Are you planning to sell your GmbH?

The most common use case for the sale of a healthy GmbH is the complete transfer of the company. It deals with the scenario of a complete handover. It is like a usual Company sale to consider. In addition, further variants are explained.

You will gain insights into the sale of GmbH shares and the sale of an insolvent GmbH. You will also be informed about the sale of a “shell” GmbH. You will expand your knowledge with suitable recommendations for action in the respective special cases.

Table of contents

- GmbH sale in 8 steps:

- Selling a healthy (complete) GmbH

- Sell GmbH shares

- Can you sell a limited liability company with debts?

- Sell limited liability company shell

- GmbH Sales Taxes at a Glance (incl. Sample Invoice)

- On which portal the GmbH sell

- What experiences have others had with the sale of a GmbH?

- Conclusion

- FAQ

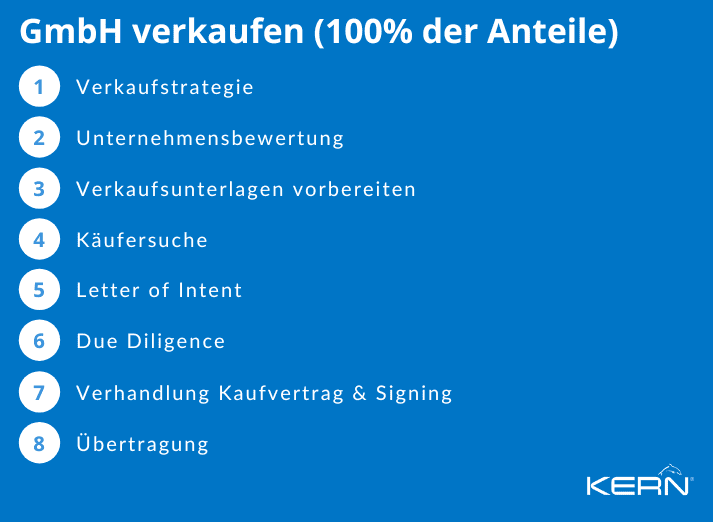

GmbH sale in 8 steps:

1. buy side: strategic and financial investors

When selling a limited liability company, it is important to consider both financial and strategic investors. Financial investors provide capital and are usually focused on short-term returns (5-6 years), while strategic investors bring more than just money and ideally complement or strengthen the business model.

Strategic investors can bring in industry knowledge, customer relationships or other resourceswho can support the growth of the GmbH. Ultimately, the choice between financial and strategic investors depends on the goals of the seller and the needs of his business.

2. company exposé, NDA and LoI

When selling a GmbH, preparation requires a number of steps, including the preparation of a Company exposéswhich contains detailed information about the company, the preparation and signing of a NDA (Non-Disclosure Agreement) between all parties involved (before the exposé exchange) and the subsequent development of a Lol (Letter of Intent)in which the most important conditions for the possible sale are set out. Nevertheless, a letter of intent such as the LoI is not legally binding on either side.

