Are you wondering what to consider when selling a company? Or how best to plan the sale of a company? So why not use a company sale checklist for this? In it you will find valuable tips on how to successfully hand over your business to a successor.

Basics webinar presented by Nils Koerber

Company sale (M&A) without risk and loss of value

The sale of a company is a unique project for the majority of all entrepreneurs. The search for a suitable successor for one’s own company is fundamentally different from many transactions to date. The topic Company succession proves to be very complex in many places. Checklists can optimise the process.

Such checklists contain important information on all phases of the sale of a business. They offer orientation for the many steps of a handover on the part of the entrepreneur. In addition, they give a reliable framework for the entire process up to agreement with the buyer before.

The Roadmap to business succession offers further information from the right time to the successful sale of your business.

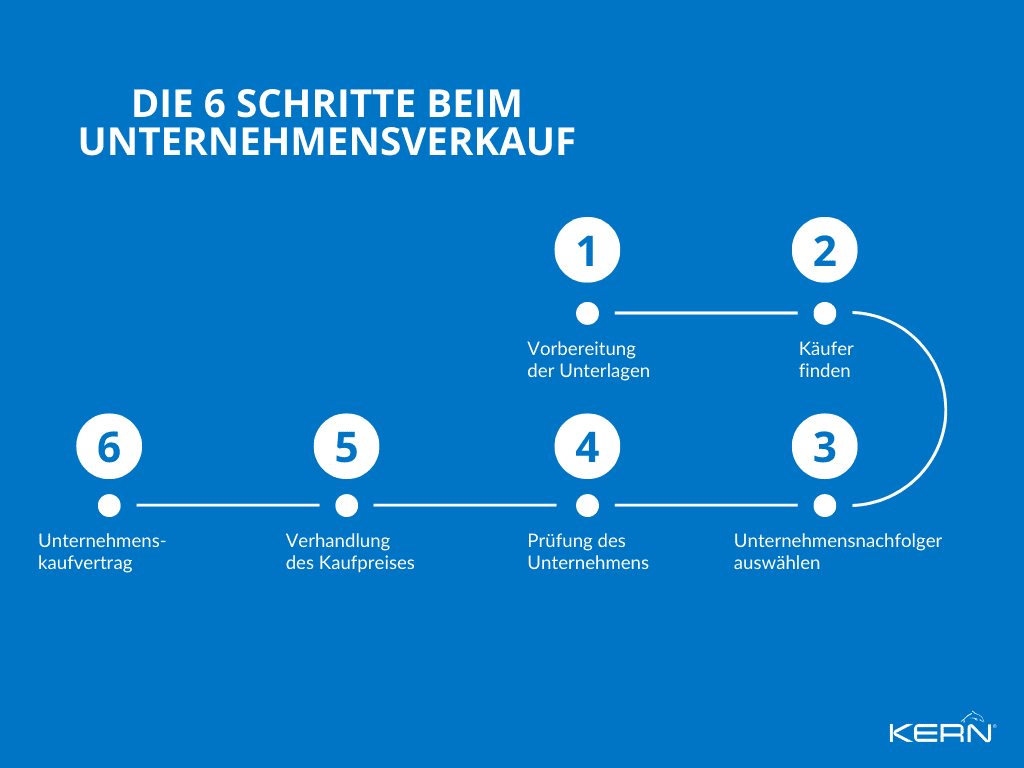

What are the 6 steps in selling a business?

The sale of the company takes place in 6 steps:

- Preparation of the documents

- Find buyers

- Select company successor

- Audit of the company

- Negotiation purchase price

- Company purchase agreement

Step 1: Preparation of the documents

The first step is to make a list of the documents the buyer will need. This is followed by a list of the most important documents - depending on the company, you may not need all of them.

- Financial statements: You need audited financial statements for the last three years to show potential buyers the financial health of your business.

- Tax returns: All tax returns of your business for the last three years must be presented to potential buyers.

- Business plan: A well-developed business plan is indispensable in order to be successful at the Company acquisition Provide a clear vision of the future of your business.

- Turnover development: A good past turnover will show potential buyers that your business is a good investment.

