. Partial income procedure taxable in the form of income tax.

When selling a corporation, the sale of company shares (?Share deal?) in principle tax advantages compared to the sale of assets (?Asset deal?). Due to the partial income procedure, 40% of the capital gain is tax-free in accordance with § 3 para. 40a EStG.

If the shares are held as private assets, it must be checked whether there is a so-called significant participation of at least 1 percent in the corporation. In such a case, the profits are also subject to the partial income procedure. However, if there is a so-called smallest shareholding of less than 1%, final withholding tax is due (25% plus solidarity surcharge and, if applicable, church tax).

Tip: If the micro-participation was acquired before 2009, its sale is tax-free.

When selling a (commercial) partnership, it is generally not decisive from a tax point of view whether the partnership is sold in parts or as a whole or whether the partnership sells its assets. In both cases there is an asset deal and the capital gain is taxable in both cases.

Tip: The sale of entire businesses or entire co-entrepreneurial shares by private individuals can be given preferential treatment depending, among other things, on the amount of the capital gain and the age of the seller. Thus, the transferor can take advantage of a reduction in the income tax rate for capital gains up to a certain amount. Pursuant to § 34, para. 3 of the Income Tax Act, the reduced tax rate may be applied for once in a lifetime, when the taxpayer has reached the age of 55 or is permanently incapacitated, up to a total amount of ? 5 million. The reduced tax rate in this case is up to 56 % of the average tax rate. The prerequisite for this is a sale of the business as a whole.

Excursus: Difference between value and price

Where is the difference between value and price and what is actually taxed?

The decisive factor for taxation is the enterprise value. It is determined with scientific methods as of the reporting date on the basis of certain assumptions. It expresses what the valuer plans to do with the company and depends on the method chosen to calculate the company value. Here you can find out more about how to calculate your Calculate enterprise value and which methods for Business valuation there is.

However, the decisive factor is that the calculated enterprise value is always different from the market value. The market value, on the other hand, is achieved in the course of a negotiation, which depends on the negotiating skills of the buyer and seller. In addition, many different factors influence the market value of a company. These are, first of all, supply and demand in a particular industry, the general development of the industry, the individual development of the company for sale and, finally, the future earnings expectations of the buyer.

How can a buyer optimise his future tax burden at an early stage?

The buyer can also optimise his tax burden at an early stage by designing his shareholding structure.

Tax concessions/ Holding

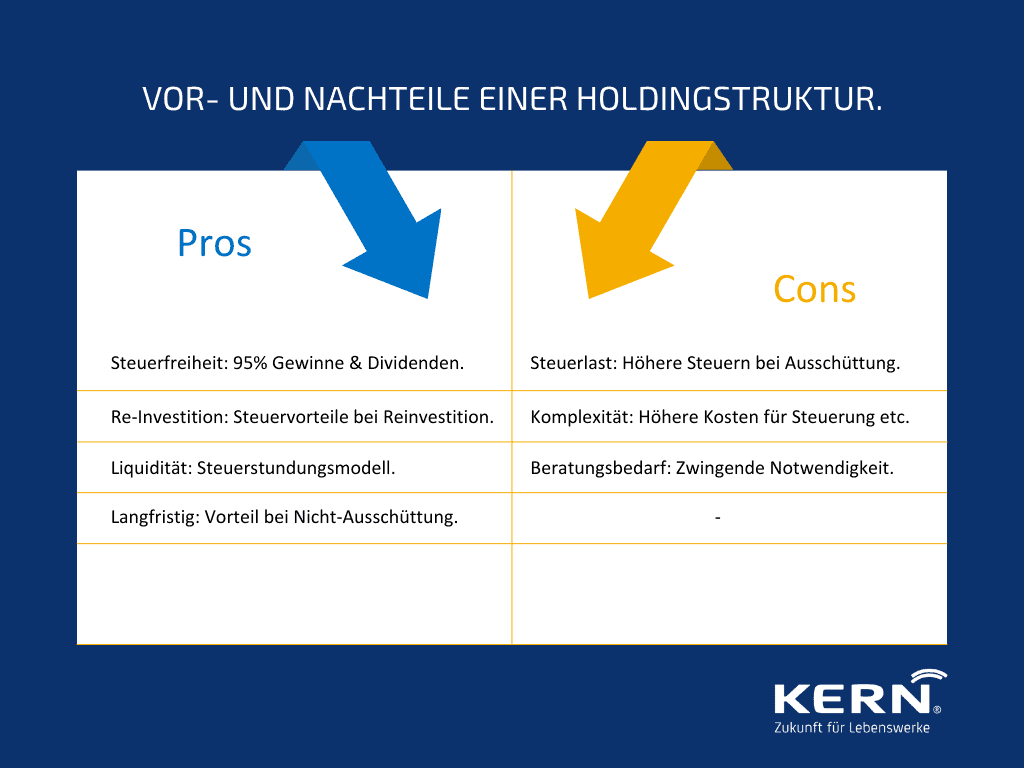

If a company purchaser intends to resell its company or its shareholding with a company share of more than 15% in a few years, a Holding structure basically suitable for this. This is because, according to the current legal situation, capital gains and dividends at the level of the holding company are 95% tax-exempt.

This is particularly worthwhile for entrepreneurs who want to reinvest income from company sales or investment income in other entrepreneurial activities. This income always leaves the tax-privileged sphere of the holding company when it is distributed to the shareholders. In this case, the shareholders must expect a slightly higher tax burden than in the case of a direct participation in the company.

However, this model is more of a tax deferral model than a tax avoidance model, resulting in a liquidity advantage for the entrepreneur. If not distributed, this can result in a very long-term tax advantage.

