A business broker plays a central role in business brokerage by acting as an intermediary between the seller and the potential buyer. However, he identifies potential buyers and only takes care of the entire process of a transaction to a limited extent. In this article, we explain the differences between a business broker and an M&A advisor, discuss different remuneration models and highlight in which situations the services of an M&A advisor may be beneficial and add important value.

Read shortly

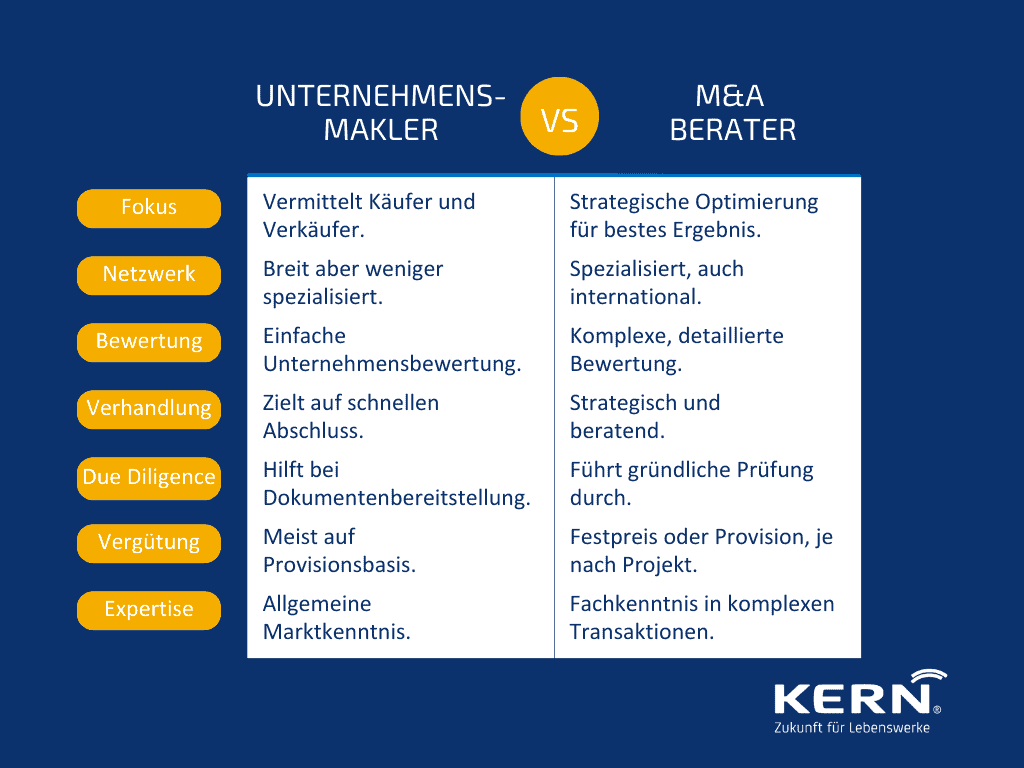

- Tasks of a business broker: preparation or at least coordination of sales documents with the seller, procurement of buyers and, if necessary, also the moderation of sales negotiations.

- Differentiation from a specialised M&A advisor: intermediary vs. advisor, specialisation in the process of a company sale, inter alia with a sound company valuation, exposé preparation and responsibility for the entire process up to the handover, complementary services.

- Why choosing an M&A advisor can be beneficial: Extensive expertise in process knowledge, objectivity and independence, strategic advice.