- Employee contracts: All employee contracts must be transferred to the new owner to avoid legal complications.

- Real estate leases: If your company owns real estate, the leases for this real estate must be transferred to the new owner.

- Patents: Any patents your company owns must be transferred to the new owner to protect your company’s intellectual property.

- Supplier contracts: All contracts with your company’s suppliers must be transferred to the new owner for a smooth transition.

- Customer lists: A list of your company’s current customers is very helpful for potential buyers.

- Other important documents: You may need to provide potential buyers with other important documents that are specific to your business.

If you prepare all these documents in advance, the sale of your business will go much more smoothly. If you have any questions about which documents you need to submit, you can consult a business lawyer.

Step 2: Find buyers

Here are some tips to help you find the right buyer for your business:

- Define your ideal buyer.

The first step in finding a buyer is to define your ideal buyer. What type of buyer are you looking for? What industry do you want to sell into? Answering these questions will help you narrow down your search. This will help you find buyers who are more likely to be interested in your business. - Use your networks.

One of the best ways to find a buyer is to use your networks. Talk to your friends, family and business partners. Find out if anyone knows a buyer who might be interested in buying your business. - Work with a professional.

If you are not sure where to start your search, you can work with an M&A consultancy. Professional advisors have experience in finding buyers for businesses and can help you navigate the process. - Use online resources.

There are a number of online resources that can help you find buyers for your business. Websites such as ?DUB?, ?nexxt-change? as well as the ?KERN Company exchange? are good places to start your search. - Consider a strategic buyer.

A strategic buyer is a company that wants to acquire another company to expand its business. If you think your company would be a good fit for a strategic buyer, you can approach companies in your industry.

Would you like us to support you?

Step 3: Select company successor

This can be a difficult decision because there are many factors to consider. Here are some tips to help you choose the right successor for your business.

- Consider the future of the company.

When you select a successor, you need to think about the future of the business. What are your plans for the company? How big is the growth potential? You need to select someone who will not only maintain the current level of success. He should also be able to take the company to the next level. - Look for someone with the right skills and experience.

Of course, you want to select someone who has the right skills and experience to take over the company. But you also need to make sure that the person fits well with the company culture and shares your vision for the future. - Choose someone you can trust.

This may seem obvious, but it is important that you choose someone you can trust to take over the business. It should be someone you are happy to leave the business to. - Make sure the person is up to the responsibility.

Taking over a business is a big responsibility. You need to make sure that the person you choose is ready for this level of responsibility. He or she should have the experience and confidence to take on the challenge. - Ensure a Succession planning.

Once you have selected a successor, you need to have a plan for how they will take over the business. This should include a timetable, a list of responsibilities and a plan for the transition into the role of successor.

Deciding who should take over your business is an important decision. You should take the time to consider all the factors. This way you can be sure that you are making the best choice for the future of your business.

Step 4: Audit of the company

There are many factors to consider when selling a business and an audit is one of the most important. This may involve due diligence on the seller’s side. The Due Diligence but can also be carried out separately by the buyer. Then the inspection is a stand-alone measure for you as the seller.

You might also be interested in this:

An audit of the company when selling the business is an important step. It ensures that the business is sold for the right reasons and that the buyer gets a fair deal.

The audit should be conducted by an independent third party. It should also include a review of the financial statements, legal documents and business processes.

The process can also be extended to the company’s customer base, employees and suppliers. The audit should identify any potential risks that could affect the sale of the business.

Step 5: Negotiating the purchase price

When it comes to negotiating the purchase price of a business, there are some important things to consider. First of all, you need to have a clear idea of what the business is worth. This means that you need to consider things like the Take into account the assets of the company, its revenues and profits, and its growth potential need to. Once you know the value of the business well, you can start negotiating the purchase price.

Remember that the seller probably has his or her own idea of what the business is worth. It is also important that you are prepared to compromise. In many cases, the seller will be willing to negotiate the purchase price if they feel they are getting a fair offer.

Also remember that the purchase price is not the only thing you negotiate. You also need to talk about the terms of the sale. This includes things like the payment schedule and the duration of the contract. If you are not familiar with these terms, you should consult an expert.

