Ready for a successful Company sale? Our guide takes you through the crucial steps to achieve the best results. From saleability to targeted buyer search and tax planning, we offer practical tips. Learn how to overcome potential deal breakers and smooth the transition after the sale. This article is your key to an effective and successful sale process ? read on to take your business to a new level of succession readiness and implementation!

Table of contents

- Read shortly

- Before the sale: sales ability and strategy

- Company valuation and expose’

- Targeted buyer search

- Buyer review and Letter of Intent (LoI)

- Due diligence

- Negotiations and company purchase agreement

- Taxation (incl. sample calculation)

- The 7 most common deal breakers in company sales

- Checklist for company sales

- Conclusion

- FAQ

Read shortly

- Thorough preparation and a clear strategy are the key to success.

- Emphasis on sales skills and strategic planning.

- Effective Business valuation and convincing exposé.

- Buyer verification and Letter of Intent as decisive negotiation stages.

- Tax aspects: Sample calculation and early advice from experts.

- Proactive management of deal breakers (breakdown of negotiations) for a smooth sales process.

Video: Selling a company in 10 steps

Discover the world of company sales in our video: “Selling a company in 10 steps”. Here we offer you an insight into the process of a successful company sale. In just a few minutes, you will get to know the decisive steps that characterise this important business transaction for securing the future of your life’s work.

Before the sale: sales ability and strategy

Preparing for the sale of a business requires a thoughtful approach, centred on saleability and a well-thought-out strategy. A successful business sale requires more than just the right timing - it requires thorough preparation and a clear strategy to achieve the best possible results.

Optimise sales capability: Before launching your business on the market, it is crucial to ensure that it is optimised for sale. This involves assessing and optimising various aspects, from financial stability to organisational efficiency. Potential buyers will be paying close attention, so it is important to identify and address any weaknesses in order to increase the overall value of the business. A particular feature, especially for smaller companies, is a verifiable deputy arrangement. This ensures that the knowledge and diverse contacts are retained, even if the captain leaves the ship at some point.

Strategy development: A clear sales strategy is essential to ensure that the process runs smoothly. This includes setting realistic targets, selecting the appropriate sales method (e.g. asset or share deal or even a bidding process), identifying potential buyers and setting an appropriate selling price. This strategy is communicated first to the potential buyers. This way, everyone knows whether and how further steps can be planned and implemented. At a much later stage, it is also relevant for extended internal and external communication.

Tips for a successful sale:

- Start early: A long-term preparation process makes it possible to rectify possible deficiencies and prepare the company optimally for the sale. Colloquially also known as ‘making the bride or groom pretty’.

- Obtain professional advice: Experts such as lawyers, tax advisors and business consultants can provide valuable support and ensure that legal and financial aspects are handled correctly. And it often takes time simply due to legal requirements.

- Facilitate due diligence: Transparent and well-organised documentation facilitates the due diligence process for potential buyers and promotes trust.

- Involve employees: The possible involvement of leading employees in the process and the communication of open and transparent information create a positive environment and minimise uncertainties. However, this step must be weighed up in a particularly complex way.

With careful preparation, a well thought-out strategy and the consideration of important tips, companies can ensure that the sales process is effective, transparent and successful.

Company valuation and expose’

The company valuation and the preparation of a convincing exposé are decisive steps in initiating a successful company sale process. The company valuation lays the foundation for realistic pricing and requires an in-depth analysis of key financial figures, market positioning and future potential.

A carefully prepared exposé presents the company in its best light and is crucial for attracting potential buyers. It should not only include key financial figures, but also emphasise the company’s strengths, unique selling points and growth opportunities.

The combination of a sound business valuation with an appealing exposé creates confidence among potential buyers and lays the foundation for a successful sales strategy. In this process, professional advice is often invaluable to ensure that both the valuation and the exposé effectively communicate the uniqueness and potential of the business.

Targeted buyer search

The targeted search for buyers is crucial for the successful sale of a company. A customised approach to reaching potential buyers can speed up the sales process and increase the chances of an optimal transaction. Platforms such as KERN Börse, DUB.de and Nexxt-Change provide valuable resources for this search, allowing sellers to maximise their reach and engage directly with interested buyers anonymously. Utilising these platforms in conjunction with targeted marketing strategies gives sellers a competitive advantage and increases the likelihood of a successful business transfer. A precise focus on the individual characteristics and requirements of potential buyers is crucial for a customised approach and optimal results.

