The sale of GmbH shares is associated with innumerable requirements of the legislator and depends on many different aspects.

Already at this point, it is helpful to note that this article aims to outline a simple process and by no means a Extensive counselling and support for the M&A process can or would like to replace.

This article opens with a fictitious example where the seller or shareholder wishes to sell a percentage of his limited liability company shares and it is not assumed that the sale will be 100%, which in fact is a classic Company sale and whose fictional description would have a much higher scope in the description.

Table of contents

A typical example of the sale of shares in a limited liability company would be a potential dispute or open disagreement between the respective shareholders. In the most common cases, the sale of shares in a limited liability company is made to the co-partners of the company or to a specific third party, and this is what this article aims to shed light on.

In the case of a GmbH sale of 100 % of the company shares, we recommend the article Sell company.

Tip: If you want to sell your GmbH shares, you will certainly face some tax and legal questions. This guide will help you to get a first orientation. If you want to avoid risks in your specific case and save costs and taxes, contact us, we will be happy to support you.

Request initial consultation now or take a look at our Company sale consulting

1. sell GmbH shares: Valuation

In general, it should of course be noted that for the sale of the GmbH shares, if applicable, the Consent of the Company and is subject to notarial execution. The sale shall be confirmed at the shareholders’ meeting.

This article does not go into detail about possible valuation procedures, which are primarily carried out by certified and authorised experts for tax, law or M&A, for example. One of the most important and most widely used procedures is the income capitalisation approach according to IDWS1. Further information on valuation procedures can be found here: Calculate enterprise value.

The aforementioned capitalised earnings method or the EBIT method (multiples factor) is often used to determine the current value of the company shares. In the case of larger companies and groups of companies, the Discounted cash flow method. In the EBIT method (EBIT=Earnings Before Interest and Taxes), for example, the valuation is based on the net earnings before interest and taxes and is multiplied by a factor. Since it is difficult to compare the individual characteristics of the business models of medium-sized companies in particular, the multiplier method should always be viewed with a certain degree of “fuzziness”.

To illustrate this, here is an example with fictitious amounts and an annual surplus of 100,000 euros:

Item 1.) + Net profit for the year: 100,000 euros

Item 2.) + Tax expense: 10,000 euros

Item 3.) - Tax refunds: 20,000 euros

Item 4.) + Interest expense (financing) 7,000 euros

Item 5.) - Interest income 4,000 euros

Result: 93,000 euros

However, it is important to note that a performed Valuation in no direct obligatory relationship to a possible purchase price and these can therefore be seen independently of each other.

Sale of the GmbH shares at nominal value

If, for example, a shareholder decides to sell his shares to the intended buyer at nominal value - i.e. sometimes far below the actual value - there are no legal restrictions on this. However, if the price for the shares is conspicuously low, a tax authority could also assume a hidden gift and would question this if necessary. If a trustee is appointed for the transfer, the resale will also take place at nominal value.

Attention should be paid to the Difference to company shares or the sale of company shareswhich is represented here only with a simple explanation. The company share is, among other things, the part that a shareholder has made as a contribution to the company as a whole and refers to the company assets, i.e. a share of the contribution. Company shares refer to shares in the company, for example, the “company” has five shareholders and each shareholder has the same share or the valuation is made, for example, according to the contributed parts of the original share capital.

May GmbH shares be sold below value?

In principle and from a general legal point of view, nothing stands in the way of selling the GmbH shares for less than their value. However, any specifications and aspects in the articles of association that have stipulated certain requirements must be taken into account. These can be, for example, specifications for the right of first refusal to existing shareholders of the company and possible payment modalities, such as the course of payments and other specific points in the case of a sale.

2. negotiations & purchase agreement for GmbH shares

The implementation of the sale of shares is associated with countless legal and tax aspects. Therefore, the use of advisors or a lawyer is recommended in one’s own interest. During the negotiation, of course, the Skill of the seller who will primarily rely on a valuation according to the methods mentioned above in the article and will certainly also make decisions based on market conditions and his own experience.

Of course, the time circumstances for the sale play an essential role here and the associated time frame for a fast or slow processing of the desired sale. For the preparation of the purchase agreement, countless standard templates are circulating, some of which are subject to a fee, but these should rather be regarded as information or a guiding recommendation. For the final purchase agreement, it is highly recommended to engage an experienced M&A lawyer or notary.

Company audit: due diligence

The due diligence phase is a detailed form of evaluation of a substance, which takes place, for example, before the acquisition of a company or shares. This Risk assessment is primarily left to experts from the industry, a law firm, a tax consultant or an auditor.

The aim of this assessment is to ensure that the information given is correct, for example when acquiring shares in a limited liability company, and to identify possible risks. The Due Diligence is also the assessment of due diligence. In this process, the company or a person is analysed and evaluated in detail with regard to economic, legal and financial circumstances. For this purpose, an assessment or recommendation of the possible purchase price is generally also made by the commissioned expert after the analysis.

For more information on this important point on the way to the Company purchase agreement we recommend our article on the Due Diligence Checklist.

3. conclusion & transfer of the company shares and payment

There is nothing to prevent the sale of the shares in principle. The sale will take place in accordance with legal requirements as a so-called Assignment of the shares of a GmbH by means of a purchase agreement or other legal transactions under the law of obligations. However, the settlement should be carried out via a liable third party such as a lawyer or tax advisor in order to be on the safe side when complying with all legal steps.

An obstacle to the proper sale of shares could be, in particular, a listed point in the respective articles of association that must be complied with. This could be, for example, the requirement to give preference to a third party in the right of sale.

The most common variant for payment and the use of external experts is the deposit into an escrow account and the subsequent transfer of the values to the seller.

Can GmbH shares be sold without a notary?

The sale of the GmbH shares constitutes a contract under the law of obligations and therefore the commissioning of a notary is unavoidable, as a so-called assignment obligation is entered into. Thus, a conforming conclusion can only take place in the form of a notarial act.

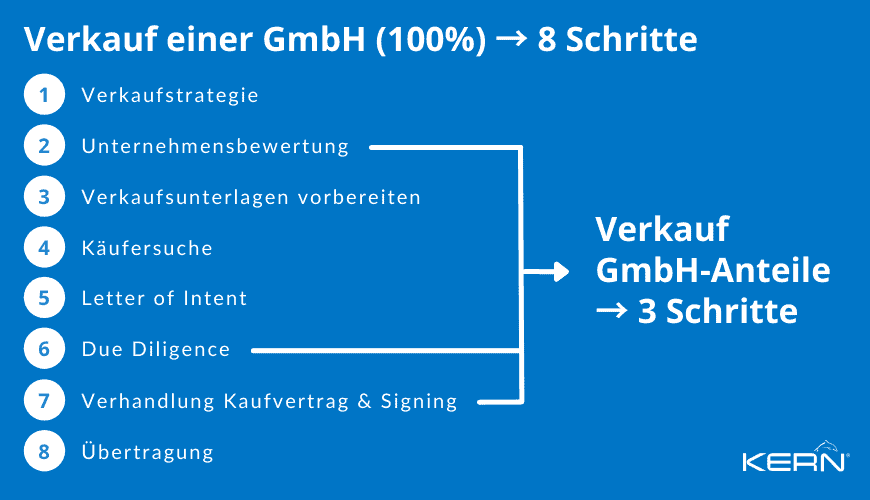

The following list of the procedure represents a basic implementation and can of course vary in reality

Sale process Share sale:

1. confidentiality agreement ? Non Disclosure Agreement

2. letter of intent ? Letter of Intent

3. due diligence

4. contract for the purchase of GmbH shares

5. notary appointment and purchase price payment

6. transfer of the GmbH shares ? Closing

7. registration in the commercial register

Payment modalities (what should be considered?): The transfer of the GmbH shares shall only take place after full payment of the agreed purchase price.

One-off payment: Generally, the full purchase price is due at the notary appointment and, in the most common cases, has already been deposited in an escrow account of the notary at an early stage.

Payment by instalments: Partial payments or performance-based payments can also be made (depending on the agreement), which are contractually fixed and based on concrete parameters such as turnover or earnings in the future. Various tax regulations must be observed, such as how the payments can be declared.

What costs can be expected?

In the most common cases, an expert hour of between 200 and 400 euros should be calculated for the preparation and support of a due diligence. This is only a guideline and can also be agreed as a flat rate. Depending on the scope of the due diligence, an average duration of at least fourteen days up to several weeks is to be expected, resulting in a cost amount of at least five figures. In addition, there may be further investments for consultation and fees.

In the case of an acquisition of shares within known shareholder structures, these expenses can also be divided among each other if necessary.

When acquiring the GmbH shares by means of a bank financing, one can thus expect here approx. 3 to 8 percent as incidental costs for the purchase transaction In the case of notarial processing, fixed fees of the legislator and the payment of the implementation and advisory activities of the notary are added.

Selling GmbH shares: Taxes

The proceeds from the sale of GmbH shares fall under income from capital assets and are therefore taxable. However, this must be clarified individually with a tax advisor.

With regard to the tax allowances, the amount of the participation is decisive. For example: If the seller holds 1 per cent or more in the GmbH, the so-called partial income procedure applies and thus 60 per cent of the profit is taxable. For shareholdings of less than 1 per cent, the so-called final withholding tax applies.

Primarily, there are also differences regarding taxation. For example, in the case of the sale of shares, this depends on who is the shareholder in the GmbH. The following is a brief list:

| Private individual | approx. 25 per cent income tax |

| Sole proprietorships/partnerships | 25 percent income tax plus trade tax |

| GmbH/Holding company | 1.5 per cent corporation and trade tax |

More on the topic: In our contribution Sell GmbH Taxes we give you 8 tips for optimal taxation!

Legal, risks and liability

The decisive advantage of a limited liability company is the liability requirements, which means that generally only the company is liable without the personal liability of the shareholders. The shareholders are only liable for the Raising of the share capital agreed in the articles of association.

The general safeguarding during the implementation is carried out by a personally commissioned lawyer who prepares a draft contract according to the desired specifications and presents it to the buyer party. This has the advantage that any clauses of the detailed safeguarding of the buyer party could be overlooked despite careful examination. The draft purchase agreement provides the other party with structure and content. The commissioned lawyer will thus also choose those formulations that primarily correspond to the interest of the client

In Germany, the transfer of shares is always subject to the GmbH Act, in particular §15 GmbHG.

Right of first refusal under the shareholders’ agreement: What does this mean and what problems can arise? A memorandum or articles of association may contain various provisions, such as the granting of a right of first refusal to existing shareholders and possible provisions for the sale of GmbH shares if this is not directly claimed. The sale of GmbH shares is subject to a resolution. The blocking minority refers to the share with which shareholders can prevent resolutions. A majority is required for the implementation of various resolutions.

The GmbH acquires its own shares

In principle, a GmbH is legally permitted to acquire its own shares. However, various legal restrictions apply to the acquisition, such as shares whose contribution obligation has not been paid in full. Here, applicable law applies and cannot be circumvented. Other deviating agreements in the articles of association are therefore invalid. However, a suitable lawyer for company law should of course be consulted on this.

What happens to share capital when a GmbH is sold?

As a rule, the sale of GmbH shares does not change the share capital of the GmbH, which as a legal construct must always have the agreed minimum amount. Nevertheless, a sale can also be used to change the share capital.

5 possible mistakes when selling GmbH shares

An example would be the so-called splitting of the company. The shareholder sells his shares and, for example, rents his own property to the GmbH before the sale. Due to the sale, the rental relationship with the GmbH is now terminated. Consequently, this results in a fictitious re-sale, which is separately taxable.

The decision to divest oneself of GmbH shares and thus possibly decide against possible market developments and the expansion of business potential can of course have the most diverse motives. Therefore, it is advisable to talk to an M&A advisor, a lawyer or a tax advisor and to openly address one’s own points and thus explore possible other points of view.

The requirements of any valid articles of association of a company must be complied with and any agreed advance sale rights granted. However, if this is not the case, the seller may assume that there is a Possible selection of interested parties There may be people who have not yet heard of the intention to sell and who could be potential buyers. Thus, it is advisable to contact, for example, auditors, M&A consultants or specialised law firms that can realistically assess the buyer market and anonymously approach interested parties undercover. If the intention to sell becomes public, this could unsettle employees, customers and suppliers and lead to considerable damage.

The available audit results of a due diligence, own empirical values and best market knowledge are extremely helpful for a mature sales strategy and conducive during negotiations. And it makes sense for these complex processes, which are Support from experts who can demonstrably show with references that they have regularly been involved in sales negotiations (M&A transactions) and whose experience offers many advantages.

The signing of sale agreements is usually irreversible, so it is advisable to consider all possible contingencies and exclusionary points in order to be on the safe side. As a book tip for an overview of the extensive topics, chances and mistakes of a planned sale of shares, ?Company succession - the process knowledge?.