In the world of business succession, SMEs (and how are SMEs actually defined?) are no small fry. Their special characteristics require a customised approach. This article shows what is important when it comes to succession and how you can successfully organise the process.

Table of contents

Read shortly

- SME succession requires a special approach

- Family ties and emotions are key

- Limited resources require careful financial planning

- Preserving corporate culture is crucial

- Local market knowledge is a competitive advantage

- Structured planning for sale or succession

Special features of SME succession

Succession planning in small and medium-sized enterprises (SMEs) is like a chess game in which the rules are not only complex but also differ from the strategies of large corporations. If you are in the exciting world of Company succession you will quickly realise that SMEs have their very own rules and challenges. But what exactly do you need to pay attention to in order to win the game?

What is the definition of an SME? Micro, small and medium-sized enterprises (SMEs) are defined in EU Recommendation 2003/361. According to this, a company is an SME if it has no more than 249 employees and an annual turnover of no more than ? 50 million or a balance sheet total of no more than ? 43 million.

Family ties and emotional bonds

In medium-sized companies, family ties are often the common thread that runs through the entire organisation. These are not just business partnerships, but connections based on years of experience, trust and sometimes even blood ties. In many cases, this is a life’s work. The succession process in such a company therefore requires not only business acumen, but also the ability to deal with the emotional aspects that can arise in family relationships.

Resource constraints and funding channels

SMEs generally have limited resources compared to large corporations. Finding suitable sources of funding and creating a viable financial plan is therefore crucial. Unlike large corporations, SMEs cannot always rely on internal sources of capital or global investors to fund their succession plans.

Corporate culture and employee retention

The corporate culture of an SME is often closely linked to the personality of the outgoing owner or the founding family. Maintaining this culture and retaining employees with the new owners are key components of a successful succession. SMEs cannot afford to lose talent or lose the identity of their company. Another special feature: the majority of shareholders and managing directors are one and the same person and are therefore particularly characteristic of every company in the SME size category.

Regional influence and market knowledge

SMEs are often deeply rooted in their regional markets. Knowledge of local conditions and customer needs is a decisive competitive advantage. When it comes to succession in SMEs, it is essential to take this regional influence into account and ensure that the new owners understand the specific requirements of the location.

Preparing SMEs for sale and succession

The preparation of an SME for a Company sale or a successor is crucial for the continuation of the company’s success. This requires a careful and structured approach. Start with a thorough business valuation to determine the true value of your company and set a realistic selling price. Identifying suitable buyers or successors is a crucial step in finding individuals or organisations that have the necessary capital and skills to successfully continue your business.

Comprehensive financial due diligence and careful assessment of legal aspects are essential to ensure the financial health of your company and to minimise obstacles in the Company sale to avoid a change of ownership. The continuity of the corporate culture should be maintained by ensuring that the new owners appreciate and respect the values and traditions of your company. Clear communication with employees, customers and other stakeholders is essential (but usually only after the handover has been secured and not before) to minimise uncertainty. A detailed transition plan ensures that all parties involved understand the sale of the business. Finally, the tax and legal aspects of the sale or succession should be carefully considered to minimise potential risks and meet the legal requirements when transferring the business.

