The path to successful M&A (short for mergers & acquisitions) in the SME sector requires strategic planning, smart execution and the avoidance of costly mistakes. In this article, discover the key to five steps to a smooth M&A process. M&A process. From preparing the documents to selecting the right buyer. Tried and tested tips and proven strategies for the successful sale of your company as part of an M&A transaction.

Table of contents

Success factors for the sale of a company in the SME sector

- Preparation of the documents: Clear insights into the finances, history and strategy, including the strengths and weaknesses of a business model, create trust. This also includes the early preparation of all relevant documents for later inspection in a buyer audit.

- Buyer search: Targeted market research on potential investors and network utilisation for the identification of suitable buyers.

- Company succession: Selection of the right and suitable successor for a smooth handover and further development of a company.

- Negotiation of the purchase price: Realistic valuation, negotiating skills and a focus on long-term value creation in an attractive financing mix.

Company purchase agreement: Precise and comprehensive formulation of all eventualities, involvement of experts for legal protection and expertise.

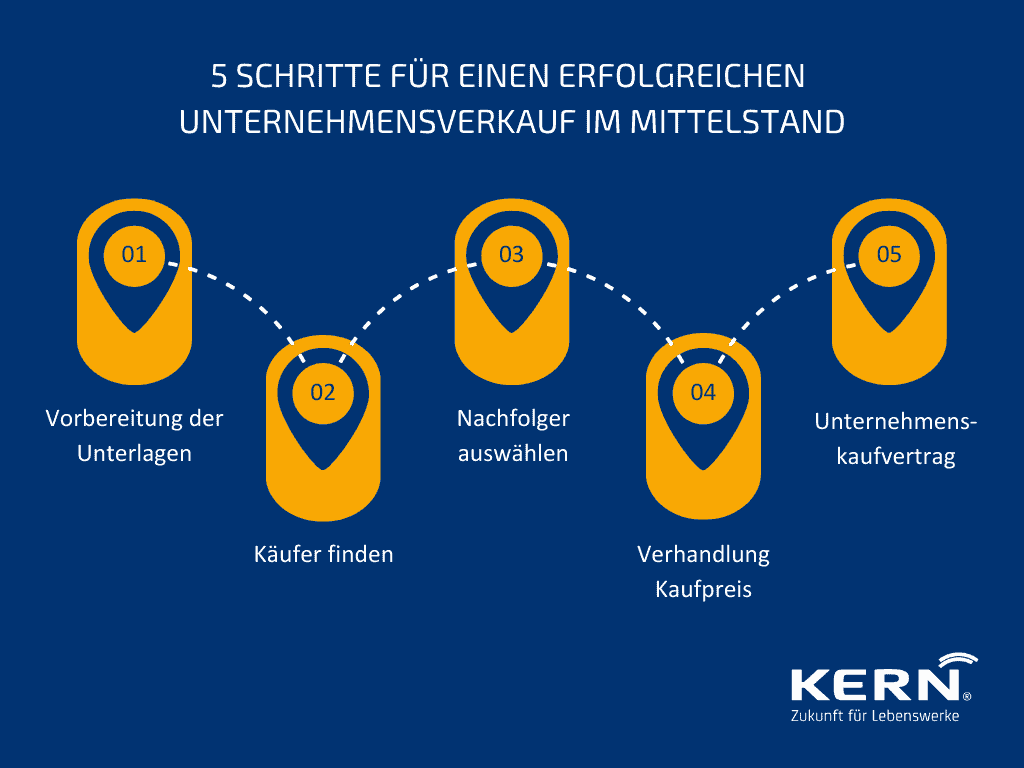

5 steps for a successful company sale in the SME sector

A successful company sale in the SME sector requires a well thought-out and structured approach. In this article, we will show you the path to a successful company sale in five clear steps. Let’s start with the first and decisive phase:

1 Preparation of the documents

Comprehensive preparation of the sales documents for a company forms the foundation for a successful M&A process and a successful company sale. Potential buyers need clear insights into the financial performance, company history and strategic orientation. The same applies to the strengths and weaknesses of a business model. Only transparent and complete documentation can build trust and set the course for promising negotiations. The internal preparation for a well thought-out DD (due diligence = inspection phase by the buyer) should also start early and systematically record all documents at an early stage.