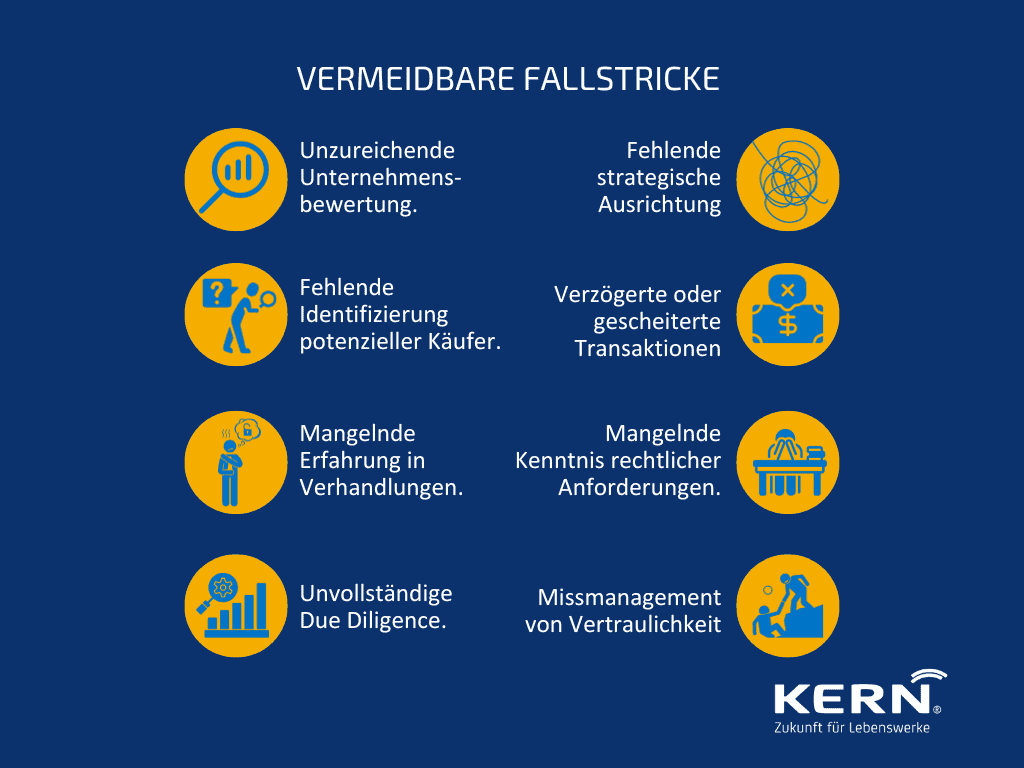

- Pitfalls that can be avoided by choosing a specialised advisor: Inadequate business valuation, failure to identify potential buyers, lack of experience in negotiations, incomplete due diligence, lack of knowledge of legal requirements, delayed or failed transactions, lack of strategic direction.

- Remuneration via fixed price or commission: fixed price (transparency, no conflict of interest, predictability), commission (performance incentive, lower financial risk, proof of expertise), mixed forms of fee models.

Table of contents

Distinction from a specialised M&A advisor

Remuneration via fixed price or commission?

Why is the choice of an M&A advisor more advantageous in many cases?

Pitfalls that can be avoided by choosing an expert advisor

Mixed forms of sales consultants

FAQ - The most frequently asked questions

What is a corporate broker?

A business broker is an expert in business sales who specialises in bringing buyers and sellers together to start the sales process and connect interests. In essence, it is an intermediary who acts as an intermediary between the two parties.

Tasks of a corporate broker:

- Identification of buyers: Business brokers have an extensive network and resources to find potential buyers who may be interested in your business. This includes strategic investors, individuals as well as private equity firms and other interested parties in the financial investor environment.

- Negotiations: If necessary, the broker moderates the negotiations between the entrepreneur and the potential buyer in order to negotiate the best possible conditions for both sides. Caution is advised if both parties to the contract appoint a joint broker. Then mutual interests can arise. The possible expertise for the implementation of purchase review processes, such as a DD (due diligence) the skilful moderation of all players, including lawyers, can also be part of the tasks. This depends on the experience and scope of services of a broker.

- Completion of the sale: Finally, the business broker accompanies you through the closing process or stays out of the negotiations completely. The parties concerned must settle this among themselves in advance.

Distinction from a specialised M&A advisor

The world of business sales can be confusing with various technical and expert terms. One of the most common sources of confusion is the distinction between a business broker and a specialist M&A (Mergers & Acquisitions) advisor.

Although both professionals work in the transaction world and are closely related, there are crucial differences between their tasks and focus. Find out here how a corporate broker differs from a specialised M&A advisor:

1. intermediary vs. advisor: A business broker acts primarily as an intermediary between buyer and seller. He has the task of searching for and presenting suitable buyers. If necessary, he also takes on the role of moderator between the parties involved.

An M&A advisor, on the other hand, is a full-service provider and focuses on making strategic recommendations as early as the preparation stage, thereby optimising the entire M&A process in advance. While the company broker drives the transaction forward, the M&A advisor offers an all-round carefree package, which often begins with an analysis, continues with a qualified company valuation and then perfectly concludes the preparations for a sales process with an exposé as well as neutral teasers. Then the decisive sales phase begins.

