One of the criteria why a company sale fails is an exaggerated asking price on the seller’s side. The buyer’s and seller’s ideas about the value of the company therefore differ greatly.

The cause is rarely an incorrect company valuation. Rather, the emotional value of the company is perceived by the owner to be so high that he classifies it as equally high in monetary terms. The buyer side, however, usually looks at a company in a completely different way. Perhaps you would say more rationally. However, emotional factors also play a major role on the buyer’s side. In most cases, it is a matter of a pronounced need for security. Therefore, in principle, a prospective buyer only wants to know one thing: How sustainably can the company create added value for its target group?

Basics webinar presented by Nils Koerber

Company sale (M&A) without risk and loss of value

Only if you can make a prospective buyer believe that the answer to this question will also succeed positively in the future, will he assume that the company will also generate a return in the future. This is important, e.g. for the repayment of financing. A close look at the past is not enough to make a statement about the sustainability of the economic power. Classics of failure, such as Nokia, Polaroid, etc., show that sticking to the known and mastered technology, to the existing business model, does not necessarily guarantee a profitable future value proposition for a future target group.

Sale of the company through change of the business model

The influence that a change in the business model can have on the purchase price and succession is shown by the case of a pure contract manufacturer of turned and milled parts. He wants to sell his company because he does not want to continue with the entrepreneurial responsibility. The order situation is good, as he is known for his quality, punctuality and know-how. There are many prospective buyers, but most of the purchase price offers do not meet the seller’s expectations. This is usually justified with the lack of scalability or a missing unique selling proposition.

Our question to the seller about what he would do differently in his business model led to the following statements: offer design know-how as well and expand production to component groups in order to increase the depth of added value. Concrete ideas were available, but the seller could not and did not want to implement them himself.

The inclusion and discussion of these ideas right from the start of the discussions and selection of potential buyers soon revealed the ideal buyer, who recognised and appreciated the potential.

The business model of a company

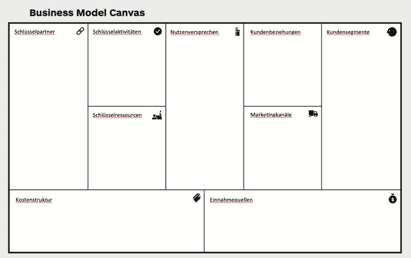

Whenever we speak of added value for a target group, it is the company’s business model that describes this context. At the heart of it, it is primarily about the value proposition. With which products or which service do you create added value? For whom? For your customers or those who are to become customers? Then we are talking about your target group or customer segments. The decisive factor here is the relationship you have with your customers and the channels through which you reach them.

The right-hand side in the so-called Business Model Canvas (canvas means canvas, wallpaper) is responsible for the turnover in the company.

On the left-hand side, list the key activities, resources and partners to deliver your value proposition. This describes the cost side of your business model.

The valuation of a business model

If one looks at the traditional, past-oriented valuation methods of companies, one finds that the view into the future is only taken into account to a very limited extent. In addition to the net asset value method (valuation of the current components of the fixed assets) and the multiplier method (multiplication of the EBIT by a multiplier typical for the industry), company values in the DACH region are primarily valued using the capitalised earnings value method and in the international context predominantly using the discounted cash flow method. Here the last three annual financial statements are formed as an adjusted average balance sheet and then the cash flow or EBIT is discounted over the future ten years with a capitalisation interest rate. In simple terms, it attempts to determine the probability that today’s earnings will still be generated in future years. In the Canvas model, the left-hand side is subtracted from the right-hand side and then discounted with a risk interest rate. This is because there are in fact no empirical values available as to how the future will turn out. The same applies to the development of turnover.

You already realise that looking into the future is looking into the past and extrapolating into the future. It has more to do with looking into a crystal ball and the principle of hope that the prospective buyer may not take this aspect quite so seriously.

Valuation methods for the sale of a company

Future-oriented valuation methods try to give a more qualitative touch to looking into the crystal ball. We should therefore not expect a monetary company value from operational planning methods, data-based methods or benchmark methods. They are more ratings about the individual factors of the business model (see the Canvas approach) and its sustainable development forecast. In doing so, we would like to IDEASCANNER which, according to customer feedback, is ‘a real eye opener’ and ‘better than anything else on the market’, because a Business Model Canvas does not tell you where you should improve your business model.

Authors:

Wolfgang Bürger, KERN locations Nuremberg and Würzburg

Roland Greppmair, KERN Munich location

Holger Habermann, KERN locations Munich and Salzburg

Andreas Stütz, IDEASCANNER, Founder & CEO

TIPS for further reading:

MBI - Success model for corporate succession

Corona, Company Sale & Now? Part 1

The Cooperative Model - When Employees Follow in the Footsteps of the Company’s Founders Part 1