2 Find a buyer

Identifying potential buyers is crucial for the success of a sale and a successful M&A process. Targeted market research into the potential investor target groups and the use of networks can help to address the right target group. Whether strategic investor, financial investor (and there are many different types) or management buy-in or buy-out ? the choice of the right buyer not only influences the sale price, but also the long-term future of the company.

3 Selecting a company successor

Choosing the right company successor is of great importance, especially in the context of Company succession and mergers & acquisitions. In addition to professional qualifications, personal compatibility and identification with the corporate culture also play a role. Ensuring a smooth handover and the continuous development of the company are key aspects in this phase. Who possesses or promises the quality of leadership for the company that is needed for the future?

4 Negotiation of purchase price

Negotiating the purchase price is often the most exciting part of selling a company in the entire M&A process. A realistic valuation of the company, negotiating skills and a focus on long-term value creation are crucial here. Fairness on both sides creates a solid foundation for successful cooperation in the future. Anyone who feels they have been ripped off will only cooperate with limited commitment afterwards.

5 Company purchase agreement

The company purchase agreement is the legal framework for the sale. A precise formulation of all relevant options that takes into account the interests of both parties is essential. The involvement of experts, such as lawyers and tax advisors, ensures legal protection and minimises the risk of conflicts after the sale.

A well thought-out and structured process, starting with the preparation of the sales documents through to the final company purchase agreement, paves the way for a successful company sale in the SME sector. In the following sections, we will look at each of these steps in more detail and offer you valuable insights for a smooth process.

