Company shares, whether in the form of shares, GmbH shares or venture capital, are a key aspect of the business world. Here you can find out what opportunities and stumbling blocks there are and how you can successfully invest in company shares.

Read shortly

- Company shareholdings offer influence and profit sharing.

- Types: AG, GmbH, KG, OHG, dormant partnership, eG, venture capital.

- Company participations in start-ups promote innovation.

- Purchase process: objectives, due diligence, financing, contract drafting.

- Professional support simplifies the search for investments.

- Checklist for avoiding common mistakes.

Table of contents

What are company shareholdings?

Company shareholdings are shares or investments that a person or another company acquires in a company. These shareholdings can take a variety of forms and often give the holder a say, potential profit-sharing and influence over company decisions.

Types of corporate investments at a glance

Equity investments are a way of participating in a company and benefiting from its success. There are different types of corporate investments, which vary depending on the corporate structure and investment objectives. In the following, we take a closer look at some of these forms of participation:

Public limited company (AG)

The public limited company (AG) is one of the best-known and most widespread forms of corporate investment. In an AG, the capital is divided into shares that can be purchased by investors. Each shareholder receives shares in the company and usually has voting rights at the general meeting. AGs are often listed on stock exchanges and at the same time also offer quick options in the event of a desired sale of the shares.

Limited liability company (GmbH)

The GmbH is a common corporate structure in many countries. In a GmbH, shares are not publicly tradable and usually belong to a limited number of shareholders. The liability of the shareholders is limited to their contribution, which means that personal assets are protected from corporate debts.

Limited partnership (KG)

In a limited partnership there are two types of partners: the general partners and the limited partners. The general partners are responsible for the management and are personally liable for the debts of the partnership. The limited partners, on the other hand, have limited liability and only bear the liability risk up to the amount of their contribution.

General partnership (OHG)

The general partnership is a form of partnership in which all partners have personal and unlimited liability. There are no restrictions on the number of partners and the general partnership is often used in small family businesses and partnerships. However, it is rather rare.

Silent society

The silent partnership is a special form of participation in which an investor contributes capital to a company but does not play an active role in the management or is even subject to restrictions as a shareholder. A silent partnership is often used to raise capital or to share in the company’s profits.

Cooperative (eG)

Cooperatives are primarily designed to promote the interests of their members. Each member has one vote, regardless of the number of shares held. Cooperatives are widespread in many industries, especially banking, agriculture and consumerism.

Venture Capital (VC)

Venture capital is a form of corporate investment in which external investors invest capital in start-ups and growth companies. In return, they receive shares in the company. VC investors offer not only funding, but also expertise and networks to help the company grow.

Excursus: Company participations in start-ups

The participation of established companies or experienced investors in start-ups has become a significant trend in the business world. This form of company participation brings various advantages for both the startups and the established companies. Start-ups are often innovative and agile, while established companies have resources, industry knowledge and market presence.

The involvement of incumbents in startups can take various forms, including financial investments, partnerships, joint ventures or acquisitions. In doing so, startups benefit from access to capital and resources, while incumbents can benefit from innovative ideas and new business opportunities.

This win-win situation has led to corporate investments in start-ups becoming a promising strategy for growth and innovation, enriching the corporate landscape in many ways. However, it must also be mentioned that about 80% of all start-ups fail (source German Startup Monitor).

How can you buy company shares?