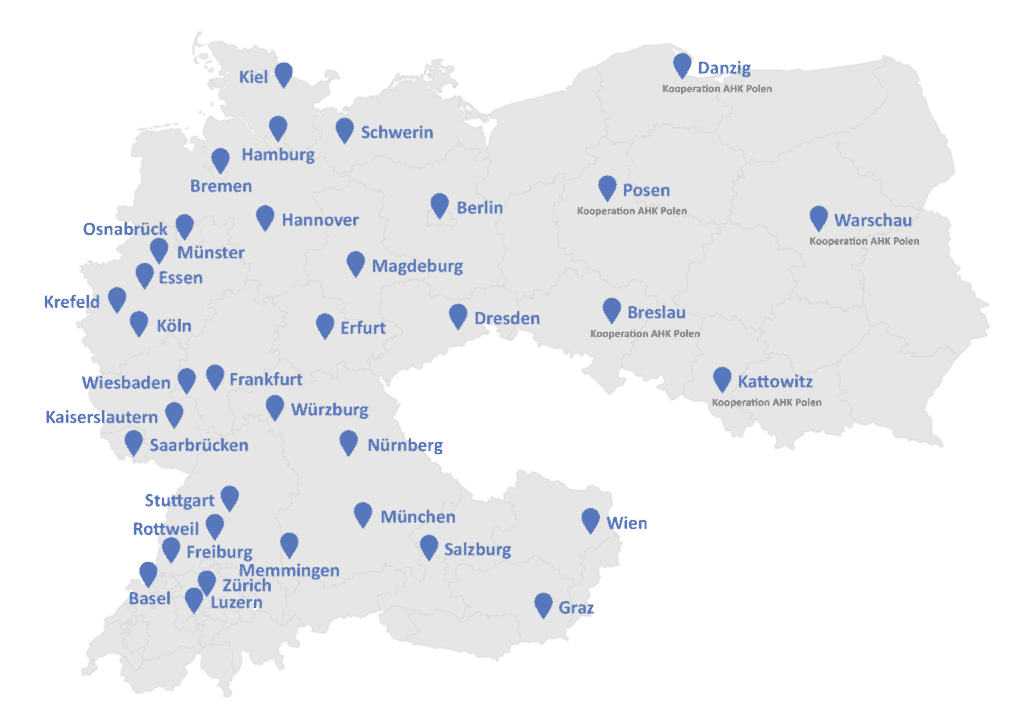

Support for SME sales

SME sales support can be invaluable in this complex process. Experienced advice can guide you through the entire transition, from business valuation to identifying potential buyers or successors, from financial due diligence to preserving the corporate culture. KERN is your expert partner for successful succession planning in SMEs. Our advisory services offer you the benefits of in-depth expertise and a proven track record to ensure that your SME successfully manages the transition to the next generation.

SME succession planning in 7 steps

Succession in SMEs requires careful planning and a structured approach. In order to successfully organise this important transition, you can use the following seven steps as a guide:

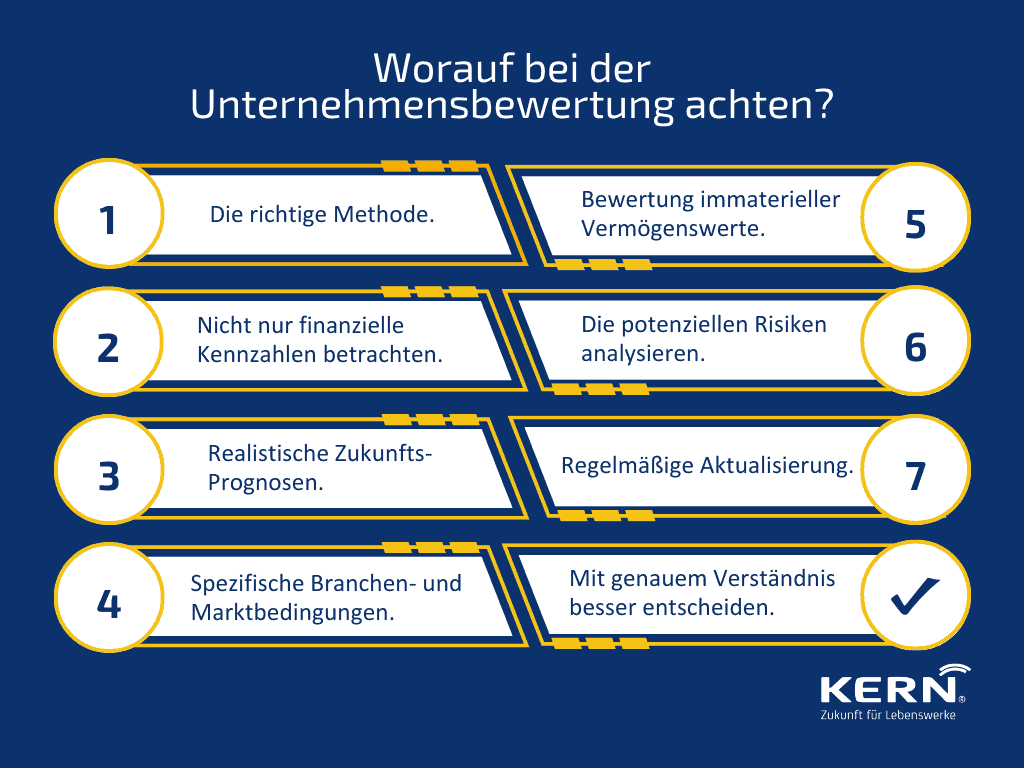

Step 1: Company valuation

A thorough Business valuation is the starting point for a successful company sale or a smooth company succession. The aim here is to determine the exact value of your company. This step is crucial as it forms the basis for setting a realistic selling price. A fair and reasonable price is crucial to attract potential buyers or successors. By transparently explaining the value and strengths of your company, you can convince interested parties in the area of company sales. The capitalised earnings value method according to IDWS1 is a generally recognised basis for this.

Step 2: Identification of buyers or successors

The search for suitable buyers or successors is a complex process. It is not only important to find people or organisations that have the necessary capital, but also the skills and commitment required to continue running your company successfully. Choosing the right entrepreneur or owner plays a decisive role in the future of the company.

Step 3: Financial and legal review

A thorough financial review is essential to ensure that the financial health of your company is guaranteed. In this area, not only current financial data is analysed, but future projections are also taken into account. In parallel, you should carefully review legal aspects such as existing contracts and obligations. This helps to avoid potential obstacles in connection with the sale of the company.

Step 4: Continuity of the corporate culture

Maintaining the corporate culture is an important aspect of succession planning. The personality of the outgoing owner or the founding family is often closely linked to the corporate culture. It is crucial to ensure that the new owners appreciate and respect the values and traditions of the company. This ensures the seamless integration of the company into the new management level. And sometimes the company culture and values also need to be visualised in writing for the first time, as they were previously ‘only’ lived by the owner of the SME, but were never clearly and transparently written down. Everyone knows the senior’s direction through daily experience, but the culture and philosophy have never been communicated in concrete terms.

Step 5: Communication and planning

Clear communication is crucial to minimise uncertainty among staff, customers and other stakeholders. The creation of a detailed transition plan is also of great importance. This plan should define the responsibilities and timeline for the generational transition and ensure that all stakeholders are fully informed and involved in the process. These steps are critical to success in this area of business sale or succession. In most cases, however, these steps are only taken with or after the handover and not before. That would be risky.

Step 6: Taxes and legal aspects

Examining the tax and legal aspects in connection with the sale or succession of a company is of central importance. A careful review helps to minimise potential risks and ensure that the legal requirements are met when the company is transferred. This step is essential to avoid legal problems and ensure that the sale of the company runs smoothly.

Step 7: Finalising the deal

Once all the preparations have been made and the interests of all parties have been taken into account, the company sale or succession is officially finalised. At this stage, all agreements are finalised and the company changes hands or management. Successful completion of this step marks the transition to a new era for the company.

With this clear structure and the seven steps, entrepreneurs can organise succession planning and ensure that the generational changeover is successful and smooth.