Step 6: Company purchase agreement

A contract of sale is a contract between a buyer and a seller that sets out the terms of a transaction. This contract can be used for the sale of any other type of business (from a sole proprietorship to a limited liability company). The sales contract should contain the purchase price and the terms of the sale. And in addition, all the conditions that must be fulfilled before the sale is completed.

As an important instrument the contract protects both the buyer and the seller and ensures that both parties are clear about the terms of the transaction. A sale and purchase agreement should be used whenever a business is sold. It ensures that the transaction goes smoothly and that both parties are satisfied.

We are happy to be there for you if you ever have any questions

At KERN Business Succession, we understand the complexity of both the Company sale as well as business succession and Company acquisition. For almost 20 years, our group of advisors has focused on business succession. Thanks to this experience, today we solve all questions and tasks that are of importance to entrepreneurs.

With these 6 checklists you have all steps exactly in view

Every partner at KERN is an entrepreneur themselves and has a wide range of personal life experiences with the topic of business succession. Combined with the attitude that the important values of a company are transferred into the future in a mindful, appreciative and professional manner, the following documents and checklists were created. For the benefit of the transferor, the transferee, the employees and the company itself.

We recommend these checklists to every entrepreneur. They are a great support for the individual handover and for company sales.

Table of contents Documents and checklists

- Checklist company sale, procedure and planning

- Business management checklist

- Checklist for old-age provision and assets

- Checklist company sale taxes

- Checklist to find the right business successor

- Legal aspects ofm Company sale

- Bonus: The Due Diligence Checklist

Checklist company sale, procedure and planning

Once the decision has been made in favour of a Company sale, detailed knowledge of Company sale procedure and planning are essential. The Company saleThis asset is subject to special rules. Only conscientious preparation will enable you as the transferor to maintain an overview at all times during the individual phases and to make the right decisions.

This is true even if you are an experienced lawyer or a mandated M&A consulting supports you in all steps of the company succession. Because the regulation of your succession is your central issue.

| No. | Procedure and planning | Yes | Still not |

| 1 | I have a personal, written life and goal plan. | ||

| 2 | There is strategic corporate planning for the next few years. | ||

| 3 | My entrepreneurial goals are clearly defined. | ||

| 4 | My personal and business goals are compatible with each other. | ||

| 5 | I have already thought about withdrawing from my business. | ||

| 6 | I have already set my sights on a time to retire from my business. | ||

| 7 | I am looking forward to a ‘work-free’ time. time after the handover. | ||

| 8 | I have defined activities for myself that will keep me busy after I retire. Challenge professional life in a new way. | ||

| 9 | I would like to ? possibly after an appropriate handover phase ? completely leave my withdraw from the company. | ||

| 10 | In addition to the management of the company, ownership of the company is also to be transferred to third parties. | ||

| 11 | I have clear ideas about how business succession should be regulated. | ||

| 12 | I have qualified contacts (lawyer, tax advisor, auditor, business and banking advisors), who helped me plan and implement my Accompanying succession planning. | ||

| 13 | There is already a ‘roadmap’ for the handover of my business. | ||

| 14 | My roadmap to business succession is shared with my family / closest Friends voted. | ||

| 15 | Senior staff are aware of this roadmap. | ||

| 16 | There are arrangements in case I am unexpectedly absent for a longer period of time or completely. | ||

| 17 | There is contingency planning in case the successor suddenly drops out. |

Business aspects

From our experience, different ideas about the value of a company are often responsible for the failure of succession projects. One major reason is the high emotional value of the company for the current shareholder(s), which easily leads to a particularly high monetary valuation. A successor looks quite differently at the life’s work of a transferor.

When evaluating a company, he wears investor’s glasses and takes a rather rational approach to the takeover. Although he is not entirely free of emotional factors either - a pronounced need for security may be mentioned here as an example. But the central question is: How sustainably does the company’s business model generate added value for its customers?