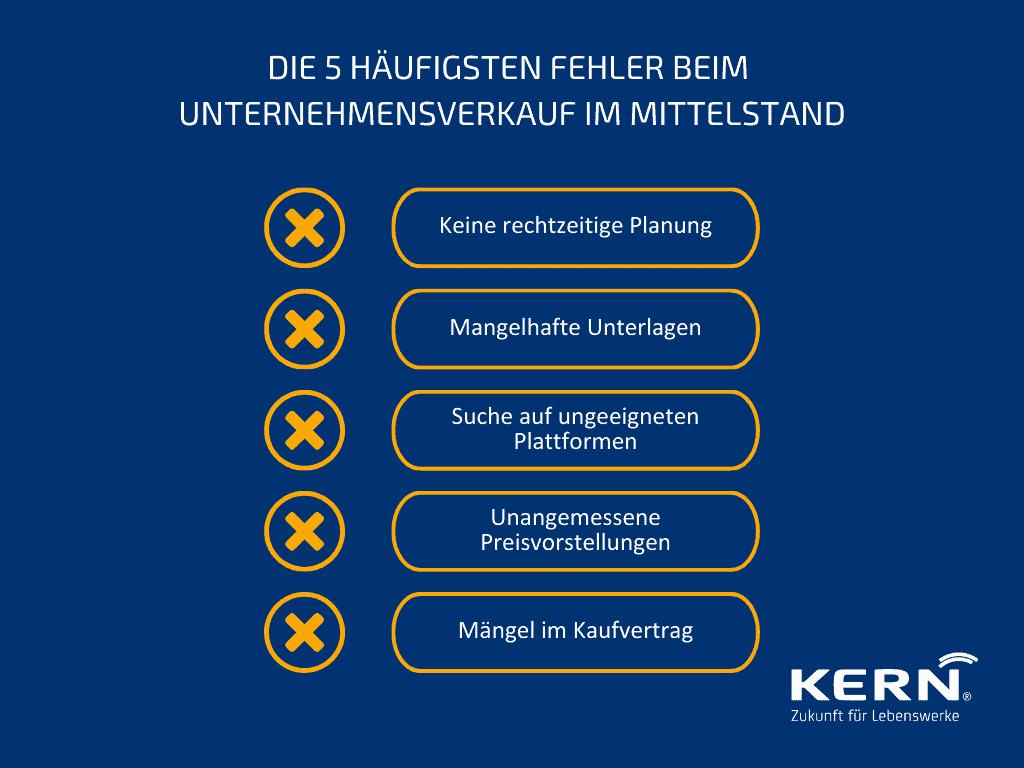

The 5 most common mistakes when selling a company in the SME sector

A successful company sale in the SME sector requires not only smart decisions, but also skilful avoidance of common pitfalls. In this article, we highlight the five most common mistakes that companies in the SME sector make during the sales process and show how they can be avoided

Mistake 1: No timely planning

Planning the sale of a company in good time is crucial to its success. A common mistake is to underestimate this process and only start collecting data for the buyer review, for example, when the sale is already imminent. Early strategic considerations and structured preparation are essential in order to create the optimum conditions for a successful sale. Tax and legal aspects in particular require time and cannot simply be realised in a matter of days or weeks.

Error 2: Inadequate documentation

Incomplete or inadequate documentation can significantly affect the confidence of potential buyers. Another common mistake is neglecting to prepare the documentation or starting too late. Clear, transparent and complete information is the key to arousing the interest of buyers and ensuring a smooth sales process.

Mistake 3: Searching on unsuitable platforms

Choosing the right platforms for finding potential buyers is crucial. A common mistake is to use unsuitable or overly broad platforms and ways of approaching buyers, which can lead to misunderstandings among buyers. In the worst case, an ill-considered dispersion of the sales offer can even lead to a cancellation of the desired anonymity. Precise market research and a targeted presence on relevant platforms or covert contact channels are crucial for discreetly and anonymously addressing the right buyers. A platform such as the KERN exchange can serve as an example here, offering transferors and transferees professional support for company placement and advice. And this is always in the sense of process support and not as a sober brokerage service.

Mistake 4: Inappropriate price expectations

Unrealistic or unreasonable asking prices are a common stumbling block in the sales process. It is important to realistically assess the value of the business, taking into account the market, industry and other relevant factors. A balanced pricing strategy is crucial to avoid scaring off potential buyers and still get the best deal possible.

Excursus: Calculating company value

The realistic and objective valuation of a company forms the basis for successful pricing when selling. The determination of the company value takes into account various factors such as key financial figures, market conditions and future prospects. A common and reliable method is the capitalised earnings value method according to IDWS1, in which future cash flows are discounted to their current value. Industry-specific multiples and the analysis of comparable transactions also play a role in other methods.

For a more comprehensive view and detailed insights into the world of business valuation, we refer you to our further article on the topic “Calculate enterprise value”.

Use our company value assessment from more than 2,000 company valuations.

Mistake 5: Defects in the purchase contract

A carefully drafted purchase agreement is essential to avoid legal uncertainties. A common mistake is to overlook or neglect defects in the purchase agreement. The involvement of experienced legal advisors (and by that we mean legal experts who have worked on a wide range of transactions over the years) and a thorough review of the contract are essential to prevent potential conflicts after the sale and to protect the interests of both parties.

By avoiding these common mistakes and focusing on a thoughtful and structured approach, you can significantly improve the chances of a successful SME business sale. In the following, we will take a closer look at each of these mistakes and offer you practical tips for a smooth sales process.