3. risk assessment via due diligence

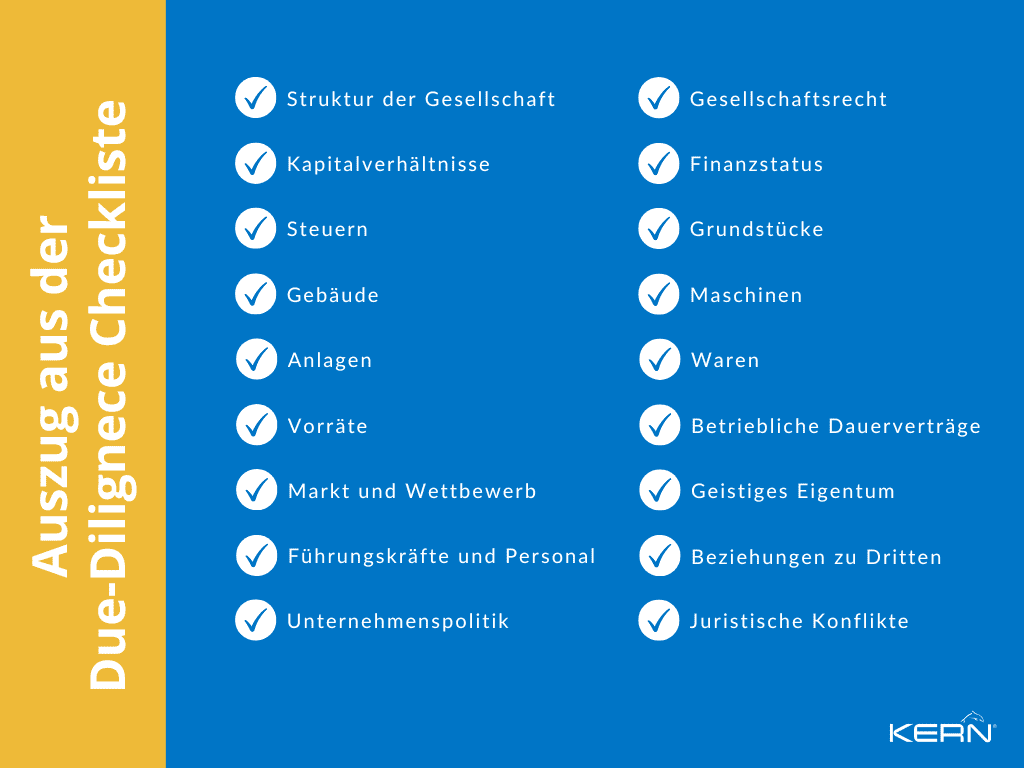

The company audit by the buyer (Due Diligence) is an important step in the sale of the GmbH. Prospective buyers thereby thoroughly examine the company to be sold. A digital data room is usually set up. Exceptions are smaller company structures where this can also be done manually with a few file folders.

During due diligence, potential buyers assess the risks associated with buying a business before making a decision. This includes reviewing financial statements, analysing market trends, assessing compliance with laws and regulations, risks of any kind and evaluating tax implications and much more.

This gives company auditors and tax consultants access to all relevant documents of the GmbH from the prospective buyer. This enables you to carry out a company analysis. Strengths and weaknesses as well as risk potentials are analysed and thoroughly evaluated.

If the analysis is positive, the interest in buying increases. A detailed detailed analysis of all aspects of the company follows. As a shareholder, you must make the documents available for inspection. It is therefore advisable to start collecting data at an early stage. After all, the employees should not notice at this early stage.

Questions must be answered conscientiously and above all truthfully. In the case of extensive company structures, discussions with executives must often be permitted. However, this should be one of the last steps, organised shortly with or before the signing of the purchase contract.

The Due Diligence Checklist in the advanced stage includes, among others, the following aspects:

4 The company purchase agreement

The company purchase agreement shapes the conditions under which the sale of a limited liability company takes place, including details of the Rights and obligations of the buyer and the sellerThe price, payment terms, guarantees and other important information as well as the legal framework conditions.

This contract should be carefully considered by both parties before signing, as it may have significant implications for all parties involved.

5 Share Deal and Asset Deal

When selling a limited liability company, you may be confronted with the terms Share Deal vs. Asset Deal come into contact. A limited liability company can be sold either through a share deal or an asset deal.

In a share deal, the future shareholder acquires the GmbH shares of the company from the seller and assumes full responsibility for the company in its ‘running’ structure. structure. In an asset deal, the buyer acquires only some or all of the assets of the GmbH from the seller and is responsible for all liabilities or rights and obligations associated with these assets. The legal shell of the company remains with the seller.

6. taxes on the sale of the GmbH

We have created a sample calculation for you for the taxes that are incurred when selling a GmbH. Here you come directly To the sample invoice.

In our article we give sellers 8 tips for optimal taxation. Read more here.

7. disagreements on the sale of the company

Following mergers and acquisitions, disputes may arise between the buyer and the seller if the terms of the purchase agreement are not complied with or if one party believes that the other party has not fulfilled its obligations.

These disputes can be costly and time-consuming. It is therefore all the more important to have precise records and wording on the agreed objectives and framework conditions. To avoid such disputes, it is important to have clear and detailed contracts[P1] and to ensure effective communication between all parties involved. Both sides should therefore choose experienced lawyers from the M&A environment rather than the previous in-house lawyer for personnel or contract issues.

8. sale of shares and other special cases

The sale of a GmbH is complex and can have the most diverse occasions. Therefore, we present various special cases below, such as the sale of an insolvent GmbH or a shell GmbH. Click here to go directly to the relevant section.