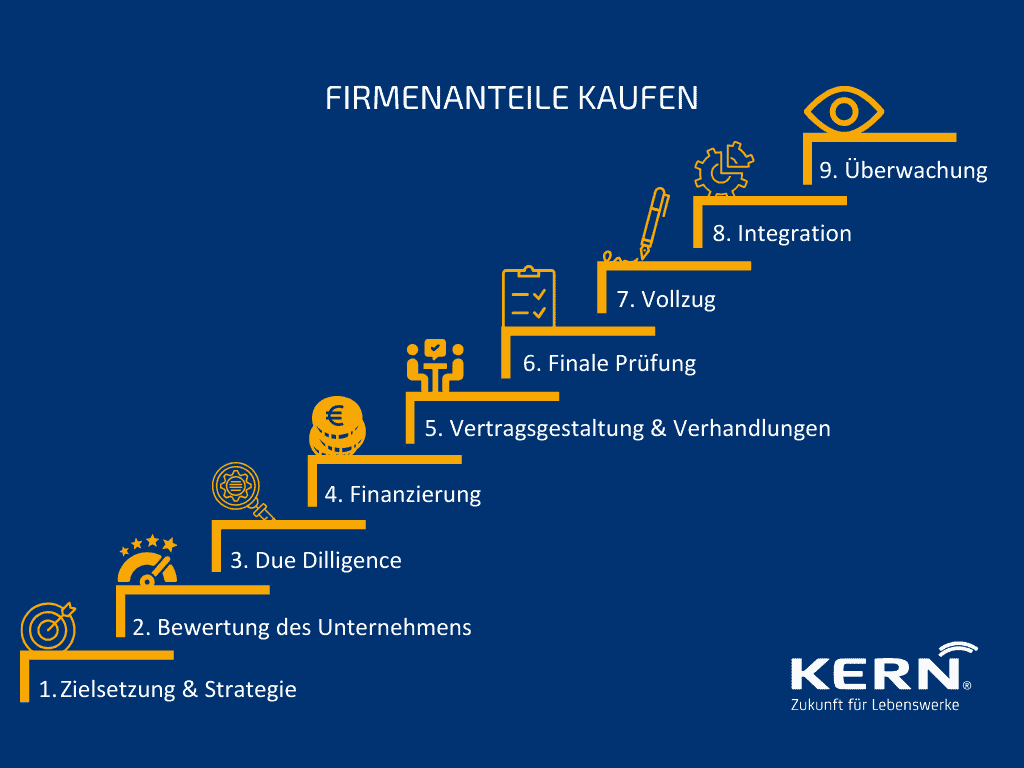

Buying a stake in a company can be a challenging but extremely rewarding investment. To go through this process successfully, thorough preparation and a smart approach is essential. Here is a step-by-step guide to help you in your venture:

Step 1: Objectives and strategy

Before preparing to buy company shares, clarify your financial goals and investment strategy. Consider what type of company and industry suits your needs and risk appetite.

Step 2: Valuation of the company

Determine the value of the company in which you want to buy company shares. This requires a thorough Evaluationwhich takes into account the financial health, future earnings prospects and assets of the company. It may be helpful to consult an accountant or valuation expert.

Step 3: Due Diligence

Carry out a comprehensive Due Diligence to review the legal, financial and operational situation of the company. This includes analysing contracts, company documents, tax returns, debts, and legal obligations. Pay special attention to potential risks and challenges.

Step 4: Financing and raising capital

Determine how you will finance the purchase of the company shares. This can be equity, debt or a combination of both. Make sure you have the necessary financial resources, regardless of origin, to complete the purchase.

Step 5: Contract drafting and negotiations

Work with lawyers and technical experts to draft the purchase contract. Be sure to include all relevant conditions, prices, payment terms, transfer agreements and guarantees in the contract. Negotiate these terms carefully to ensure that your interests are protected.

Step 6: Final check and signing

After completing the negotiations and clarifying all legal and financial issues, you should carefully review the final contract. Once you are satisfied with all the conditions, sign the purchase contract.

Step 7: Share transfer and execution

After the contract is signed, the actual transfer of the company shares takes place. This involves the transfer of ownership rights and compliance with legal requirements. Observe the procedures for registering share owners in the commercial register or other relevant authorities.

Step 8: Integration and management

After the purchase of the company shares, the integration phase begins, during which you can actively shape your position as a shareholder (if agreed). Work closely with the company’s management to optimise your investment and ensure long-term success.

Step 9: Ongoing monitoring and adjustment

It is important to keep an eye on your investment, monitor the company’s performance and make adjustments if necessary. This may include optimising the business strategy, making further capital infusions or selling your shares.

Where can you find a company shareholding that is sold

The search for a suitable company shareholding for sale can be a demanding task. But with professional support, the process is made much easier.