Only if you can demonstrate to your successor that you will succeed in doing so in the future, will he or she assume that your company will generate sustainable earnings. Read more about this in our documents.

| No. | Business aspects | Yes | Still not |

| 1 | There is a fixed strategic and operational plan for my company. | ||

| 2 | This planning is constantly monitored and adapted to changing conditions if necessary. | ||

| 3 | There is a target system for my company. | ||

| 4 | My company is controlled by a system of key figures. | ||

| 5 | There is a written organisation chart for my company. | ||

| 6 | The current organisational structure meets future requirements. | ||

| 7 | The process organisation is transparent and comprehensible for third parties. | ||

| 8 | The second level of management is capable of running the company without me. | ||

| The operational management functions are performed optimally: | |||

| 9 | in the field of human resources management | ||

| 10 | in the field of marketing | ||

| 11 | in the area of distribution | ||

| 12 | in the field of research and development | ||

| 13 | in the area of production / service provision | ||

| 14 | in the area of purchasing | ||

| 15 | in the field of accounting | ||

| 16 | There is a strengths and weaknesses analysis for my company. | ||

| 17 | The personnel structure is adapted to my company’s size and purpose. optimally tuned. | ||

| 18 | My industry is a growth industry. | ||

| 19 | The existing market potentials are exploited. | ||

| 20 | I know the most important key data of my competitors. | ||

| 21 | I have competitive advantages. | ||

| 22 | All my products / services are competitive | ||

| 23 | I know the product life cycle of all my products / services. | ||

| 24 | I know that there is no need for action on new product development in the short term. | ||

| 25 | The product contribution margins / the cost unit-related value added are known. | ||

| 26 | I have a powerful sales force. | ||

| 27 | Distribution is predominantly remunerated according to performance. | ||

| 28 | There is a transparent sales concept. | ||

| 29 | There are no dependencies on individual suppliers / subcontractors. | ||

| 30 | There is a meaningful pre- and post-calculation. | ||

| 31 | My company is profitable. | ||

| 32 | All business areas of my company are profitable. | ||

| 33 | There have been restructuring projects in the recent past. | ||

| 34 | The financing structure is optimal. | ||

| 35 | There is scope for funding. | ||

| 36 | The liquidity reserves are sufficient. | ||

| I am satisfied with my location: | |||

| 37 | Regional location | ||

| 38 | Fine site |

You would like to Sell company or are planning a family-internal company succession and want to Calculate enterprise valuebefore you consult a counsellor for a Business valuation mandate? Then use our service now Company value calculator: simple and free of charge.

Checklist for old-age provision and assets

What is your future financial situation and, if applicable, that of your family? What financial resources will be available to you in the future to cover your living expenses? What financial resources do you have and what regular payments can you continue to expect? For this purpose, you should draw up as detailed an income and expenditure plan as possible so that you can precisely estimate any gaps in provision and their amount.

This information is therefore important in order to assess whether the sale of the business or the business purchase price should represent a significant financial cornerstone of your retirement provision or whether you can focus on other objectives of the sale of the business. You can start this research here:

| No. | Retirement provision and asset situation | Yes | Still not |

| 1 | There is an income/expenditure plan for the time after my departure from the company. | ||

| 2 | I know the amount of my entitlements from the statutory pension insurance and from the voluntary supplementary pension insurance, if applicable. | ||

| 3 | My standard of living even after leaving my company is secured. | ||

| 4 | I have a precise overview of the scope and structure of my Assets. | ||

| 5 | The structure of my assets is aligned with my goals and wishes. | ||

| 6 | My insurance portfolio and needs have been reviewed in the last three years and optimised. | ||

| 7 | My inheritance matters have been clarified and, if necessary, supplementary contracts have been signed. closed. | ||

| 8 | There is a list of persons entitled to a compulsory portion, in my estimation. | ||

| 9 | The heirs are informed of the inheritance shares to which they are entitled. | ||

| 10 | I am informed about the possibilities of anticipated succession. | ||

| 11 | The clarification of inheritance law matters ensures that in the In the event of inheritance, the business assets remain in the company. | ||

| 12 | It is ensured that the existence of the company is not jeopardised by inheritance disputes. can be endangered. | ||

| 13 | I have checked whether the cover for my surviving dependants is sufficient. | ||

| 14 | A check was made as to whether sufficient liquidity was available for the heirs, in order to be able to settle any inheritance claims. |

Checklist company sale taxes

The first look at the figures has to be right in order to attract the right buyers and create a lasting interest in the company.