Notes on the formalities and legal framework

In addition to technical terms such as Share deal or asset deal the sale of a limited liability company involves further stumbling blocks. To avoid these, In the following, you will find important information that must be observed when selling a corporation.

Formalities

A GmbH sale must be notarised to be legally binding. The notary is responsible for observing the formalities and informing both parties about important aspects of the sale. Furthermore, the notary also takes over the obligatory registrations with the commercial register.

When an existing business is sold, all rights and obligations are transferred from the GmbH to the buyer. Furthermore, the buyer takes over all assets together with the company. As a rule, all liabilities remain with the company. They do not pass to the buyer company and also not to the private person of a buyer. Likewise, the buyer must take over all rights and obligations of all employment contracts 1:1.

It is important that the GmbH articles of association and the concluded partnership agreements (shareholders’ agreement) are taken into account. We will be happy to advise you on pitfalls regarding existing agreements.

Legal framework

In this context, it is essential to distinguish between the terms ?Letter of Intent? and ?Company purchase agreement?. The Letter of Intent is non-binding with regard to the future conclusion of the contract and represents a declaration of intent prior to the buyer’s examination (DD).

The Company purchase agreement constitutes a legally binding document. Nevertheless, experience has shown that the letter of intent should not be dispensed with when selling a GmbH.

It separates the wheat from the chaff of interested parties and creates binding clarity on the most important parameters for a sale between buyer and seller.

Every limited liability company has articles of association or partnership agreement. These specify any Rights and duties between the GmbH shareholders and the GmbH recorded. If there is a single owner, a model statute is often used. If there are several owners, on the other hand, there are often complex control rights and sales restrictions. In order to identify possible undesirable regulations at an early stage, these articles of association should be checked before acquiring the GmbH.It is important for purchasers and sellers of a GmbH to check such articles of association at an early stage. In this way, unpleasant surprises are avoided at the notary’s office.

Next steps

As an attentive reader, you have already received valuable information on the sale of a limited liability company up to this point. If you now Moving from theory to practice you can enter your Calculate enterprise value. This provides you with a good basis for further decisions.You want to sell your GmbH and have other questions first? A professional M&A consulting provides you with security.

Selling a healthy (complete) GmbH

As a seller of a limited liability company, it is advisable to, Thoroughly plan the entire M&A process. The reason for your decision to sell usually also determines your strategy going forward. Are you interested in a prompt sale or is a maximum sale price your priority? Do you want to sell 100 % or a stake first?I

in line with your M&A strategy compile all sales documents. An appropriate business valuation is central to the process. Details on these important steps can be found in our article on the subject of Sell company. It is also useful to understand the position of the buyer. This way you can prepare yourself for possible conflicts.

You have made the initial contact with a prospective buyer and want to start the vetting process with the potential buyer after signing a lol. The examination, also Due Diligence (DD) This involves a comprehensive review of all relevant documents of a company.

Although you as the seller can also arrange for due diligence, it is usually the buyer who wants to use this expertise. He wants to exclude risks and develop an appropriate purchase price. With a purchase offer, the negotiation phase between the two parties begins. If the negotiations end with an agreement, the modalities must be laid down in a contract.

The conclusion of the M&A process in the execution and eventual handover phase. The latter can take place in a few days, but can take a very long time Detailed information on all facets of the transaction can also be found in the article Sell company.

While the general process of selling a limited liability company is similar to the process of selling a limited liability company in special circumstances, there are some relevant aspects that need to be considered. to pay special attention to when selling a GmbH (limited liability company) applies. In the following we therefore deal with important special cases when selling a GmbH.

Sell GmbH shares

The GmbHG clarifies that GmbH shares can be sold as long as no agreements from the articles of association are violated. A company valuation is always recommended for the sale of GmbH shares. The transaction has strong parallels to the general M&A process. A notary is also required.

Selling an insolvent GmbH

It is also possible for you to sell an insolvent GmbH. The prerequisite is that the company has not yet been declared insolvent. In addition, there must be no arrears with social security institutions.

An advantage of the sale of an insolvent GmbH arises for you in a direct way: The good reputation as a manager can probably be preserved (if the rescue via the sale is successful). Likewise, the credit rating can probably be maintained with new owners. Insolvency can thus be prevented or, with a new shareholder, better used for the future of the company in terms of the business model. As with all M&A issues, the following applies here: Every case is different.