Buyer review and Letter of Intent (LoI)

Due diligence and the letter of intent (LoI) play a central role in the sale of a company. Due diligence requires a thorough examination of all relevant aspects in order to identify potential risks. The LoI is a document that expresses the serious intention of the buyer. Careful preparation on the part of the seller, transparent communication during the due diligence process and precise drafting of the LoI are crucial. Flexibility and co-operation are key factors for successful negotiations and a smooth transition to closing.

Due diligence

Due diligence, or buyer due diligence, is an essential step in the sale of a business. Potential buyers scrutinise financial documents, legal obligations and operational processes to identify risks. This thorough review builds trust between the parties, minimises misunderstandings and lays the foundation for successful negotiations. Comprehensive due diligence is crucial for a secure and successful transaction by recognising and addressing potential challenges at an early stage.

Negotiations and company purchase agreement

The negotiation phase and the preparation of the company purchase agreement are decisive steps in the context of a company sale, especially when it comes to the transfer of the life’s work in the context of the Company succession goes. During the negotiations, the buyer and seller meet to clarify the terms of the transaction, taking into account not only the purchase price but also other important aspects such as payment terms, transition periods and any guarantees. The resulting company purchase agreement is the legal document that sets out the agreements between the parties. A careful and professional approach is crucial here in order to seamlessly integrate the life’s work into the business succession. Open communication plays a central role in strengthening mutual trust and ensuring that the interests of both parties are adequately taken into account. These steps not only set the framework for a smooth transaction, but also form the basis for a successful long-term business transfer and the preservation of the life’s work.

Taxation (incl. sample calculation)

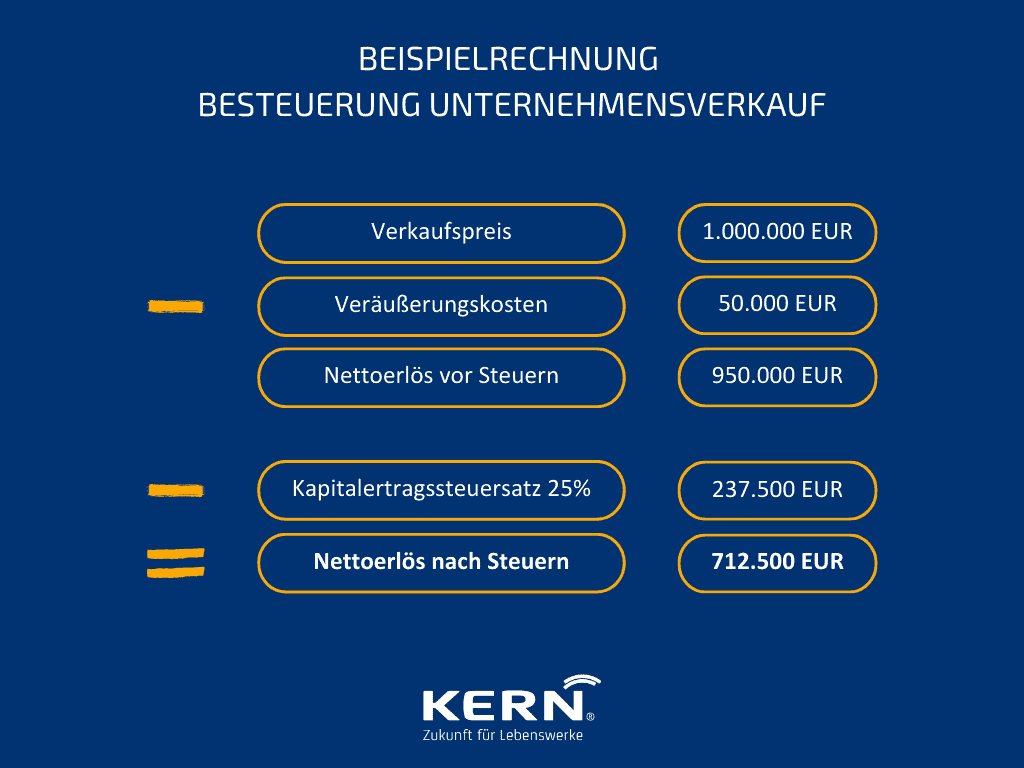

Taxation also plays a central role in the sale of a company and can have a significant impact on the financial results of the transaction. In order to gain a clear insight into the tax aspects, we will look at a simplified example calculation:

Assume the sale price for the company is EUR 1 million. After deducting the costs of sale of €50,000, the net proceeds are €950,000 (assuming for simplicity’s sake that there are no relevant fixed assets in this example). The tax burden varies depending on the legal form and individual circumstances, but let’s assume that the capital gains tax is 25%. In this case, the tax burden would be 237,500 euros, resulting in net proceeds after tax of 712,500 euros.