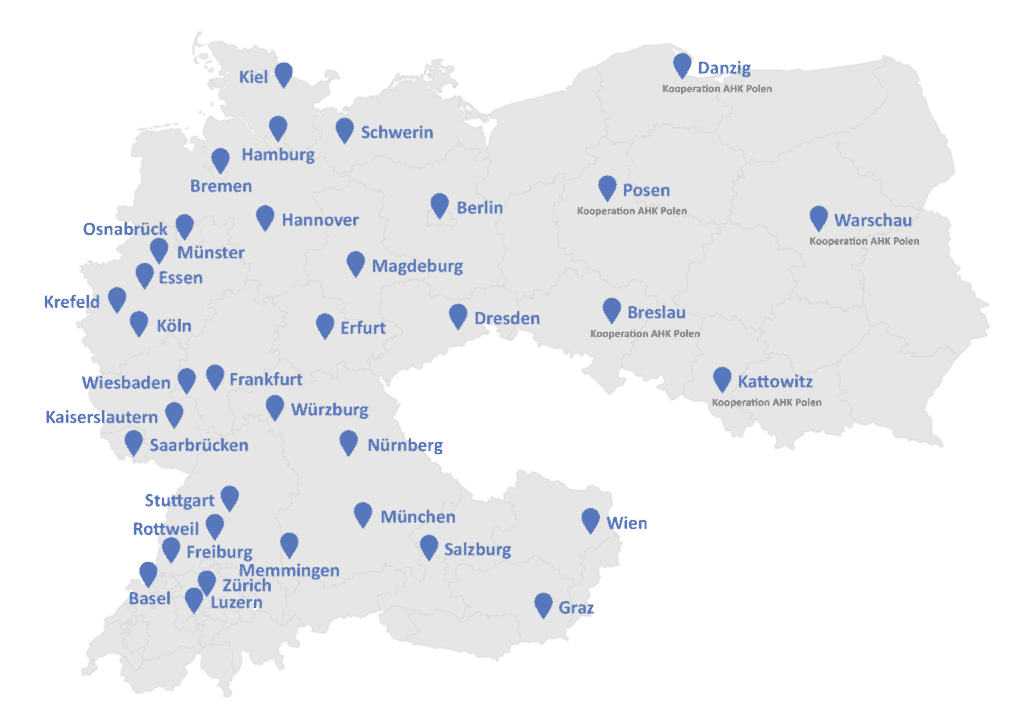

At KERN, we specialise in bringing investors and entrepreneurs together and offering tailor-made solutions. Our network and our expertise in business brokerage, enable us to search specifically for suitable investment opportunities. Whether you are looking for an already established start-up with potential or a company that has been active in the market for decades, KERN will provide you with comprehensive support. The exception is completely new start-ups. We do not support them.

You can rely on our experience in the investment sector to provide professional support in your search for a company investment. If required, we are happy to be your partner on this path.

You are also welcome to take a look at which companies are currently participating in our Company exchange be traded.