Furthermore, the successor company can appoint its own managing director. You yourself as the seller will no longer be called upon to satisfy claims for damages. Criminal law consequences are avoided.

As insolvency can be a sensitive issue, individual advice is strongly recommended.

Can you sell a limited liability company with debts?

A limited liability company can be sold together with all its debts. The sale of an indebted GmbH can be a quick and elegant solution for the seller. Managing directors are released from the obligations incurred. You can escape any liability risks and claims for damages which would threaten you in the event of a possible regular insolvency due to over-indebtedness.

There are interested parties who are interested in indebted limited liability companies. An investor with sufficient funds can profit from the situation. However, it is important that no insolvency has been filed yet. Therefore, if insolvency is imminent, be sure to check your options.

Sell limited liability company shell

Shell companies are companies that have been closed down and have given up their previous activities. The buyer can revive this shell company under certain conditions. He can then, if necessary, continue to use it with a different corporate purpose. As a rule, case law understands the corresponding use of the shell company as a new economic formation. It treats purchasers of shell companies like founders of a limited liability company.

Depending on the condition of a company and the business model, this interesting process can be an interesting variant. However, since there are pitfalls here as well, a close examination of the transaction should be carried out. The advice of an experienced management consultancy is undoubtedly useful.

Sell the GmbH at what price ? Valuation of the GmbH

It is obvious that sellers want to achieve the highest possible price. Buyers, in turn, want to pay the lowest possible purchase price when selling a GmbH. This section is not intended to deal with negotiating skills. The focus is on the valuation of a GmbH. How is a (preferably) accurate enterprise value calculated?

For the determination of an asking price, a Business valuation essential. A company valuation can never describe a ‘correct’ value. value. However, it provides useful orientation or even objectified assessments.

There are several methods to choose from. Each method offers a different combination of effort, required data and accuracy of the output. This starts, for example, with a rule of thumb that refers to the EBIT (earnings before interest and taxes) and is referred to as the multiples method.

Stock exchanges and consultants determine the industry factor for the respective company and multiply it by the EBIT. Done.

Suitable sector factors for small and medium-sized enterprises are the so-called ?SME Multiples?. These are empirical values determined from previous, real transactions. The fact that this rule of thumb can only provide a rough orientation is obvious with the few data required. The individual characteristics of companies and industries are not taken into account.

Note on the determination of the purchase price by means of a so-called multiple method: There are continuous records of real transactions and their values. From this, very rough industry clusters are formed and a range from - to is reproduced. So, for example, in one sector a multiplier can be between 3 and 7, especially for small companies. |

The exact and current SME multiples, you will find here.

Other valuation methods, such as the capitalised earnings value method according to IDWS1 , individually address all the details of a business and thus provide a much more realistic picture. A detailed list of methods and a practical calculator can be found in the article Calculate enterprise value.

GmbH Sales Taxes at a Glance (incl. Sample Invoice)

Of course, there is a not inconsiderable amount of taxation in the case of a GmbH sale. It is therefore indispensable to consider taxation in any M&A transaction. For the sale of a limited liability company in Germany the so-called Partial income procedure to be applied, which in the § 32d para. 2 no. 3 EStG is defined. It clearly sets out how the shareholder’s income is to be treated in the event of a GmbH sale. At the same time, legal constructs prior to a sale can also significantly reduce the tax burden.

| Disposal price | 800.000 ? |

| - Share capital (min.) | 25.000 ? |

| - Lawyers & Tax Consultants | 20.000 ? |

| - Other costs, e.g. M&A advisors | 15.000 ? |

| = Capital gain | 740.000 ? |

| Taxable amount (60 %) | 444.000 ? |

In this example, 444,000 ? must therefore be taxed at the personal tax rate.

Due to the importance of this topic, it is advisable to go into it in greater depth with the help of the article on the sale of a company.

You are welcome to read more about the topic here.