And despite all the will to optimise taxation, the following applies to family entrepreneurs in contrast to corporate groups: keep your shareholding structure simple. Because the more complex it is, the more expensive it is to manage. Possible tax savings are offset by the costs of consulting, company formation, bookkeeping and annual financial statements. Here, too, the advice of a tax advisor is highly recommended so that the tax advantages offered by a holding structure can be realised.

What is meant by acquisition costs or costs of disposal?

The acquisition costs of a participation are to be §253 HGB at most in the actual amount. Regardless of whether the participation generates profits or losses, the acquisition costs remain fundamentally unchanged.

When acquiring or selling a company, incidental costs are also incurred. These include, among others, consulting expenses, commissions, expenses for experts as well as notary fees. These acquisition costs can be deducted from the proceeds of the sale just like the costs of sale, so that the taxable capital gain is reduced.

When is a company sale tax-free?

A sale of a company is only tax-free for small companies that achieve a capital gain of up to 45,000 euros.

The legislator has provided for this allowance in the case of business disposals if the entrepreneur has already reached the age of 55.§ 16 para. 4 EStG ).

Conditions:

- This allowance can only be claimed once in a lifetime (?once-in-a-lifetime rule?) and amounts to 45,000?

- This tax-free amount is reduced as soon as the capital gain exceeds 136,000? (exemption limit).

This means: If the capital gain exceeds 181,000? the seller no longer has a concrete advantage from the tax-free allowance. The taxable capital gain is accordingly equal to the capital gain.

Therefore, the high, one-off tax allowance for business disposals is primarily relevant for entrepreneurs who have reached the age of 55 with a smaller business size and a correspondingly lower business sale price.

Why time and good preparation of the sale of the business helps to save taxes

Time is an important factor in the preparation of a company sale. The sooner you have clarity about possible transfer scenarios, the sooner you can make provisions for an optimal result within the legal deadlines. Please keep in mind: Tax optimisation needs time to take effect, especially with regard to succession. Consult with a transaction-experienced succession specialist with whom you can reach a professional M&A process prepare. Together with your advisor, you plan your company sale, take a tax burden comparison based on this and identify tax optimisation potential.

At this point we would like to point out that it is worth paying income taxes especially in preparation for a planned sale of a company. In the context of a Fitness checks you can leverage further potential for value enhancement and use it in a Balance sheet adjustment make visible. This, too, is not done overnight: On average, the entire Company sale procedure between two and five years. And this strategy pays off. Because the earnings made visible make companies more attractive and improve the chances for a successful sale. Positive side effect: the income taxes are a good investment.

A small calculation example: A yield increase of 25% shows in practice an often above-average increase in the Calculation of the enterprise value and thus the achievable purchase price. Against this background, some tax-saving models that are popular among small and medium-sized enterprises quickly become relative.

Conclusion

Start planning your business succession in good time. Make your individual decision as to whether you prefer an internal or external business succession. Your answer to this question will in turn provide clarity as to which of the various types of tax are relevant to your handover process.

And last but not least, timely preparation of their succession opens up the possibility of taking advantage of the various tax concessions and thus ’saving’ taxes.

Frequently asked questions

How is a company sale taxed?

A company sale is always taxed on the basis of the income, i.e. the gross sales proceeds less acquisition costs and incidental costs of the sale. The amount of the tax burden depends on whether the seller is a natural person or a legal entity (e.g. in the form of a holding company).

Like a Company sale to succeed in 10 steps, you can find out in our KERN expert video.

How is the sale of a GmbH taxed?

Share Deal vs. Asset Deal: If you have a Sell limited liability company the sale is tax-exempt at 40% through the so-called partial income procedure. In the case of holding companies, there is even a tax exemption of 95% while the remaining 5% are again taxed according to the partial income procedure. Sell GmbH TaxesThe sale of GmbH shares within the framework of a “share deal” is thus often more advantageous for the seller from a tax point of view than the sale of the individual assets within the framework of an “asset deal”.

How much is the capital gain taxed?

This depends on whether the seller is a natural person or a legal entity (e.g. a GmbH or AG). Company sales by natural persons are initially taxed on the basis of the personal tax rate, depending on their individual tax situation. However, there is a whole range of Tax breaks and allowances, the use of which should be checked in consultation with a tax advisor.

Company sales by corporations are initially taxed under the partial income procedure. Here, too, the legislator allows for a far-reaching tax exemption in certain constellations, so that the total tax burden can be reduced to up to 1.5%.

Calculation model from 55 years - half tax rate

Assume you are 64 years old and a master baker. In 2021, you sold your bakery with a capital gain of 130,000 euros. In that year, your business still made a profit of 40,000 euros before the sale. You have not yet applied for the reduced tax rate or the tax-free allowance. You have you have reached the age of 55 and have sold your business for a profit of no more than five million euros. You may therefore claim both the reduced tax rate and the tax-free allowance. The reduced tax rate is usually more advantageous for you as a taxable entrepreneur. Your calculations could look as follows:

- Capital gain 120,000 ? Tax-free amount 45,000 ?

- = taxable capital gain 75,000 ?

- Taxable capital gain 75,000 ? + current profit 30,000 ?

- = Total amount of income 105,000 ?

- The normal income tax at an average tax rate of 35.22 % is 36,981 ?

- In the case of a business sale, the income tax on the capital gain is reduced from 35,22% to 19,72% (35,22% x 56%).

- You therefore owe the tax office 14,790 euros for your capital gain and 10,566 euros for your profit.

- Your tax allowance is therefore 11,625 ?