Checklist: What you should consider when buying company shares

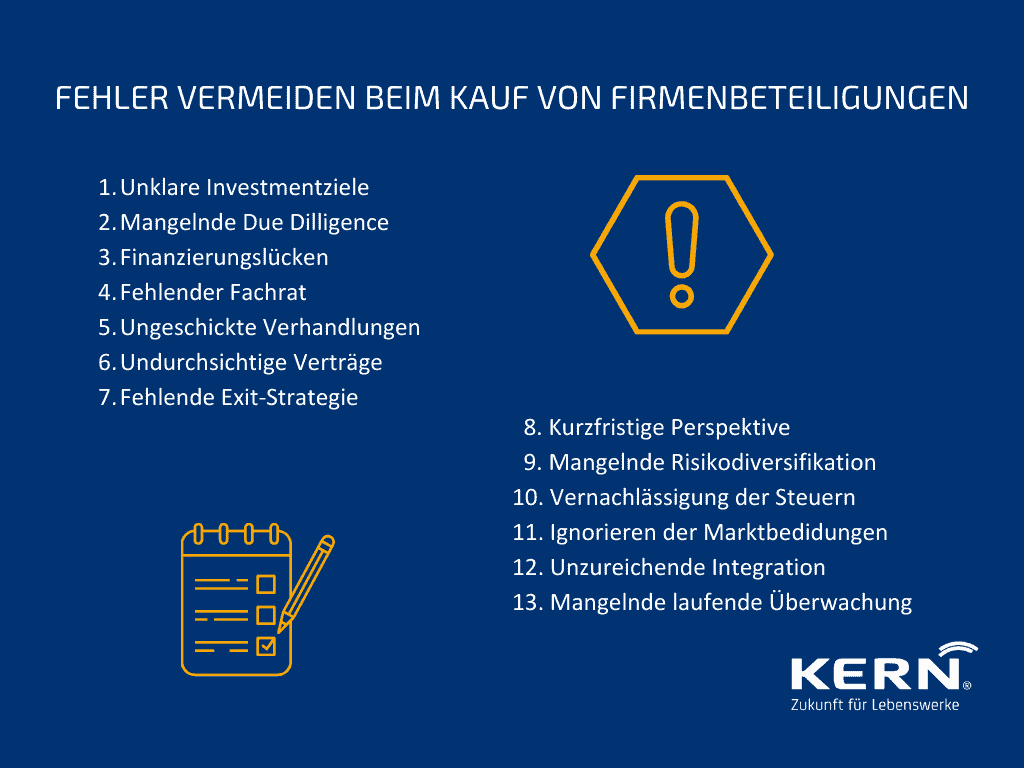

Buying company shares can be complex and there are many stumbling blocks to avoid. Here is a checklist pointing out common mistakes and challenges:

1. unclear investment objectives: Unexplained or contradictory investment goals can lead to wrong decisions. Define clear goals and strategic intentions.

2. lack of due diligence: Inadequate due diligence on companies can lead you to overlook potential risks and problems. Conduct comprehensive due diligence.

3. funding gaps: Lack of sufficient funding can jeopardise success. Make sure you have the necessary financial resources or access to funding.

4. lack of a professional council: Ignoring legal and financial advisors can lead to devastating consequences. Seek professional support in good time.

5. clumsy negotiations: Unprofessional negotiations can lead to poor contract terms. Act tactically and persistently during negotiations.

6. opaque contracts: Unclear or missing contract terms can cause misunderstandings and disputes later on. Ensure clear, comprehensive contracts.

7. lack of an exit strategy: The lack of an exit strategy may mean that you have difficulty selling your company stake in the future. Plan for the exit from the beginning.

8. short-term perspective: Being too focused on short-term gains can jeopardise long-term success. Think about long-term perspectives and developments.

9. lack of risk diversification: Concentrating on a single investment can put all your capital at risk. Diversify your investments.

10. neglect of taxes: The tax implications of the purchase should not be overlooked. Find out about the tax implications.

11. ignoring market conditions: Ignoring market trends and economic developments can lead to bad investments. Pay attention to the market context.

12. insufficient integration and management: Do not neglect planning for the time after the purchase. Consider working with the management of the company.

13. lack of ongoing monitoring: If you don’t actively track the company’s performance, problems can go undetected. Keep an eye on your investment and adjust your strategy.

The topic of financing

Financing is crucial when it comes to raising capital for the purchase of company shares. It involves raising capital to support business activities and expand. Whether through equity, debt or alternative financing methods, the right financing strategy is of great importance.

For more in-depth insights and comprehensive information on this important topic, read on here.

Conclusion

Company shareholdings are a diverse concept offering a wide range of investment opportunities. Whether you are interested in a public limited company, a limited liability company, a limited partnership or other forms of participation, the choice depends on your goals and risk appetite. The participation of established companies in start-ups has become a significant trend and offers opportunities for growth and innovation. However, with a high failure rate.

In order to buy company shares, thorough preparation and consideration is crucial, as there are numerous challenges and stumbling blocks that should be avoided. Financing plays a central role and requires a sound strategy.

FAQ

Buying shares in a company can be a good investment, but it depends on several factors, including the financial health of the company, the market situation and related outlook, and your own investment goals.

Before buying company shares, you should carefully consider factors such as the company’s financial stability, industry, growth potential, corporate strategy and current market price.

Yes, there are risks in buying shares in companies, including market volatility, company insolvency, losses due to economic conditions and changes in corporate governance.

Yes, it is possible to buy a partial stake in a company, but this depends on the company structure and the participation options offered.

Yes, you can buy shares in a foreign company. This usually requires access to international stock exchanges or financial markets and may involve additional legal and tax aspects. These should definitely be checked by experts in advance. Especially the area of taxes can hold unexpected surprises.