An indicative offer is a basic tool in the M&A process that serves as the first step in the communication between a potential buyer and the seller. It is not legally binding and provides an initial purchase price indication. It may also contain other elements such as the derivation of the purchase price, specific information requirements, financing plans and a preliminary timetable.

This offer allows sellers to assess the seriousness and intentions of prospective buyers and to compare different offers.

Definition: What is an indicative offer?

In the context of M&A transactions, an indicative offer serves as the first written offer of the potential buyer. It sets out the general conditions under which the interested party would acquire the target company. In addition to the asking price, it may also contain specific reservations, such as the approval of supervisory bodies or financing commitments. Unlike a letter of intent, it represents a unilateral declaration of intent and forms the basis for subsequent negotiations. This instrument helps sellers to assess the seriousness and qualifications of the various interested parties.

Distinction from the Letter of Intent (LoI)

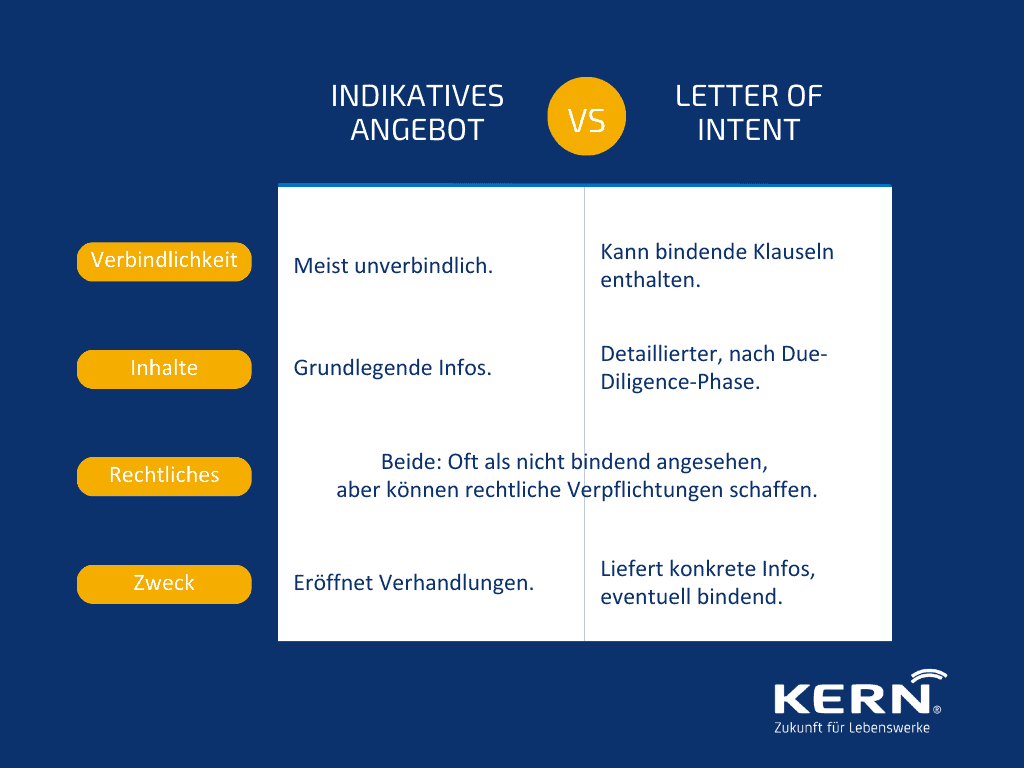

An indicative offer and a Letter of Intent (LoI) are both instruments for documenting purchase intentions, but they differ in essential points:

- Commitment: Both an LoI and an indicative offer are usually not binding unless they contain explicit binding clauses. However, an LoI may contain specific binding elements such as confidentiality or exclusivity agreements.

- Contents: An LoI is often more detailed and is usually prepared after an initial Due Diligence phase is drawn up. An indicative offer is usually more general and serves as a first approximation between the parties.

- Legal implications: Although both documents are often considered non-binding, they can still create legal obligations in some jurisdictions, such as the duty to negotiate in good faith.

Overall, an indicative offer serves more to express the basic interest in acquiring the target company and to initiate the negotiation process, whereas an LoI contains more concrete information from the contracting parties and may contain binding elements. It is important to understand the differences between these two documents and use them according to the requirements and expectations in a business relationship to sell a company.

How do you create an indicative offer?

How do you create an indicative offer?