In pure figures, it looks like this:

- Sales price: 1,000,000 euros

- Disposal costs: -50,000 euros

- Net proceeds before taxes: 950,000 euros

- Capital gains tax rate: 25%

- Tax burden: 950,000 euros * 25% = 237,500 euros

- Net proceeds after taxes: 950,000 euros - 237,500 euros = 712,500 euros

It is important to note that this is only a simplified example calculation and that individual tax circumstances must be taken into account. Early advice from a tax expert is advisable in order to determine the optimum tax structure for the sale of the company and avoid unpleasant surprises.

With sufficient time and adapted structures (e.g. holding concept), it is even possible to save almost 100% in taxes on a sale.

The 7 most common deal breakers in company sales

A successful company sale requires not only well thought-out preparation and a structured process, but also the proactive identification and management of potential stumbling blocks. Here are the seven most common deal breakers that can jeopardise the success of a company sale:

Poor financial situation: A company in financial crisis sends warning signals to potential buyers. In order to gain trust, it is crucial to improve the financial situation and present clear strategies for overcoming debt or liquidity problems.

Lack of growth potential: Companies without recognisable growth potential deter investors. The development of a convincing growth strategy and the identification of new market opportunities are essential in order to arouse the interest of potential buyers. The business model must have resilient prospects for the future.

Enormous investment backlog: A high investment backlog can jeopardise the Enterprise value significantly. Necessary investments should be made before the sale in order to modernise outdated systems, technologies or infrastructures and maintain competitiveness.

Obsolete products or services: Products or services that no longer meet current market requirements are a deal breaker. Updating the product portfolio and innovation are crucial to increasing the company’s attractiveness to potential buyers.

Lack of know-how transfer: If a smooth transfer of expertise cannot be guaranteed, uncertainty arises among potential buyers. Measures to document expertise and train key personnel are essential to ensure a successful transition.

Dependence on a small number of customers: A strong dependence (cluster risk) on a small number of customers harbours considerable risks. Diversifying the customer base and building long-term customer relationships are crucial in order to convince potential buyers.

Problems with management or employees: Difficulties in management or conflicts with employees can significantly affect the sales process. Implementing effective management and fostering a positive working environment is essential to keep buyers interested.

Checklist for company sales

The “Company Sales Checklist” is your indispensable companion for a well thought-out and structured sales process. From preparation to completion, this checklist provides a clear guide to ensure that no important step is overlooked. Use this resource to efficiently plan and successfully realise your business sale.

Conclusion

To summarise, a successful company sale requires thorough preparation and a clear strategy. Transparent communication during the due diligence process and a well-formulated letter of intent are crucial. The tax aspects emphasise the importance of early advice. The targeted search for buyers via platforms such as KERN Börse, DUB.de and Nexxt-Change as well as the proactive management of potential deal breakers are critical to success. Finally, post-merger integration emphasises a smooth transition. By taking a holistic approach, companies can ensure that the sales process is effective and successful.

FAQ

Depending on its size, complexity and sector, the process of selling a company can take several months to a year or longer. The average is 12-18 months.

When determining the company value, key financial figures, market trends, the potential for future growth, intangible assets and other influencing factors should be taken into account.

Companies can increase their attractiveness by optimising financial data, clear organisational structures, well-documented processes and transparent communication.

Confidentiality can be ensured through the use of non-disclosure agreements (NDA), the gradual disclosure of sensitive information and the restriction of the circle of knowledge.

Professional help from Business brokersThe involvement of lawyers, solicitors and other experts is often recommended in order to effectively manage the sales process and take legal aspects into account.

It is possible to sell only part of the company, but this depends on the structure and nature of the business.

Clear communication, realistic pricing, flexibility and a willingness to compromise are crucial for successful negotiations.

It is possible, but the sale can be more challenging. A transparent presentation of refurbishment measures or potential can help.

Dealing with employees can vary depending on the type of sale and is very clearly regulated in Germany with all rights and obligations. The buyer must continue to fulfil the contractual framework conditions and legal requirements without restriction. Clear communication and consideration of employee interests are crucial. At the same time, the moment of internal communication should be considered very carefully. If in doubt, it is better to do this later and only when the ink is really dry.