On which portal the GmbH sell

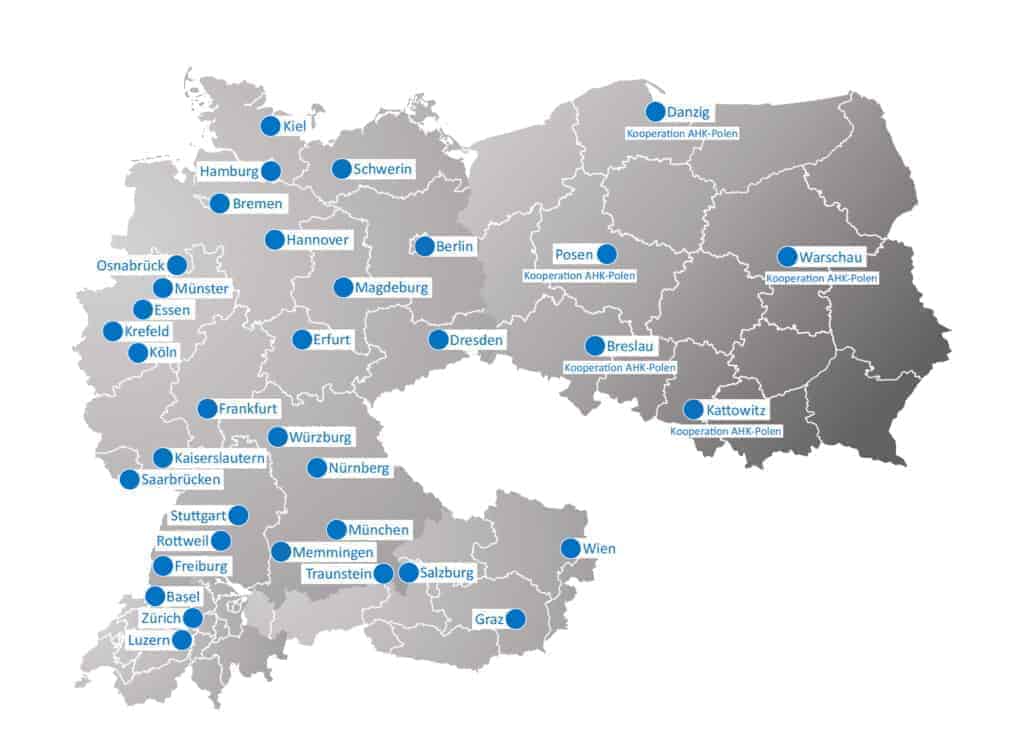

In order to find a buyer for the GmbH, it is obvious, to achieve the widest possible distribution of anonymous sales information. Potential buyers can be found both nationally and internationally. Therefore, it makes sense to use the internet for a broad impact of the sales offer.

Reputable and well-known portals in German-speaking countries are ?DUB?, ?nexxt-change? and the ?KERN Company exchange?. The aforementioned providers offer security, sensitive handling of data and high coverage. These are the ideal conditions if you want to sell a GmbH.

Our expert tip: On the one hand, an advertisement should contain all the important information to attract interested parties. On the other hand, certain information can have unintended consequences. If, for example, it can be deduced from the advertisement which GmbH is being offered for sale, the lost anonymity can lead to problems with customers or employees. In the worst case, this can contribute to the failure of the business acquisition. |