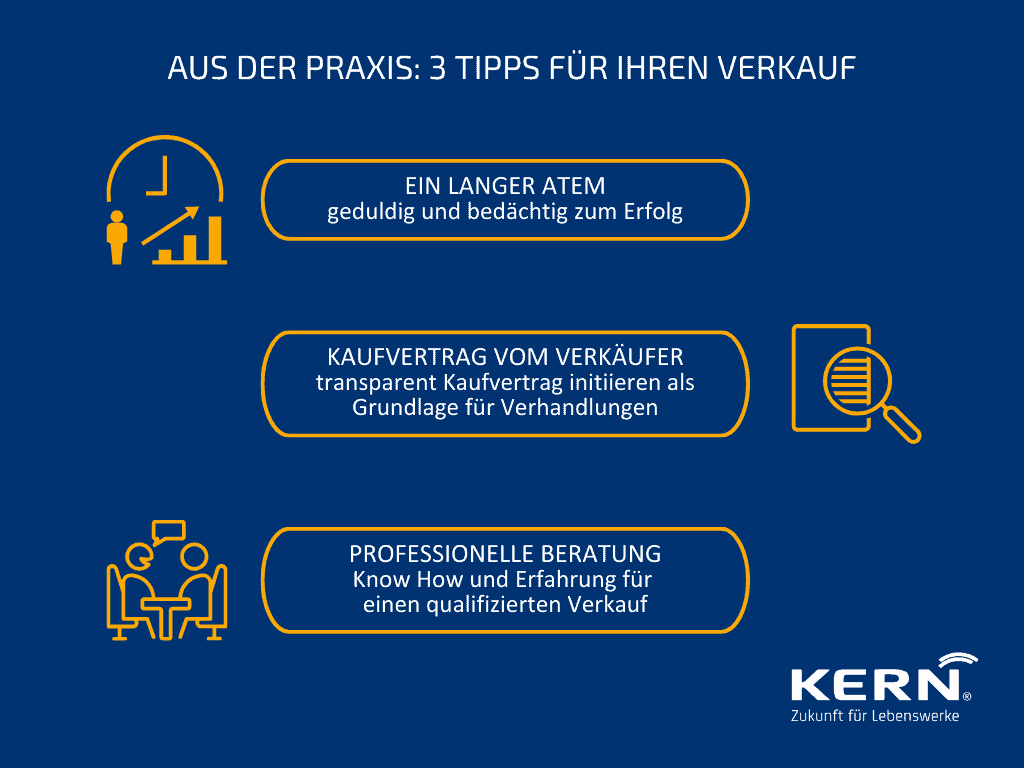

From the field: 3 tips for your sale

The successful sale of a company requires not only strategic considerations, but also tried-and-tested approaches. Here we share three key tips from the field to optimise your sales process.

A long breath

A successful company sale is not a sprint, but rather a marathon. Patience is not just a virtue, but the key to success. The search for the right buyer, negotiations and contract drafting can take time. Patience enables you to go through the process carefully and achieve the best possible deal. And sometimes it is inevitable to start all over again.

Purchase contract from the seller

Focus on transparency and set clear rules from the outset. A common practical tip is to initiate the purchase agreement as the seller. This gives you the opportunity to shape the framework from the outset and better protect your interests. A contract initiated by you often provides a solid basis for negotiations and minimises the risk of misunderstandings.

Professional advice

Selling a company is a complex matter that often requires expertise. A tried and tested tip is therefore to seek professional advice. Experienced M&A consultants and lawyers can not only support you with the valuation, but also ensure that legal aspects and contractual details are optimised. Investing in professional advice often pays off in the form of a smooth sales process and optimised conditions. As a rule, the higher sales proceeds then easily cover the investment for the sophisticated advice.

Conclusion

A successful company sale in the SME sector requires not only a clever strategy, but also careful and well thought-out implementation. The five steps, from preparing the documents to the company purchase agreement, form a structured guide to successfully organising the sales process.

Avoiding the most common mistakes, such as inadequate planning or unrealistic price expectations, is crucial. The path to a successful sale requires patience, as the search for the right buyer, negotiations and contract drafting can take time.

The clever initiation of the purchase agreement by the seller provides a solid basis for negotiations and minimises the risk of misunderstandings. Professional advice also plays a key role. Experienced management consultants (M&A experts) and lawyers can not only assist with the valuation, but also ensure that legal aspects and contractual details are optimised.

A well thought-out process, combined with tried-and-tested advice, paves the way for a smooth and successful company sale in the SME sector.