KFW’s current SME Succession Monitoring, from December 2020, confirms that business succession works even in times of crisis, but that a planned company sale does not become any easier.

Successful company succession has never been a daily business. Especially in the current CORONA ? crisis, entrepreneurs willing to succeed, but also potential buyers, are facing completely new challenges.

Insolvency filings rise in Q1 2021

A current survey by the German business exchange DUB from January 2021 shows that the majority of insolvency administrators surveyed already expect a significantly increased number of insolvency applications for the first quarter of 2021. The Adler clothing stores were obviously just the beginning here.

Basics webinar presented by Nils Koerber

Company sale (M&A) without risk and loss of value

Promised subsidies and bridging loans cannot help many companies to survive the current crisis. This can also quickly affect companies in sectors that are not yet feeling the negative effects of CORONA. Sudden, unexpected payment defaults by customers and suppliers can quickly lead even supposedly healthy companies into considerable liquidity problems.

The suspension of the obligation to file for insolvency cannot be extended permanently. Most of the experts interviewed are extremely sceptical about the current suspension of the obligation to file. It leads to distortion of competition and ultimately does not save companies that have been struggling for a long time.

State aid influences future follow-up projects

It is already becoming apparent that for current succession projects, but also for future planned business successions, bridging aid and subsidies granted in the past will lead to considerable problems. No one can say exactly today whether the funds granted may not have been granted without justification (at least from the point of view of the authorities) and will be reclaimed at some point.

This leads to considerable uncertainties in the purchase price determination and to a significantly higher risk sharing of the sellers in the future.

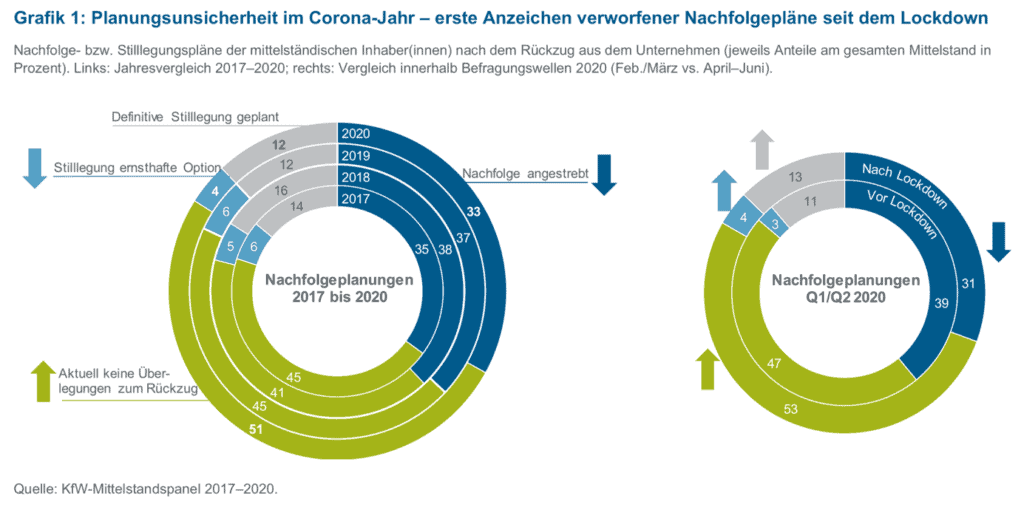

Half of the entrepreneurs have no concrete considerations for a business succession and the time afterwards

In past surveys conducted as part of the KfW SME Panel in 2017-2019, it was only about 41-45 % of all SMEs.

The reason for the significant increase in ?unprepared entrepreneurs? is acute concerns about the company’s existence in the current crisis, but also the increasingly uncertain future. This development is directly related to the first lockdown in spring 2020 and will probably be further exacerbated by the current lockdown.

The significantly declining number of succession ? advertisements of entrepreneurs willing to sell on the Internet platform www.nexxt-change.de, a succession exchange, confirm this trend. In April 2020, over 50 % fewer such advertisements were placed than in the average month.