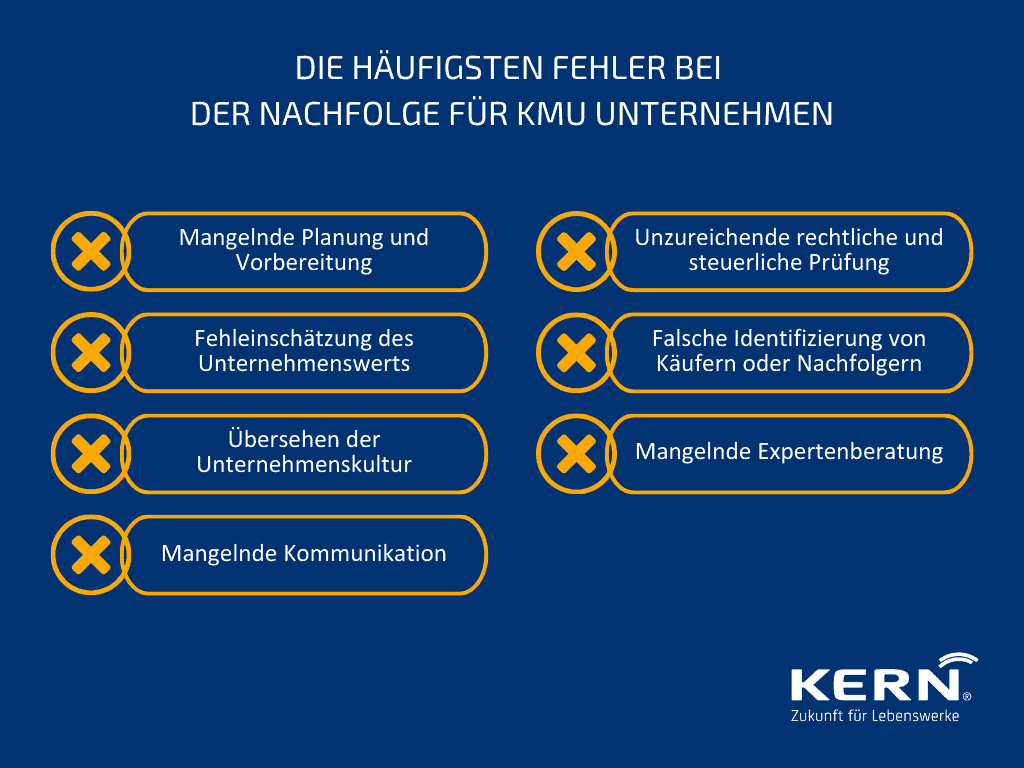

Frequent errors in the implementation

As everywhere, there are mistakes that can occur in the SME succession process. To pave your way to a successful SME succession, you should avoid the following common mistakes:

Lack of preparation and planning: One of the most common mistakes is neglecting comprehensive preparation and planning. An inadequate transition plan can lead to uncertainties and inefficiencies.

Misjudgement of the company’s value: An inaccurate assessment of the company’s value can lead to incorrect pricing and unexpected financial problems.

Overlooking the corporate culture: If the corporate culture is not taken into account, the identity and long-standing success factors of the company may be lost.

Lack of communication: Inadequate communication with employees, customers and other stakeholders can cause uncertainty and resistance.

Insufficient legal and tax review: Errors in the legal and tax audit can lead to unexpected legal obligations and financial burdens.

Incorrect identification of buyers or successors: The selection of unsuitable buyers or successors can lead to irreconcilable differences of opinion and misunderstandings.

Lack of expert advice: Not seeking professional advice can lead to costly mistakes and unresolved challenges.

Tips for choosing the right SME successor

Choosing the right successor for your business is crucial for the future stability of your company. Here are some valuable tips to ensure you find the ideal partner for your generational transition:

Set clear goals and priorities: Clearly define your goals and priorities for the succession. Do you want to keep your business in the family, get the best financial deal or continue your entrepreneurial vision? This clarity will help you find the right successor.

Identify the right personality: The ideal successor should not only have the necessary skills and qualifications, but also fit in terms of personality and corporate culture. Make sure that the chemistry is right and that your successor shares your values.

Check professional qualifications: Carefully check the professional qualifications and experience of the potential successor. Make sure that he or she has the necessary skills to continue running your company successfully.

Obtain references and perform background checks: Conduct background checks and obtain references to ensure your successor has a proven track record and good reputation.

Plan the transition: Create a clear transition plan that defines responsibilities and timelines for the generational change. This will help to ensure a smooth transition.

Clarify legal and financial aspects: Consider all legal and financial aspects of the change in order to avoid potential stumbling blocks. An experienced lawyer and tax consultant can be invaluable here. Consider professional advice: Consider seeking professional advice to support the selection process. Expert advisors can help you identify and select the right successor.

Conclusion

Succession planning in small and medium-sized enterprises is a unique challenge that requires specific expertise. In this article, we have highlighted the special features of SME succession, from family ties to limited resources. Preparing for the sale or succession requires careful planning and advice. By following these steps and tips, you can ensure that your business is successfully passed on to the next generation. KERN is at your side as an experienced partner to make this transition smooth and successful.