Avoid mistakes

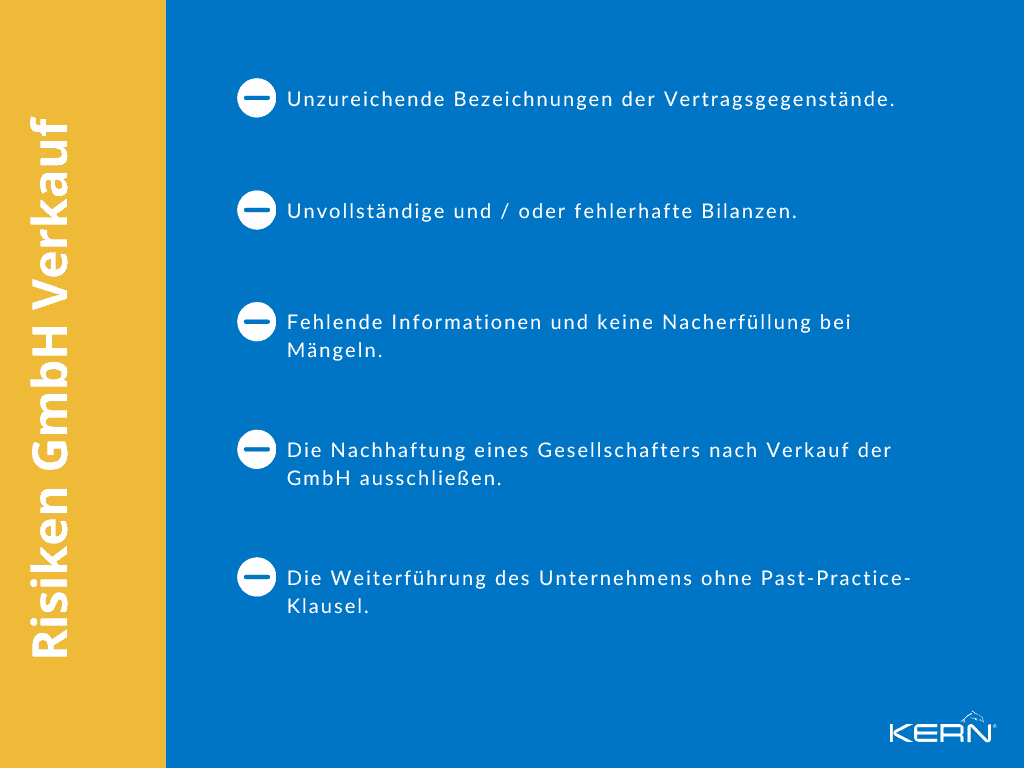

There are risks that you should avoid at all costs when selling a limited liability company:

- Inadequate designations: The subjects of the contract must always be described specifically in the contract. Individual assets are often forgotten. The effort involved should never be underestimated.

- Warranty details and claims for damages: All balances must be correct. The balance sheets must be prepared truthfully. As a shareholder, you must give guarantees for the balance sheets. Likewise for the non-existence of further liabilities. In doing so, you can be walking on dangerous ice. You are also liable for errors made, for example, by the tax advisor when preparing the balance sheets. In case of doubt, special M&A insurances are recommended for the seller.

- Liability: The important protection of the buyer against defects of title and quality is very far-reaching in the sale of a limited liability company. If a defect has become known, the buyer must inform the seller and the seller is given time for supplementary performance. If the supplementary performance does not take place, the buyer may even be entitled to withdraw from the purchase contract.

- Exclude subsequent liability of a shareholder after sale of the GmbH: With the sale, you transfer your GmbH shares and the shareholder position you held until then. You are liable for any contributions not made. Even long after a sale process, an insolvency administrator can look for the liabilities and claim them.

- Continuing the business: After signing the contract and until the transfer of the GmbH shares, several weeks may pass. In the meantime, you as a shareholder can still influence the liquidity of the company. Thus, profit could be withdrawn.

Bills cannot be paid. Maintenance and repairs as well as investments can be omitted. There are liability traps for you here. The buyer could now claim that the loss must be replaced. To avoid disputes, a past practice clause should be built into the contract.

The stumbling blocks explained should, if possible, be clearly stated in the company purchase agreement.

We have a useful overview for you here.

What experiences have others had with the sale of a GmbH?

The sale of a limited liability company is an expense that should not be underestimated. However, this burden can be significantly reduced by a good partner. You are also welcome to refer to the experience reports of our clients.

Conclusion

The sale of a GmbH is an exciting topic with various strategies and procedures. You can already choose from various formulas when calculating the value of the company. These all have advantages and disadvantages.

Are you also considering special cases? Do you want to sell an insolvent GmbH or a shell GmbH? Then new risks arise ? but also opportunities.

The general M&A process basically draws a helpful red line. However, individual circumstances must always be taken into account.

FAQ

Make sure your finances are in order. Find the right buyer who is a good fit for your business. Negotiate the terms of the sale carefully. Get help from a professional M&A advisor.

Use your personal and professional networks to approach potential buyers. In addition, hire a broker or M&A advisor to help you identify and contact potential buyers. However, clarify beforehand how far these advisors are allowed to act in the market without your knowledge. Ensure that you have the right to object to any interested party.

First, make sure that your GmbH enjoys a good reputation, is economically stable and successful, and has attractive prospects for the future. Next, have an objectified market value of your company determined.

Take time to further develop the value of your company and perhaps only start selling 2-3 years later.

Finally, you should work with an experienced M&A advisor who will help you find potential buyers and negotiate the best possible purchase price for your business.

One is that they do not clearly define the value of their business and know themselves which assets to sell and at what price.… Another is that they do not seek professional help to properly value their business. Finally, some sellers do not take the time to understand the tax implications of selling their GmbH.