Increasing likelihood of company closures due to the crisis

The current survey also shows that the share of small and medium-sized enterprises planning succession falls from 39% to 31%, i.e. by more than 20%. At the same time, the share of planned closures rises from 14% to 17% of respondents.

Short-term succession needs increase due to ageing

The pressure to organise one’s own company succession is therefore increasing significantly. On the other hand, the founding spirit of young entrepreneurs is clearly declining. The 7% of small and medium-sized enterprises alone that are looking for a successor within the next two years amounts to a total of 260,000 companies.

Intra-family business successions are also becoming rarer. Threat of inheritance tax can prevent intra-family succession.

While five years ago more than 40% of businesses were passed on within the family, now it is only 34%. This is related to demographic developments, as the outgoing generation of entrepreneurs historically has fewer children. In addition, the professional and private interests of the children and founding generation are often significantly different from those of the current entrepreneurs.

In addition, the currently applicable exemption rules for the intra-family transfer of company shareholdings massively hinder planned successions. In particular, if companies are currently severely affected by the CORONA crisis, they can no longer guarantee the required wage totals in order to be spared inheritance tax. Short-time work is not taken into account in the wage totals. Politicians urgently need to improve this situation! Inheritance tax due is currently claimed by the tax offices even in the case of insolvency, if necessary even by the owners privately.

Financial risks and family burdens are often obstacles to setting up a business

The financial risks for company buyers are increasing, as the willingness of banks to provide financing is tending to decline due to the current crisis situation. Even if financing is promised, it is hardly granted without personal securities/guarantees from the successor generation. Moreover, financing commitments are dragging on.

Transferors are also expected to take on a significantly longer and higher share of the risk after the actual transfer of the business. Granted subsidies and bridging aid can, as indicated above, lead to considerable difficulties in the future.

No one can say today to what extent the aid granted will be reviewed and who will have to repay what aid and when. This leads to a clearly uncertain purchase price determination.

Company succession, well prepared and accompanied by experts, can succeed even in times of crisis!

This is also confirmed by the current KfW ? Mittelstand Panel. Many succession mandates concluded in recent months prove that even in times of crisis good solutions can be found that satisfy both the seller and the successor generation. Even if the preparation should be much more thorough and the negotiations are often longer and more intensive, in the end sustainable solutions can be designed for both sides.

As entrepreneurs are currently more involved than ever in day-to-day business, it becomes even clearer: Company succession is not a day-to-day business.

In any case, initial succession plans should be concretised early on and the company should be made fit and crisis-proof. Handover processes therefore tend to take longer. Entrepreneurs willing to succeed should expect the process to take at least 2-3 years.

Conclusion for business succession:

The Company sale procedure in corona times has not become easier. Especially when selling a company, transaction security takes precedence over maximising the purchase price.

The sales process is usually prolonged by many imponderables on the market. A participation of the previous owners in the future success of the company is now the rule in many sales negotiations when setting the purchase price. Financing discussions with credit institutions are much more protracted and difficult than was previously the case.

But the crisis also offers opportunities.

With an experienced ‘entrepreneur at eye level’ who has experienced and shaped succession, good company successions can be shaped both within and outside the family, even in the current CORONA crisis. What counts more than ever: good preparation and support are demonstrable success factors.

Sources:

KfW ? SME Panel 2017-2020 Number 308, 17 December 2020Succession ? SME Monitor Ring 2020 well prepared for the crisis ? Corona exacerbates start-up bottleneck https://www.kfw.de/KfW-Konzern/KfW-Research/KfW-Mittelstandspanel.html

German Enterprise Exchange DUB ? Survey on the insolvency situation in Germany ? 13 January 2020 https://www.dub.de/insolvenzboerse/insolvenz-und-konkurs/wann-beginnt-die-grosse-insolvenzwelle/

Image: Fotolia.com

TIPS for further reading:

Opportunities and challenges posed by Corona in the generational transition

Selling your business - How to increase the value of your business!