2. specialisation: A business broker specialises in brokering the sale of businesses. He has an understanding of the process and usually has an extensive network of potential buyers.

A specialised M&A advisor, on the other hand, may focus on a broader range of M&A activities, including mergers, acquisitions, capital raising and strategic advice. This means that M&A advisors typically offer a broader range of services and are process advisors in depth.

3. focus on transaction execution: The main focus of a corporate broker is to successfully broker the sale of the business. He works with the parties to ensure that the sale goes smoothly.

A specialised M&A advisor, on the other hand, can take on a strategic role that goes far beyond mere transaction execution. He helps identify opportunities, evaluate companies and develop M&A strategies. It is a coach, facilitator, mediator and ‘interpreter’ as well as advisor all in one.

4. complementary services: It is important to note that corporate brokers and M&A advisors are not necessarily mutually exclusive. In fact, in many cases they can work together to achieve the best possible benefit for the client.

For example, a business broker may bring in an M&A advisor to deliver strategic benefits to the sale process. This cooperation can help to optimise the entire M&A process, but is rather rare.

Remuneration via fixed price or commission?

When selecting a corporate broker or an M&A advisor to assist with the sale of a business, it is important to consider not only which expert best suits the needs at hand, but also how the services of these professionals will be remunerated. The question of remuneration, whether via a fixed price or a commission, is crucial and should be carefully considered. Here we take a look at the advantages and disadvantages of both remuneration models:

Fixed price:

Remuneration via a fixed price is a clear and predetermined payment to the chosen expert, regardless of the outcome of the transaction. Let’s say a fixed price of 30,000 euros was set to use the services. Regardless of whether the company is ultimately sold for 0.5 million euros or 1 million euros, the payment remains the same. This model has its own advantages:

- Transparency: From the outset, it is known exactly how much the services will cost, which enables better budget planning and, depending on the scope of services and duration, the seller is on the safe side

- No conflict of interest: As the remuneration is independent of the sales result, there is no conflict of interest between the client and the service provider. The interest in getting the best price for the company may not be quite as strong as with a success variant.

Commission:

Remuneration via a commission means that the expert receives a percentage fee on the sales price. Let us imagine that the company is sold for 2 million euros and the service provider receives a commission of 5 % on the sale price, which corresponds to 100,000 euros. In this case, the remuneration depends directly on a successful sale. This model also has its own advantages:

- Performance incentive: The expert has a strong incentive to achieve the highest possible sales price for the company, as his remuneration depends directly on this price.

- Lower financial risk: It is only paid if the sale actually takes place, which reduces the financial risk if the transaction fails for any reason.

- Expertise evidence: If advisors or brokers are willing to work on a commission-only basis, this may indicate confidence in a successful transaction, or it may indicate strong pressure from the broker to succeed.

Mixed forms of fixed price and commission:

For sellers of companies, this model is particularly reliable and secure. The individual steps in the entire sales process are priced in advance and only invoiced if a proper partial delivery of the promised service has been made.

In addition, the expert receives a commission if successful and then offsets the upfront costs against the commission (there is often a minimum commission as a lower limit).

In this way, the seller does not pay anything twice and can fairly and transparently track success with his expert in payment when targets are reached.

Use our company value assessment from more than 2,000 company valuations.

Why is the choice of an M&A advisor more advantageous in many cases?

In the complex task of selling a company, choosing the right specialist is crucial. In this respect, the question arises: when and why might the engagement of an M&A advisor be the better choice over other options such as company brokers or self-selling? This consideration requires a detailed analysis of the specific requirements and objectives of a business sale, and it turns out that M&A advisors can play a beneficial role in many cases.

Specialised expertise: M&A advisors specialise in the complex nuances of mergers and acquisitions. Their extensive knowledge of the M&A market, ability to identify potential buyers or sellers and strategic approach to the entire transaction process are valuable resources. This expertise can help create optimal conditions and opportunities.

Objectivity and independence: M&A advisors usually operate independently and objectively, without being involved in conflicts of interest. This impartiality allows them to act in the best interest of the client and focus on achieving the best results. This is in contrast to potential conflicts of interest that could arise in other remuneration structures.