The company’s values are to be applied to a Company takeover to be presented transparently. This principle also enjoys the highest priority with regard to the attractiveness of the company to potential investors. This applies above all to frequently occurring hidden reserves in the balance sheet. If possible, these should not remain silent. This principle remains correct even if the lifting of hidden reserves results in a higher tax burden in the short term. In principle, it is important to reduce the balance sheet total as much as possible through a balance sheet adjustment and to dissolve tax optimisations and pension reserves. All balance sheet items that are not clearly attributable to the company should leave the balance sheet.

The most important recommendation here is to separate the areas between the former shareholder and the company to be sold. You can find out which issues need to be taken into account here in this Company sale taxes Checklist:

| No. | Taxes | Yes | Still not |

| 1 | I have already started my basic reflections on my succession plan with a discussed with qualified tax experts. | ||

| 2 | I am aware of the tax consequences of my succession plan. | ||

| 3 | With a view to the planned succession arrangement, I have reviewed my tax situation. already have it checked | ||

| 4 | I see a need for action here in the run-up to the succession regulation. | ||

| 5 | I am aware of the tax structuring options for succession planning. | ||

| 6 | I have checked whether an anticipated succession might have tax advantages for me. and my heirs. | ||

| 7 | It was checked whether my inheritance regulations can be designed in such a way that, if necessary. tax allowances can be used several times. | ||

| 8 | A check was made as to whether the benefit of my life insurance policies, if any, in the death are exempt from inheritance tax. | ||

| 9 | The succession plan also takes into account the issue of my old-age security under Consideration of tax aspects. | ||

| 10 | It has been examined whether a change in the legal form of my company would have tax advantages. has for me.Unt | ||

| 11 | Insofar as a sale of your business is intended: It has been verified whether a purchase price payment for my company in the form of an ongoing pension is preferable to a lump-sum payment for tax reasons. | ||

| 12 | The tax matters taken up and examined during the preparation of the handover are documented in such a way that I and my potential successor thus have a secure basis for our have decisions. | ||

| 13 | All current returns and assessments for all types of taxes are available. | ||

| 14 | It has been verified that there are no tax “inherited burdens” (e.g. tax arrears, tax liabilities). (e.g. tax arrears, tax liabilities). claims, etc.). | ||

| 15 | I have the feeling with my tax advisor that he always (even now) deals with the The company’s development has grown along with it. | ||

| 16 | Any tax burdens arising from the succession arrangement can be financed without any problems. become |

Continuing theme:

In our contribution Sell GmbH Taxes we give you 8 useful tips for optimal taxation.

Checklist to find the right business successor

First of all, companies are not fungible assets, but complex, evolved and individual entities. Entrepreneurs therefore often lack knowledge about a structured approach to the search for qualitatively suitable successors. Furthermore, day-to-day business ties up the capacities of the sellers for suitable research. As a result, the time-consuming, professional search for a suitable successor for the handover fails for lack of time. Last but not least, entrepreneurs are rightly extremely sensitive when it comes to disclosing the intention to sell. After all, making a planned transaction known can have negative effects on the workforce, customers, suppliers or financing banks.

Finding a buyer involves identifying, approaching and selecting prospective buyers. This represents one of the greatest challenges for company sellers. The success of the company, the existence of the company, its jobs and the achievement of an optimal purchase price depend on it. A systematic approach involving all relevant target groups/investors is recommended for the search for a buyer. This generates a greater and qualitatively higher demand and thus helps to maximise the proceeds from the sale and to ensure the continuity of the entrepreneurial work. Read here how to proceed systematically.