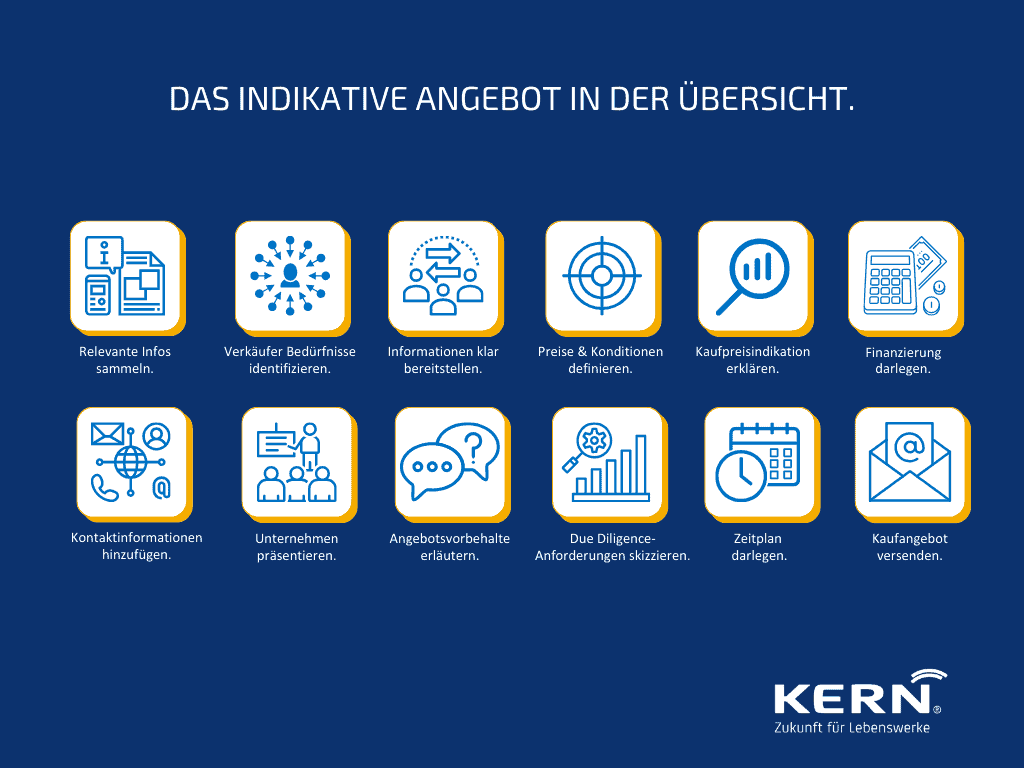

Creating an indicative offer is a crucial step in convincing potential customers or business partners of your products or services. Here are the essential steps you should follow when creating an effective indicative offer:

- Collect relevant information: Start by collecting all the necessary information to be included in your offer. As a rule, you can gather this from the exposé and, as a rule, from the process letter.

- Identify needs of the seller and his advisor: Understand the interests and requirements of the seller and, if applicable, the advisor. A thorough analysis of these interests will enable you to tailor your indicative offer specifically to them.

- Provide clear information: Your offer should contain clear and understandable information. Describe your requirements and goals in detail and precisely. Avoid jargon and use clear and simple language.

- Define prices and conditions: State the purchase price and all relevant conditions transparently. If possible, state a fixed price and not a price range, as the seller will only perceive the lower end of the range.

- Explain the purchase price management: Indicative offers often serve as a starting point for negotiations. Therefore, explain how you arrive at the purchase price indication and thus show that you have dealt with the company valuation.

- Present funding: Initial considerations regarding the financing of the purchase price increase the credibility of the offer and improve your chances in a bidding process, for example.

- Add contact information: Your contact information, such as phone number or email address, should be clearly visible in the offer to make it easier for potential customers to contact you.

- Present your company: Provide a brief overview of your company to build trust and credibility. Information about your experience, references and qualifications can be included here.

- Offer reservations: A purchase offer is usually subject to certain reservations. Explain these, e.g. if the consent of your shareholders is still pending.

- Information/due diligence requirements: It is helpful for the seller if you already outline basic due diligence requirements that are essential for you.

- Set out the timetable: Provided you have time preferences or bottlenecks in the M&A process If you have any other questions, you should also explain them or, if necessary, signal flexibility in terms of time.

- Sending the purchase offer: Send the indicative offer to the potential customer or business partner, usually by e-mail or by the desired communication channel, to convey your intention to buy and your offer to buy. Meet any deadlines set by the seller or ask for an extension if necessary.

Significance for the M&A process

The indicative offer plays a crucial role in the early phase of the M&A process. It is usually used to assess the interest of potential buyers in a company and serves as a basis for further negotiations. It allows the seller and its M&A advisor to get a first impression of potential offers and to move the process forward efficiently.