Strategic advice: M&A advisors often offer much more than pure transaction services. They can provide strategic advice and analysis to ensure that the sale process is in line with the company’s long-term goals. This additional perspective can make the difference between a simple sale and a strategically valuable transaction.

Choosing an M&A advisor is not the only option in every case, and individual requirements in the sale of a company may vary. Nevertheless, close analysis shows that specialised expertise, independence and strategic advice can in many cases create clear added value for the company. However, the decision should always be based on a thorough evaluation of the company’s specific needs and goals.

Pitfalls that can be avoided by choosing an expert advisor

1. inadequate company valuation: Accurately valuing your business is critical to setting an appropriate selling price. An M&A advisor has the knowledge and resources to conduct a sound valuation to ensure that your business is offered at a realistic market price.

2. lack of identification of potential buyers: Finding suitable buyers can be a challenge. M&A advisors have an extensive network and can identify and target potential buyers, including strategic investors and private equity firms. Pre-selection matters and not just any prospective buyer will be presented. This could even be a security risk.

3. lack of experience in negotiations: Negotiating the sale price and the terms of the contract requires expertise and experience. An M&A advisor specialises in successfully conducting negotiations and ensuring that your interests are protected.

4. incomplete due diligence: Thorough due diligence is crucial to identify potential risks and issues before it is too late. M&A advisors assist in providing documents and information to ensure that due diligence goes smoothly.

5. lack of knowledge of legal requirements: The legal framework for company sales can be complex. An M&A advisor works closely with lawyers to ensure that all legal requirements are met and the sale process runs smoothly.

6. delayed or failed transactions: Without experienced leadership, transactions can stall or even fail. An M&A advisor specialises in overcoming obstacles and ensuring the transaction is completed. And he can still get a better price in the end, even neutralising his costs for the seller.

7. lack of strategic direction: A successful business sale should fit into the long-term goals of the company. An M&A advisor provides strategic advice to ensure that the sale process supports the company’s long-term vision.

8. mismanagement of confidentiality: Maintaining confidentiality is critical to keeping the business running during the sale process. M&A advisors have best practices to maintain confidentiality and protect information from unwanted leaks.

Mixed forms of sales consultants

There is no one-size-fits-all solution in the field of corporate sales, as the needs of companies can vary. Blended sales advisors are flexible and customisable approaches that combine different services to create tailored solutions for clients. These hybrid models can combine elements of corporate brokers, M&A advisors and other professionals. Examples of hybrids are:

- Advice from M&A advisors with a commission-based approach: Here, an M&A advisor provides strategic advice and transaction support and retains an incentive by linking part of the remuneration to the successful completion of the transaction.

- Business broker with extended services: Some business brokers offer additional services, such as due diligence support or strategic advice, to provide more comprehensive support to their clients.

- Transaction advisor with a long-term focus: These advisors develop long-term relationships with their clients and work not only on individual transactions but also on long-term strategic goals, such as identifying acquisition opportunities.

Conclusion

A business broker and a specialised M&A advisor play different but crucial roles in the process of selling a business. The broker acts primarily as a business intermediary and focuses on transaction execution. M&A advisors, on the other hand, bring in-depth expertise and strategic advice to the process in order to achieve optimal results in an all-round carefree package.

The choice of remuneration structure ? whether fixed price or commission ? depends on individual preferences, budget and business objectives. For more complex sales processes, engaging an M&A advisor may be more advantageous as, in addition to valuation and buyer identification, they can provide comprehensive support in negotiations, due diligence and legal requirements.

FAQ - The most frequently asked questions

A business broker is an expert who specialises in bringing together buyers and sellers of businesses and aims to bring the two players to a conclusion as quickly as possible.

M&A consulting stands for “Mergers & Acquisitions advisory” and refers to the professional support and advice that companies receive when carrying out mergers, acquisitions or sales processes. M&A advisors provide thoughtful expertise, assist in the identification of M&A opportunities, conduct due diligence and accompany the entire transaction process as a sparring partner and advisor alongside the seller.

In order to sell a company, there are several steps that need to be taken, including valuing the business, identifying potential buyers, negotiating the sale price and terms of the contract, conducting thorough due diligence, and finalising the sale agreement. The help of business brokers or M&A advisors can facilitate the process and ensure that it is successful.