| No. | Company successor | Yes | Still not |

| 1 | There is a profile of requirements for my successor. | ||

| 2 | I have already discussed this requirement profile with a competent consultant. | ||

| 3 | I know who supports me in the search for a successor. | ||

| 4 | I already have one or more successors in mind. | ||

| 5 | My successor has already been chosen. | ||

| 6 | There is a strengths / weaknesses analysis for my successor. | ||

| 7 | The successor knows my company? | ||

| 8 | The successor knows my market, the wishes of my clients and the strengths and weaknesses of the competitors. | ||

| 9 | My successor has industry experience. | ||

| 10 | My successor has leadership experience. | ||

| 11 | My successor has the necessary formal qualifications to manage my Company. | ||

| 12 | My successor has clear ideas about what will make the company successful in the future. makes. | ||

| 13 | My successor has formulated his entrepreneurial and personal goals in writing. | ||

| 14 | There is a concrete timetable and schedule for the induction of my successor. | ||

| 15 | It has been clarified how my successor will initially work hierarchically and spatially in my company. is classified. | ||

| 16 | The senior staff of my company have been informed about the successor. | ||

| 17 | Customers and suppliers of my company are informed about the successor. | ||

| 18 | The financing of the successor is secured. | ||

| 19 | Even after retiring from the company, I am prepared to advise my successor as needed. to stand by your side. |

Legal aspects of the sale of a company

The sale of a company brings, in addition to the classic Company purchase agreement, entails some decisions on legal and fiscal aspects.

Find out for yourself whether and how the company name of your business can be transferred to the new acquirer. On the one hand, this depends largely on your personal preference and attachment to your company name, but also on its binding effect for customers. An acquirer will attach particular importance to the company name if it represents strong customer loyalty and branding. Therefore, create personal clarity and the legal requirements for yourself as early as possible in order to be able to transfer the company name if necessary.

The question of location is equally important. Can the company remain at its current location? Or would you like to use the property (if you own it) for other purposes in the future? Would you like to sell the property in order to secure your old-age provision? Or would you prefer to rent out the property to the new owner and thus generate reliable income in the long term? And when is the right time to hand over? This can be an important issue from a tax point of view, especially with regard to reaching specific age limits. But also with regard to the lead time in order to initiate tax optimisations in good time before the sale. Learn more about legal aspects:

| No. | Legal aspects | Yes | Still not |

| 1 | I know which areas of law are affected in connection with my planned succession plan. become. | ||

| 2 | I have already discussed the outlines of my planned succession plan with one or more of the qualified legal experts. | ||

| 3 | In the run-up to succession planning, I see a need for action here. | ||

| 4 | My legal form, my contracts under the law of obligations and property law and the other regulations correspond to the operational requirements. | ||

| 5 | The different legal forms as well as their effects on liability issues and I am aware of capital raising opportunities. | ||

| 6 | It is ensured that after handing over my business I am exempted from any liability for I am exempt from the company’s liabilities both internally and externally. | ||

| 7 | It is ensured that all formal requirements for the contracts to be concluded are met. | ||

| 8 | There is a structured list of all contracts required in connection with the transfer and declarations of intent. | ||

| 9 | All assets must be inspected for any reservations of title, assignments, transfers of ownership by way of security, etc. or liens have been checked. | ||

| 10 | The exploitation of my patents, property rights or similar rights is regulated. | ||

| 11 | All changes in legal form that came into question with regard to the handover were assessed for their advantageousness. reviewed. | ||

| Insofar as a change of legal form is intended: | |||

| 12 | I know the most important regulations of the new legal form relevant to me (representation, liability, participation, organs, publicity, insolvency). | ||

| 13 | The tax consequences of retaining or changing the legal form have been examined. | ||

| 14 | A property law arrangement has been made that keeps my company capable of acting at all times. | ||

| 15 | My marriage contract was reviewed as a whole with regard to any consequences for the planned succession arrangement. reviewed. |

Bonus: The Due Diligence Checklist

If you have any further questions about our company sale checklists and other supporting documents, please do not hesitate to contact experts from our Advisory Group on.

Did you like this article? Then feel free to leave us a comment.

NOW the KERN Podcast discover on our homepage and get even more expert knowledge for free!

Or simply listen to Spotify on the go: